UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Materials Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Rules 14a-6(i)(1) and 0-11. |

7380 Coca Cola Drive, Suite 106

Hanover, MD 21076

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 30, 2025

To the Stockholders of Processa Pharmaceuticals, Inc.:

NOTICE HEREBY IS GIVEN that the 2025 Annual Meeting of Stockholders of Processa Pharmaceuticals, Inc. will be held at our corporate office located at 7380 Coca Cola Drive, Suite 106, Hanover, MD 21076 on Monday, June 30, 2025, beginning at 1:00 p.m., Eastern Time. The Annual Meeting will be held for the following purposes:

| 1. | To elect the six directors nominated in the attached Proxy Statement to serve as directors until the 2026 Annual Meeting of Stockholders and until their respective successors have been elected and qualified; | |

| 2. | To approve the issuance of shares of common stock upon exercise of the Series A and B Warrants sold pursuant to the Securities Purchase Agreements entered into on January 27, 2025 in accordance with Nasdaq listing rules; | |

| 3. | To ratify the appointment of Cherry Bekaert, LLP as the independent registered public accounting firm of Processa Pharmaceuticals, Inc. for the fiscal year ending December 31, 2025; | |

| 4. | To approve, by advisory vote, the compensation of our 2025 named executive officers; and | |

| 5. | To transact such other business as properly may come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the Annual Meeting. Information relating to the above matters is set forth in the attached Proxy Statement.

The Board of Directors has fixed the close of business on May 1, 2025 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment thereof. Stockholders who own shares of the Company’s common stock beneficially through a bank, broker or other nominee will also be entitled to attend the Annual Meeting. The Annual Meeting may be adjourned from time to time without notice other than announcement at the Annual Meeting, and any business for which notice of the Annual Meeting is hereby given may be transacted at any such adjournment. A list of the stockholders entitled to vote at the Annual Meeting will be open to examination by any stockholder entitled to vote at the Annual Meeting, for any purpose germane to the Annual Meeting, during ordinary business hours and upon appointment, for a period of at least ten days prior to the Annual Meeting at the principal executive offices of the Company in Hanover, Maryland.

Your vote is very important to us, and it is important to us that your shares are represented regardless of the number of shares you may vote. We hope you will be able to attend the Annual Meeting, but in any event, we would appreciate you submitting your proxy as promptly as possible. You may vote by telephone or the Internet as instructed in the Notice of Internet Availability of Proxy Materials and in the accompanying proxy. If you received a copy of the Proxy Card by mail, you may also submit your vote by mail. We encourage you to vote by telephone or the Internet. These methods are convenient and save the Company significant postage and processing charges. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

By order of the Board of Directors

| /s/ George Ng | |

| Chief Executive Officer | |

| Hanover, Maryland | |

| May 12, 2025 |

| i |

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

The statements included in this Proxy Statement regarding future performance and results, expectations, plans, strategies, priorities, commitments, and other statements that are not historical facts are forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking, and other statements in this Proxy Statement regarding our environmental and other sustainability plans and goals, are not an indication that these statements are necessarily material to investors or are required to be disclosed in our filings with the SEC. In addition, historical, current, and forward-looking statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. Forward-looking statements are based upon current beliefs, expectations, and assumptions and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024. Readers of this Proxy Statement are cautioned not to rely on these forward-looking statements since there can be no assurance that these forward-looking statements will prove to be accurate. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

| 1 |

7380 Coca Cola Drive, Suite 106

Hanover, MD 21076

PROXY STATEMENT

2025 Annual Meeting of Stockholders

to be held on June 30, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Processa Pharmaceuticals, Inc., a Delaware corporation (“Processa,” the “Company,” “we,” “our” or “us”), for use at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at our corporate office located at 7380 Coca Cola Drive, Suite 106, Hanover, MD 21076 on Monday, June 30, 2025, beginning at 1:00 p.m., Eastern Time, and at any postponements or adjournments thereof.

If we determine that it is not possible or advisable to hold the Annual Meeting in person at our corporate office on the Annual Meeting date, we may make alternative arrangements to hold the Annual Meeting at a different date or time, in a different location, and/or by means of remote communication. In the event we determine it is necessary or appropriate to make alternative arrangements for the Annual Meeting, we will announce the decision to do so in advance, and details on how to participate will be issued by press release, posted on our website, and filed with the SEC as additional proxy soliciting material.

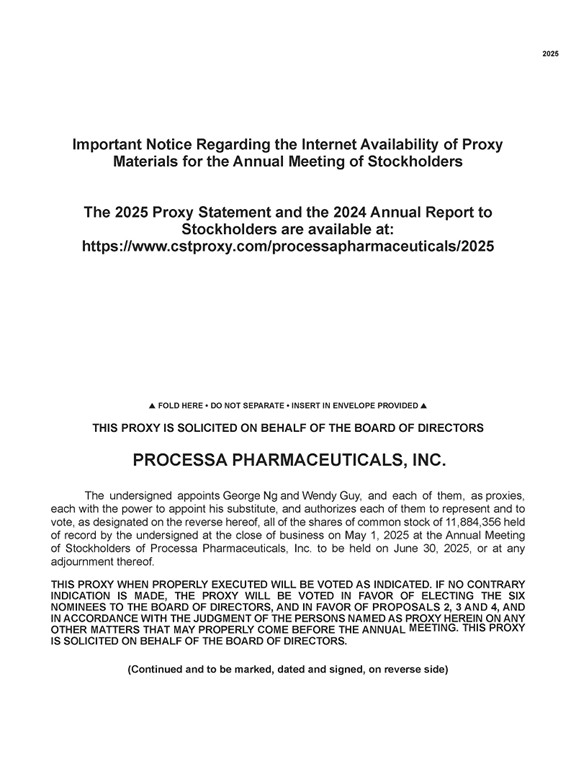

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 30, 2025

We are taking advantage of Securities and Exchange Commission (“SEC”) rules that allow us to deliver proxy materials to our stockholders via the Internet. Under these rules, we are sending our stockholders a notice regarding the Internet availability of proxy materials instead of a full printed set of proxy materials. Our stockholders will not receive printed copies of the proxy materials unless specifically requested. On or about May 12, 2025, we will mail to our stockholders who have not previously requested to receive materials by mail or e-mail a Notice of Internet Availability of Proxy Materials. The notice contains instructions on how to access this proxy statement and our annual report online and how you may submit your proxy on the internet or by telephone. If you received this notice by mail, you will not automatically receive a printed copy of our proxy materials or annual report unless you follow the instructions therein for requesting these materials. For directions to the Annual Meeting, please contact our Chief Administrative Officer, Wendy Guy at wguy@processapharmaceuticals.com.

Purpose of the Annual Meeting

The Board is soliciting your proxy for use at our Annual Meeting because you owned shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at the close of business on the Record Date, and, therefore, are entitled to vote at the Annual Meeting on the following proposals:

| 1. | To elect the six directors nominated in this Proxy Statement to serve as directors until the 2026 annual meeting of stockholders and until a successor is duly elected and qualified; | |

| 2. | To approve the issuance of shares of common stock upon exercise of the Series A and B Warrants sold pursuant to the Securities Purchase Agreements entered into on January 27, 2025 in accordance with Nasdaq Listing Rules (the “Warrant Proposal”);

| |

| 3. | To ratify the appointment of Cherry Bekaert, LLP as the independent registered public accounting firm of Processa Pharmaceuticals, Inc. for the fiscal year ending December 31, 2025; | |

| 4. | To approve, by advisory vote, the 2025 compensation of our named executive officers; and | |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponements thereof. |

The Board unanimously recommends voting “FOR” the election of each of the Board’s nominees on Proposal 1 – Khoso Baluch, James Neal, George Ng, Geraldine Pannu, Justin Yorke and David Young; and “FOR” Proposals 2, 3, and 4 using the Proxy Card.

| 2 |

ABOUT THE ANNUAL MEETING

Why did I receive these materials?

Our Board of Directors is soliciting proxies for the Annual Meeting. You are receiving a proxy statement because you owned shares of our common stock on May 1, 2025 (our Record Date) and that entitles you to vote at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting. This proxy statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.

What information is contained in this proxy statement?

This Proxy Statement includes information related to the proposals to be voted on at the Annual Meeting, the voting process, our Board of Directors, the compensation of executive officers and directors, and other information that the Securities and Exchange Commission requires us to provide annually to our stockholders.

Who is entitled to vote at the Annual Meeting?

Holders of common stock as of the close of business on the record date, May 1, 2025, will receive notice of, and be eligible to vote at, the Annual Meeting and at any adjournment or postponement thereof. At the close of business on the record date, we had outstanding and entitled to vote 11,884,356 shares of common stock.

How many votes do I have?

Each outstanding share of our common stock you owned as of the record date will be entitled to one vote for each matter considered at the Annual Meeting. There is no cumulative voting.

Who can attend the Annual Meeting?

Only persons with evidence of stock ownership as of the record date or who are invited guests of the Company, as determined by the Chairman of the Board or the executive officers of the Company, may attend and be admitted to the annual meeting of the stockholders. Stockholders with evidence of stock ownership as of the record date may be accompanied by one guest. Photo identification may be required (a valid driver’s license, state identification or passport). If a stockholder’s shares are registered in the name of a broker, trust, bank or other nominee, the stockholder must bring a proxy or a letter from that broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the stockholder was a beneficial owner of shares of common stock of the Company as of the record date. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis.

Cameras (including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, physically or by proxy, of the holders of representing one-third (1/3) of the voting power of all the outstanding shares of our common stock entitled to vote at the Annual Meeting must be present before any action can be taken by the stockholders at the Annual Meeting. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the Annual Meeting for a quorum.

How do I vote my shares?

If you are a stockholder of record (that is, you own your shares in your own name with our transfer agent and not through a broker, bank or other nominee that holds shares for your account in a “street name” capacity), you can vote at the Annual Meeting or by proxy. If you hold your shares beneficially in “street name” through a broker or nominee, you may be able to authorize your proxy by telephone or the Internet as well as by mail, but you will need to obtain and follow instructions from your broker or nominee to vote these shares.

We urge you to vote by proxy even if you plan to attend the Annual Meeting so that we will know as soon as possible that enough votes will be present for us to hold the Annual Meeting. If you attend the Annual Meeting, you may vote at the Annual Meeting and your proxy will not be counted. Our Board of Directors has designated George Ng and Wendy Guy, and each or any of them or their designees, as proxies to vote the shares of common stock solicited on its behalf. You can vote by proxy by any of the following methods.

| 3 |

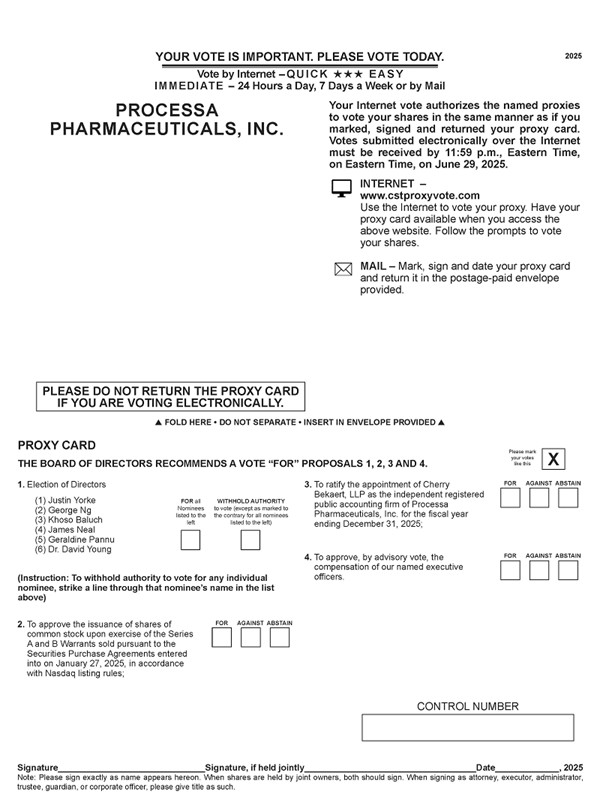

Voting by Telephone or Internet. If you are a stockholder of record, you may vote by proxy by telephone or internet. Proxies submitted by telephone or through the internet must be received by 11:59 p.m. EDT on June 29, 2025. Please see the Notice of Internet Availability of Proxy Materials or Proxy Card for instructions on how to vote by telephone or internet.

Voting by Proxy Card. Each stockholder electing to receive stockholder materials by mail may vote by proxy using the accompanying Proxy Card. When you return a proxy card that is properly signed and completed, the shares represented by your proxy will be voted as you specify on the Proxy Card.

Where can I find a list of stockholders entitled to vote at the Annual Meeting?

For the ten days prior to the Annual Meeting, a list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder of record for any purpose germane to the Annual Meeting at the Company’s principal executive offices at 7380 Coca Cola Drive, Suite 106, Hanover, Maryland 21076 upon appointment.

Can I change my vote?

Yes. If you are a stockholder of record, you may revoke or change your vote at any time before the proxy is exercised by filing a notice of revocation with the Secretary of the Company or mailing a proxy bearing a later date, submitting your proxy again by telephone or over the internet or by attending the Annual Meeting and voting in person. For shares you hold beneficially in “street name,” you may change your vote by submitting new voting instructions to your broker, trust, bank or other nominee or, if you have obtained a legal proxy from your broker, trust, bank or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person. In either case, the powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

How is the Company soliciting this proxy?

We are soliciting this proxy on behalf of our Board of Directors and will pay all expenses associated with this solicitation. In addition to mailing these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

What vote is required to approve each item?

Directors are elected by plurality vote and there is no cumulative voting. Accordingly, the director nominees receiving the highest vote totals of the eligible shares of our common stock that are present, in person or by proxy, and entitled to vote at the Annual Meeting will be elected as our directors. The approval of the Warrant Proposal, the Reverse Stock Split Proposal, the ratification of the appointment of Cherry Bekaert, LLP, and the advisory resolution on executive compensation require the affirmative vote of the majority of the votes cast, in person or by proxy, and entitled to vote at the Annual Meeting.

How are votes counted?

With regard to the election of directors, you may vote “FOR” or “WITHHOLD,” and votes that are withheld will be excluded entirely from the vote and will have no effect. For the other proposals you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions are not counted as votes cast and therefore have no effect on any proposal.

If you hold your shares in “street name,” we have supplied copies of our proxy materials for our Annual Meeting to the broker, trust, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. Your broker, trust, bank or other nominee that has not received voting instructions from you may not vote on any proposal other than the Reverse Stock Split Proposal and the appointment of Cherry Bekaert, LLP. These so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the Annual Meeting for purposes of determining a quorum but will not be considered in determining the number of votes necessary for approval of any of the proposals and will have no effect on the outcome of any of the proposals. Your broker, bank or other nominee is permitted to vote your shares on the Reverse Stock Split Proposal and the appointment of Cherry Bekaert, LLP as our independent auditor without receiving voting instructions from you.

| 4 |

Other than the items in the proxy statement, what other items of business will be addressed at the Annual Meeting?

The Board and management do not intend to present any matters at this time at the Annual Meeting other than those outlined in the notice of the Annual Meeting. Should any other matter requiring a vote of stockholders arise, stockholders returning the Proxy Card confer upon the individuals designated as proxy discretionary authorities to vote the shares represented by such proxy on any such other matter in accordance with their best judgment.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this Proxy Statement, Proxy Cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Proxy Card. Please vote your shares applicable to each Proxy Card and voting instruction card that you receive.

If I previously signed up to receive stockholder materials by mail and wish to access these materials via the internet or electronic delivery in the future, what should I do?

If you have previously signed up to receive stockholder materials, including proxy statements and annual reports, by mail, you may choose to receive these materials by accessing the internet or via electronic delivery in the future. You can help us achieve a substantial reduction in our printing and mailing costs by choosing to receive stockholder materials by means other than the mail. If you choose to receive your proxy materials by accessing the internet, then before next year’s annual meeting, you will receive a Notice of Internet Availability of Proxy Materials when the proxy materials and annual report are available over the internet. If you choose instead to receive your proxy materials via electronic delivery, you will receive an email containing the proxy materials.

If your shares are registered in your own name (instead of through a broker or other nominee), sign up to receive proxy materials in the future by accessing the internet or via electronic delivery by visiting the following website: www.investorelections.com/pcsa.

Your election to receive your proxy materials by accessing the internet or by electronic delivery will remain in effect for all future stockholder meetings unless you revoke it before the Annual Meeting by following the instructions on the Notice of Internet Availability of Proxy Materials or by calling or sending a written request addressed to:

Processa Pharmaceuticals, Inc.

7380 Coca Cola Drive, Suite 106

Hanover, Maryland 21076

(443) 776-3133

Attention: Wendy Guy

If you hold your shares in an account at a brokerage firm or bank participating in a “street name” program, you can sign up for electronic delivery of proxy materials in the future by contacting your broker.

How can I obtain paper copies of the proxy materials, Annual Report on Form 10-K, and other financial information?

Stockholders can access our 2025 proxy statement, our Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission as well as our corporate governance and other related information on the investor relations page of our website at https://www.processapharmaceuticals.com/investors/sec-filings.

The Securities and Exchange Commission’s rules permit us to deliver a single Notice of Internet Availability of Proxy Materials or a single set of annual meeting materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings to the Company. To take advantage of this opportunity, we have delivered only one notice, proxy statement and annual report to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the notice or annual meeting materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future notices, proxy statements and annual reports for your household, or wish to receive a separate copy for each stockholder, please write to the address set forth above.

If you previously elected to receive our stockholder materials via the internet, you may request paper copies, without charge, by writing to the address set forth above.

Where can I find the voting results of the annual meeting?

We will announce the preliminary voting results at the annual meeting and release the final results in a Form 8-K within four business days following the annual meeting.

| 5 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Processa’s business and affairs are managed under the direction of the Board of Directors. All of our directors are elected at each annual meeting to serve until their successors are duly elected or until their earlier death, resignation or removal. The individuals named as proxy voters in the accompanying proxy, or their substitutes, will vote for the Board’s nominees with respect to all proxies we receive unless instructions to the contrary are provided. If any nominee becomes unavailable for any reason, the votes will be cast for a substitute nominee designated by our Board. Our directors have no reason to believe that any of the nominees named below will be unable to serve if elected.

Nominees for Election

The Board has nominated the six persons named in the table below for election as directors at the Annual Meeting. The following table provides information regarding our director nominees as of May 1, 2025:

| Name of Nominee | Age | Position Held with Processa | Director Since | |||

| Justin Yorke | 58 | Chairman of the Board | 2017 | |||

| George Ng | 51 | Chief Executive Officer and Director | 2023 | |||

| Khoso Baluch | 67 | Director | 2022 | |||

| James Neal | 69 | Director | 2022 | |||

| Geraldine Pannu | 55 | Director | 2020 | |||

| Dr. David Young | 72 | President of Research and Development and Director | 2017 |

Set forth below with respect to each director nominee standing for election at the Annual Meeting are such nominee’s principal occupation and business experience during at least the past five years, the names of other publicly-held companies for which such nominee serves or has served as a director during such period, and the experience, qualifications, attributes or skills that has led the Board to conclude that each nominee should serve as a director of the Company.

Justin Yorke – Mr. Yorke is currently the Chairman of the Board, a position he has held since July 11, 2022, and has served as a director since August 2017. Mr. Yorke has over 25 years of experience as an institutional equity fund manager and senior financial analyst for investment funds and investment banks. For more than 20 years, he has been a partner at Arroyo Capital Management which manages the Richland Fund whose primary activity is investing in public and private companies in the United States. Since March 2020, Mr. Yorke has served as a director and Corporate Secretary of Splash Beverage Group, Inc (NYSE:SBEV). From 2006 to 2007, Mr. Yorke served as non-executive Chairman of Jed Oil and a director/CEO at JMG Exploration. From 2000 to 2004, he was a partner at Asiatic Investment Management, based in San Francisco. From 1997 to 2000, Mr. Yorke was a Fund Manager and Senior Financial Analyst, based in Hong Kong, for Darier Henstch, S.A., a private Swiss bank, where he managed their $400 million Asian investment portfolio. From 1995 to 1997, Mr. Yorke was an Assistant Director and Senior Financial Analyst with Peregrine Asset Management, which was a unit of Peregrine Securities, a regional Asian investment bank. From 1990 to 1995, Mr. Yorke was a Vice President and Senior Financial Analyst with Unifund Global Ltd., a private Swiss Bank, as a manager of its $150 million Asian investment portfolio. Mr. Yorke has a B.A. from University of California, Los Angeles. We believe Mr. Yorke is qualified to serve on our Board because of his extensive investment experience.

George Ng – Mr. Ng has served as our Chief Executive Officer and as a director since August 8, 2023. He has served as a member of the board of directors of Calidi Biotherapeutics Inc. (NYSE:CLDI) (“Calidi”) from October 2019 to September 2024, and was Calidi’s President and Chief Operating Officer from February 1, 2022 until June 23, 2023. He has been a partner at PENG Life Science Ventures since September 2013; a member of the board of directors and co-founder at IACTA Pharmaceuticals, Inc. since January 2020; and member of the board of directors of TuHURA Biosciences, Inc. (formerly, Morphogenesis, Inc.) since February 2020 . His experience further includes serving in various executive-level or board of director positions for multiple publicly-traded and private global biotechnology and pharmaceutical firms. Mr. Ng previously served as a member of the board of directors of Inflammatory Response Research, Inc. from May 2019 to April 2020; Invent Medical Corp from July 2019 to January 2020; ImmuneOncia Therapeutics Inc. from June 2016 to 2019; and Virttu Biologics Limited from April 2017 to April 2019. He was also the Executive Vice President and Chief Administrative Officer of Sorrento Therapeutics, Inc. (Nasdaq: SRNE) from March 2015 to April 2019; the Co-Founder and President, Business of Scilex Pharmaceuticals Inc. from September 2012 to April 2019; and the Senior Vice President and General Counsel of BioDelivery Sciences International Inc. (Nasdaq: BDSI) from December 2012 to March 2015. Mr. Ng holds a JD degree from the University of Notre Dame School of Law, as well as a B.A.S. (B.A. and B.S.) dual degree in Biochemistry and Economics from the University of California, Davis. We believe that Mr. Ng is qualified to serve on our Board due to his experience with pharmaceutical companies.

| 6 |

Khoso Baluch – Mr. Baluch has served as a director since over July 2022. He has over 36 years of experience across global geographies in the biopharmaceutical industry. He serves on Relevant Bio, a private US company, as a member of the board of directors since February 2024 and Longeveron, a US public company, as a member of the board of directors since June 2023. Since 2012, he has served as an independent director of Poxel S.A. (OTC: PXXLF), a French publicly traded biotech company, and chairs its compensation committee and as of March 2023 became Chairman. He also served as the Chairman of the Board for Da Volterra, a French privately held company, from December 2021 until November 2022. From 2016 to 2021, Mr. Baluch served as the Chief Executive Officer and a member of the board of directors of CorMedix, Inc. (Nasdaq: CRMD), a publicly traded pharmaceutical company in the United States. Mr. Baluch also held various senior positions at UCB, S.A. between January 2008 to April 2016, including Senior Vice President and President Europe, Middle East & Africa. Prior to joining UCB, Mr. Baluch worked for Eli Lilly and Company (NYSE: LLY) for 24 years, holding international positions spanning Europe, the Middle East and the United States in general management, business development, market access and product leadership. Mr. Baluch holds a B.S. in Aeronautical Engineering from City University London and an MBA from Cranfield School of Management. We believe Mr. Baluch is qualified to serve as on our Board due to his business expertise and significant executive management experience in the pharmaceutical industry.

James Neal – Mr. Neal has served as a director since July 2022. He brings more than 25 years of experience forming and maximizing business and technology collaborations globally and in bringing novel products and technologies to market. Mr. Neal served as the Chief Executive Officer and member of the board of directors of XOMA Corporation (Nasdaq: XOMA) (“XOMA”) from December 2016 until his retirement in January 2023. Mr. Neal joined XOMA in 2009 as its Vice President, Business Development. Prior to joining XOMA, Mr. Neal was Acting Chief Executive Officer of Entelos, Inc. a leading biosimulation company. Previously, in 2007, Entelos acquired Iconix Biosciences, a privately held company where Mr. Neal served as Chief Executive Officer and established multi-year collaborations with Bristol-Myers Squibb, Abbott Labs, Eli Lilly and the U.S. Food and Drug Administration. While Executive Vice President of Incyte Genomics from 1999 to 2002, he led the global commercial activities with pharmaceutical company collaborators and partners including Pfizer, Aventis and Schering-Plough, as well as sales, marketing and business development activities for the company. Earlier, he was associated with Monsanto Company in positions of increasing responsibility. Mr. Neal also serves on the Board of Directors of Akari Therapeutics, a pre-clinical stage biopharmaceutical company. Mr. Neal earned his B.S. in Biology and his M.S. in Genetics and Plant Breeding from the University of Manitoba, Canada, and holds an Executive MBA degree from Washington University in St. Louis, Missouri. We believe Mr. Neal is qualified to serve on our Board because of his business expertise and significant executive management experience in the pharmaceutical industry.

Geraldine Liu Pannu – Ms. Pannu has served as a Director since February 13, 2020. Since May 2022, she has also served as an independent director on the Board of Royal Business Bank (Nasdaq: RBB). Ms. Pannu has over 25 years of experience in investment and financial management, fund operations, consulting and marketing. Since January 2020, she has been the Founding and Managing Partner of GLTJ Pioneer Capital, a firm that specializes in land acquisition, entitlement and vertical development of multifamily, student and senior housing in the San Francisco Bay Area. From September 2018 to September 2019, Geraldine was the Managing Director of Business Development for Golden Gate Global (GGG), a leading investment fund company in the Bay Area, CA. During this time, she was also the President of Golden Wealth Management Group (GWMG), an affiliated company of GGG that provides professional wealth management services to high net worth individuals and families. From March 2007 to December 2016 , Ms. Pannu was the COO and Managing Partner for ChinaRock Capital Management, a leading hedge and venture capital fund company. She previously worked at McKinsey & Co., Monitor Company as a management consultant. She has successfully raised capital for several hedge, venture capital and real estate funds. She also helped start-up companies expand and diversify business categories and client verticals and grow revenue. Ms. Pannu was born in Shanghai and grew up in Hong Kong. She received her BBA from the Chinese University of Hong Kong and an MBA from Harvard Business School. She is fluent in English, Mandarin, Cantonese and Shanghainese. We believe Ms. Pannu is qualified to serve on our Board because of her extensive investment experience.

David Young, Pharm.D., Ph.D. - Dr. Young has served as our President, Research and Development and a director since August 8, 2023. He also served as our Chief Executive Officer from October 4, 2017 until August 7, 2023, as the Chairman of our Board until July 11, 2022, and as our President from July 11, 2022 until August 8, 2023. He has over 35 years of drug development experience serving as CEO, President and VP in different drug development companies. He served as our interim CFO from October 4, 2017 to September 1, 2018. From 2006 to 2014, Dr. Young served as a Questcor Pharmaceuticals Board Member and later as CSO, where he worked with FDA on the sNDA approval of Acthar for infantile spasms, an ultra-rare orphan indication, and other indications. In 2014, Questcor was acquired for $5.7 billion. Dr. Young was previously an Associate Professor at the University of Maryland, has served on FDA Advisory Committees, and was involved with two FDA-funded contracts as co-principal investigator and investigator. Research from these contracts resulted in multiple FDA Guidances, which became the basis of our regulatory science approach to drug development. Dr. Young has served on NIH grant review committees and was Co-Principal Investigator on an NCI contract to evaluate new oncology drugs. He has met with the FDA over one hundred times and has been a key member on more than thirty FDA indication approvals. Dr. Young received a B.S. in Physiology, M.S. in Medical Physics, and Pharm.D.-Ph.D. specializing in pharmacokinetics-pharmacodynamics. We believe Dr. Young is qualified to serve on our Board due to his pharmaceutical experience.

Recommendation

The Board of Directors recommend a vote FOR each of the nominees named above.

| 7 |

PROPOSAL NO. 2

APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK UPON EXERCISE OF SERIES A AND B WARRANTS IN ACCORDANCE WITH NASDAQ LISTING RULE 5635

On January 29, 2025, we completed an offering of 1,030,972 shares of our common stock and 7,019,700 pre-funded warrants to purchase on shares of our common stock along with Series A warrants to purchase up to 8,050,672 shares of our common stock (the “Series A Warrants”) and Series B warrants to purchase up to 4,025,336 shares of our common stock (the “Series B Warrants” and collectively with the Series A Warrants, the “Series A and B Warrants”) with institutional healthcare investors and certain of our officers and directors. The securities were sold at a combined purchase price of $0.615 for institutional investors and $0.7975 for the Company’s Chief Executive Officer and certain board members. The Series A and B Warrants both have an exercise price of $0.65 per share of common stock and will be exercisable beginning on the effective date of stockholder approval of the issuance of the shares upon exercise (the “Warrant Stockholder Approval Date”). The Series A Warrants will expire on the five-year anniversary date of the Warrant Stockholder Approval Date and the Series B Warrants will expire on the eighteen-month anniversary date of the Warrant Stockholder Approval Date. As part of the offering, we agreed to hold a meeting of stockholders for the purpose of obtaining stockholder approval of the issuance of the shares of common stock upon exercise of the Series A and B Warrants. If we do not obtain stockholder approval at this meeting, we agreed to call a meeting every ninety (90) days thereafter to seek stockholder approval until obtained or the Series A and B Warrants are no longer outstanding.

The foregoing summary of the Series A and B Warrants does not purport to be complete and is subject to, and qualified in its entirety by, the forms of such documents attached as Exhibits 4.1 and 4.2, respectively, to our Current Report Form 8-K filed on January 30, 2025, which are incorporated herein by reference.

Reasons for Stockholder Approval

In the offering, we agreed to hold an annual or a special meeting of stockholders to obtain the stockholder approval of the Series A and B Warrants.

In addition, our common stock is listed on the Nasdaq Capital Market and we are subject to the Nasdaq listing standards and rules. Under Rule 5635(d) of the Nasdaq Stock Market, stockholder approval is required in connection with a transaction, other than a public offering, at a price below the Minimum Price (as defined under Nasdaq rules) involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance. The issuance of shares of common stock upon exercise of the Series A and B Warrants could result in the potential issuance of more than 19.99% of our outstanding common stock at below the Minimum Price under Nasdaq rules without approval of our stockholders.

Possible Effects of the Proposal

If the stockholders do not approve this Proposal 2, then the Series A and B Warrants will not become exercisable. However, we will also be obligated to incur additional management resources and expenses to call and hold a meeting every 90 days thereafter to seek such stockholder approval until the date stockholder approval is obtained. Additionally, the failure to obtain stockholder approval may discourage future investors from engaging in future financings with us. If these consequences occur, we may have difficulty finding alternative sources of capital to fund our operations in the future on terms favorable to us or at all. We can provide no assurance that we would be successful in raising funds pursuant to additional equity or debt financings.

If the stockholders approve this Proposal 2, the Series A and B Warrants shall become immediately exercisable. If the warrants are exercised for cash, it will generate additional working capital for the Company, and will result in an increase in our common stock outstanding, diluting the percentage ownership of our current shareholders to the extent that the holders exercise their warrants.

Recommendation

The Board of Directors Recommends that the Stockholders Vote FOR the Approval of the Issuance of Shares of Common Stock Upon Exercise of the Series A and B Warrants Sold.

| 8 |

PROPOSAL NO. 3

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Cherry Bekaert, LLP (“Cherry Bekaert”) as our independent registered certified public accounting firm for the fiscal year 2025 and has further directed that the selection of Cherry Bekaert be submitted to a vote of stockholders at the annual meeting for ratification.

In selecting Cherry Bekaert to be our independent registered public accounting firm for 2025, our Audit Committee considered the results from its review of Cherry Bekaert’s independence, including (i) all relationships between Cherry Bekaert and our Company and any disclosed relationships or services that may impact Cherry Bekaert’s objectivity and independence; and (ii) Cherry Bekaert’s performance and qualification as an independent registered public accounting firm.

Our Audit Committee charter does not require that our stockholders ratify the selection of Cherry Bekaert as our independent registered public accounting firm. We are doing so because we believe it is a matter of good corporate governance practice. If our stockholders do not ratify the selection, our Audit Committee may reconsider whether to retain Cherry Bekaert, but still may retain the firm. Even if the selection is ratified, our Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of us and our stockholders.

Representatives of Cherry Bekaert are expected to attend the annual meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

Audit and Non-Audit Fees Billed to the Company by Independent Registered Public Accounting Firm

The following table sets forth the aggregate fees billed to Processa for the years ended December 31, 2024 and 2023 by Cherry Bekaert, LLP, our auditors as of October 31, 2024; and BD & Company, Inc., our auditors from January 1, 2023 to October 31, 2024:

| Service Type | 2024 | 2023 | ||||||

| Audit Fees | $ | 128,750 | (1) | $ | 94,000 | |||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | 42,461 | 1,657 | ||||||

| Total | $ | 171,211 | $ | 95,657 | ||||

Audit Fees. These fees were for professional services rendered for 2024 and 2023 in connection with the audit of our annual financial statements on Form 10-K and review of the financial statements included in our Quarterly Reports on Form 10-Q. The amounts also include fees for services that are normally provided by Cherry Bekaert, LLP and BD & Company, Inc. in connection with statutory and regulatory filings and engagements for the years identified.

All Other Fees. These fees were primarily for services related to our Registration Statements and related comfort letters in 2024 and 2023.

| (1) | Audit fees incurred in 2024 were billed accordingly: $39,500 by BD & Company, Inc. and $89,250 by Cherry Bekaert, LLP. |

| 9 |

Audit Committee Policies and Procedures for Pre-Approval of Independent Auditor Services

The following describes the Audit Committee’s policies and procedures regarding pre-approval of the engagement of the Company’s independent auditor to perform audit as well as permissible non-audit services for the Company.

For audit services and audit-related fees, the independent auditor will provide the Committee with an engagement letter during the first quarter of each year outlining the scope of the audit services proposed to be performed in connection with the audit of the current fiscal year. If agreed to by the Committee, the engagement letter will be formally accepted by the Committee at an Audit Committee meeting held as soon as practicable following receipt of the engagement letter. The independent auditor will submit to the Committee for approval an audit services fee proposal after acceptance of the engagement letter.

For non-audit services and other fees, Company management may submit to the Committee for approval (during May through September of each fiscal year) the list of non-audit services that it recommends the Committee engage the independent auditor to provide for the fiscal year. The list of services must be detailed as to the particular service and may not call for broad categorical approvals. Company management and the independent auditor will each confirm to the Audit Committee that each non-audit service on the list is permissible under all applicable legal requirements. In addition to the list of planned non-audit services, a budget estimating non-audit service spending for the fiscal year may be provided. The Committee will consider for approval both the list of permissible non-audit services and the budget for such services. The Committee will be informed routinely as to the non-audit services actually provided by the independent auditor pursuant to this pre-approval process.

To ensure prompt handling of unexpected matters, the Audit Committee delegates to its Chairman the authority to amend or modify the list of approved permissible non-audit services and fees. The Chairman will report any action taken pursuant to this delegation to the Committee at its next meeting.

All audit and non-audit services provided to the Company are required to be pre-approved by the Committee.

Recommendation

The Board of Directors recommends a vote FOR the ratification of the appointment of our Independent Registered Public Accounting Firm.

AUDIT COMMITTEE REPORT

The audit committee has reviewed and discussed the audited financial statements with management, which has represented that the financial statements were prepared in accordance with accounting principles generally accepted in the United States. The audit committee discussed with management the quality and acceptability of the accounting principles employed, including all critical accounting policies used in the preparation of the financial statements and related notes, the reasonableness of judgments made, and the clarity of the disclosures included in the statements.

The audit committee also reviewed our consolidated financial statements for the year ended December 31, 2024 with Cherry Bekaert, our independent auditors beginning November 6, 2024, who were responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States. The audit committee has discussed with Cherry Bekaert the matters required to be discussed by Statement on Auditing Standards No. 61, as amended.

The audit committee has received the written disclosures and the letter from Cherry Bekaert mandated by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the audit committee concerning independence and has discussed with Cherry Bekaert its independence and has considered whether the provision of non-audit services provided by Cherry Bekaert is compatible with maintaining Cherry Bekaert’s independence.

Based on the reviews and discussions referred to above, the audit committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2025 for filing with the Securities and Exchange Commission. The audit committee has selected Cherry Bekaert as our independent auditor for 2025.

This report is submitted by the members of the audit committee of the Board of Directors.

James Neal (Chair)

Khoso Baluch

Geraldine Pannu

Justin Yorke

| 10 |

PROPOSAL NO. 4

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

As required by the rules under the Securities Exchange Act of 1934, you are being asked to vote to approve, on an advisory or non-binding basis, an advisory resolution on the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with rules promulgated by the SEC. This resolution is commonly referred to as a “say-on-pay” resolution.

We ask that you indicate your support for our executive compensation policies and practices as described in “Executive Compensation” and the accompanying tables and related disclosures in this Proxy Statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this Proxy Statement. Your vote is advisory and so will not be binding on the Compensation Committee or the Board of Directors. However, the Compensation Committee and the Board of Directors will review the voting results and take them into consideration when structuring future executive compensation arrangements. The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting and voting on the proposal will be required for approval.

We believe that the experience, abilities and commitment of our named executive officers are unique in the biotechnology industry, and we recognize the need to fairly compensate and retain a senior management team that has produced excellent results. Accordingly, the Compensation Committee makes compensation decisions for our executive officers after consideration of the following primary objectives:

| ● | to conserve our cash and align the interests of our executives with our corporate strategy, business objectives, and the long-term interests of our stockholders, our executive compensation is primarily in the form of equity; | |

| ● | to reward executives for actions that create short-term and long-term sustainable stockholder value; and | |

| ● | to attract, incentivize, and retain our executive talent. |

Further, our executive compensation program is based on market best practices to ensure that it is appropriately risk-based and competitive with similar companies in our industry. We do not believe that our executive compensation program encourages our management to take excessive risks.

The Board of Directors encourages you to carefully review the information regarding our executive compensation program contained in this Proxy Statement, beginning on page 16, as well as the Summary Compensation Table and other related compensation tables and narrative discussion, which provide detailed information on the compensation of our named executive officers.

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a matter of good corporate governance, we are asking stockholders to approve the following advisory resolution:

RESOLVED, that the stockholders of Processa Pharmaceuticals, Inc. (the “Company”) approve, on an advisory basis, the 2025 compensation of the Company’s named executive officers disclosed in the Executive Compensation section of the Company’s proxy statement.

Recommendation

The Board of Directors recommends a vote FOR the approval of the advisory resolution on executive compensation.

| 11 |

CORPORATE GOVERNANCE

Board Composition

Currently, our Board of Directors is comprised of six members. Each director has been elected to hold office until the next annual meeting of shareholders or special meeting in lieu of such annual meeting or until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal.

Our Board of Directors may consider a broad range of factors relating to the qualifications and background of nominees, which may include diversity, which is not only limited to race, gender or national origin. We have no formal policy regarding Board diversity. Our Board of Directors’ priority in selecting Board members is identification of persons who will further the interests of our stockholders through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among Board members, knowledge of our business, understanding of the competitive landscape and professional and personal experiences and expertise relevant to our growth strategy.

Director Independence

The Nasdaq Marketplace Rules require a majority of a listed company’s Board of Directors to be comprised of independent directors. In addition, the Nasdaq Marketplace Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act.

Under Rule 5605(a)(2) of the Nasdaq Marketplace Rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3 of the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors, or any other Board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has reviewed the composition of our Board of Directors and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that each of Khoso Baluch, James Neal, Geraldine Pannu, and Justin Yorke is an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules. Our Board of Directors also determined that the directors who serve on our audit committee, our compensation committee, and our nominating and corporate governance committee satisfy the independence standards for such committees established by the SEC and the Nasdaq Marketplace Rules, as applicable. In making such determinations, our Board of Directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances our Board of Directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

There are no family relationships among any of our directors or executive officers.

Committees of the Board of Directors

Each of the below committees has a written charter approved by our Board of Directors located at our website: www.processapharmaceuticals.com. Each of the committees’ report to our Board of Directors as such committee deems appropriate and as our Board of Directors may request. Copies of each charter are posted on the investor relations section of our website. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors. In addition, from time to time, special committees may be established under the direction of our Board of Directors when necessary to address specific issues.

The Board of Directors met 20 times during 2024. All directors attended each meeting, with the following exceptions: Khoso Baluch missed three meetings, James Neal missed one meeting, Geraldine Pannu missed three meetings, Justin Yorke missed one meeting, and David Young missed two meetings.

| 12 |

Audit Committee

Our audit committee is comprised of Khoso Baluch, James Neal, Geraldine Pannu, and Justin Yorke, with James Neal serving as chairman of the committee. Our Board of Directors has determined that each member of the audit committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the applicable Nasdaq Listing Rules, and has sufficient knowledge in financial and auditing matters to serve on the audit committee. Our Board of Directors has determined that Justin Yorke is an “audit committee financial expert” within the meaning of the SEC regulations and the applicable Nasdaq Listing Rules. The audit committee’s responsibilities include:

| ● | selecting a firm to serve as the independent registered public accounting firm to audit our financial statements; | |

| ● | ensuring the independence of the independent registered public accounting firm; | |

| ● | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results; | |

| ● | establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; | |

| ● | considering the effectiveness of our internal controls and internal audit function; | |

| ● | reviewing material related-party transactions or those that require disclosure; and | |

| ● | approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm. |

The audit committee met four times during 2024. All the committee members attended each meeting, with the exception of Khoso Baluch who did not attend one meeting.

Compensation Committee

Our compensation committee is comprised of Khoso Baluch, James Neal and Geraldine Pannu, with Geraldine Pannu serving as chairman of the committee. Each member of this committee is a non-employee director, as defined by Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Our Board of Directors has determined that each member of the compensation committee is “independent” as defined in the Nasdaq Listing Rules. The composition of our compensation committee meets the requirements for independence under the Nasdaq Listing Rules, including the applicable transition rules. The compensation committee’s responsibilities include:

| ● | reviewing and approving, or recommending that our Board of Directors approve, the compensation of our executive officers; | |

| ● | reviewing and recommending to our Board of Directors the compensation of our directors; | |

| ● | reviewing and recommending to our Board of Directors the terms of any compensatory agreements with our executive officers; | |

| ● | administering our stock and equity incentive plans; | |

| ● | reviewing and approving, or making recommendations to our Board of Directors with respect to incentive compensation and equity plans; and | |

| ● | reviewing all overall compensation policies and practices. |

The compensation committee met one time during 2024. All the committee members attended the meeting.

Nominating and Governance Committee

Our nominating and governance committee is comprised of James Neal, Geraldine Pannu and Justin Yorke, with Justin Yorke as the chairman of the committee. Our Board of Directors has determined that each member of the nominating and corporate governance committee is “independent” as defined in the applicable Nasdaq Listing Rules. The nominating and corporate governance committee’s responsibilities include:

| ● | identifying and recommending candidates for membership on our Board of Directors; | |

| ● | recommending directors to serve on Board committees; | |

| ● | reviewing and recommending our corporate governance guidelines and policies; | |

| ● | reviewing proposed waivers of the code of conduct for directors and executive officers; | |

| ● | evaluating, and overseeing the process of evaluating, the performance of our Board of Directors and individual directors; and | |

| ● | assisting our Board of Directors on corporate governance matters. |

The nominating and governance committee did not meet in 2024.

| 13 |

Leadership Structure and Risk Oversight

On July 11, 2022, Justin Yorke became the Chairman of the Board of Directors. Prior to that time, Dr. David Young, our former Chief Executive Officer (now President, Research and Development) also served as Chairman of the Board. Our Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board of Directors, as our Board of Directors believes it is in our best interest to make that determination based on our position and direction and the membership of the Board of Directors.

Our Board of Directors oversees the management of risks inherent in the operation of our business and the implementation of our business strategies. Our Board of Directors performs this oversight role by using several different levels of review. In connection with its reviews of our operations and corporate functions, our Board of Directors addresses the primary risks associated with those operations and corporate functions. In addition, our Board of Directors reviews the risks associated with our business strategies periodically throughout the year as part of its consideration of undertaking any such business strategies.

Each of our Board committees also oversees the management of our risks that fall within the committee’s areas of responsibility. In performing this function, each committee has full access to management, as well as the ability to engage advisors. Our Chief Financial Officer reports to the audit committee and is responsible for identifying, evaluating and implementing risk management controls and methodologies to address any identified risks. In connection with its risk management role, our audit committee meets privately with representatives from our independent registered public accounting firm and our Chief Financial Officer. The audit committee oversees the operation of our risk management program, including the identification of the primary risks associated with our business and periodic updates to such risks, and reports to our Board of Directors regarding these activities.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee has at any time during the prior three years been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or compensation committee.

Code of Business Conduct and Ethics

We maintain a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics is available on our website at www.processapharmaceuticals.com. We intend to disclose any amendments to the code, or any waivers of its requirements, on our website or in a Current Report on Form 8-K.

Involvement in Certain Legal Proceedings

To our knowledge, none of our current directors or executive officers has, during the past ten years:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding; | |

| ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he or she was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; | |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; | |

| ● | been found by a court of competent jurisdiction in a civil action or by the SEC to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; or | |

| ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any federal or state securities or commodities law or regulation or any law or regulation respecting financial institutions or insurance companies. |

Except as set forth above and in our discussion below in “Certain Relationships and Related Transactions,” none of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

| 14 |

EXECUTIVE OFFICERS

The following table sets forth information concerning our executive officers, as of May 1, 2025. For information with respect to Mr. Ng and Dr. Young, please refer to “Election of Directors.”

| Name | Age | Position | ||

| George Ng | 51 | Chief Executive Officer | ||

| Dr. Sian Bigora | 64 | Chief Development Officer | ||

| Wendy Guy | 60 | Chief Administrative Officer | ||

| Patrick Lin | 59 | Chief Business and Strategy Officer | ||

| Russell Skibsted | 66 | Chief Financial Officer | ||

| Dr. David Young | 72 | President of Research and Development |

Sian Bigora, Pharm.D. - Dr. Bigora has served as our Chief Development and Regulatory Officer since October 4, 2017 and has over 30 years of pharmaceutical research, regulatory strategy and drug development experience. From 2009 to 2015 Dr. Bigora was Vice President of Regulatory Affairs at Questcor Pharmaceuticals (acquired by Mallinckrodt Pharmaceuticals in 2014), including leading efforts on modernizing the Acthar Gel label and in obtaining FDA approval in Infantile Spasms, events of material importance to Questcor’s subsequent success. During her time at Questcor, she assisted in building an expert regulatory group to address both commercial and development needs for complex products such as Acthar. Dr. Bigora’s role at Questcor included heading up the development of a safety pharmacovigilance group and a clinical quality group. Prior to her position at Questcor, Dr. Bigora was Vice President of Clinical and Regulatory Affairs, U.S. Operations of AGI Therapeutics, plc. In this role, she was responsible for the development and implementation of Global Phase 3 studies and interactions with regulatory authorities. Previously, she operated her own consulting company, serving as the regulatory and drug development expert team member for multiple small and mid-sized pharmaceutical companies. Dr. Bigora held multiple positions in regulatory affairs, operations and project management ending as VP of Regulatory Affairs at the Strategic Drug Development Division of ICON, plc, an international CRO, and at GloboMax LLC, a CRO specializing in FDA drug development, purchased by ICON plc in 2003. Prior to GloboMax, she worked in the Pharmacokinetics and Biopharmaceutics Laboratory at the School of Pharmacy, University of Maryland on the FDA funded Clinical Pharmacology contract and UMAB-FDA contract as a clinical scientist and instructor for FDA reviewers. Dr. Bigora received a Pharm.D. from the School of Pharmacy at the University of Maryland at Baltimore. She also completed a Fellowship in Pharmacokinetics and Pediatric Infectious Diseases at the University of Maryland at Baltimore.

Wendy Guy - Ms. Guy has served as our Chief Administrative Officer since October 4, 2017. She has over 20 years of experience in business operations, management, contracts, human resources recruiting, and finance roles. From 2009 to 2014, Ms. Guy was employed at Questcor Pharmaceuticals (acquired by Mallinckrodt Pharmaceuticals in 2014) as Senior Manager, Business Operations in charge of the Maryland Office for Questcor. During the five years she spent at Questcor, she built a dynamic administrative and contracts team, grew the Maryland Office from two employees to just under 100, and expanded the facility from 1,200 sq. ft. to 15,000 sq. ft. Prior to her position at Questcor, Ms. Guy was Senior Manager, U.S. Operations of AGI Therapeutics, plc. In this role, she was responsible for the day-to-day business and administrative operations of the company. Previously, she held multiple senior level positions with the Strategic Drug Development Division of ICON, GloboMax, and Mercer Management Consulting. Ms. Guy received an A.A. from Mount Wachusett Community College.

Patrick Lin - Mr. Lin has served as our Chief Business & Strategy Officer since October 4, 2017 and has over 30 years of financing and investing experience in the Biopharm Sector. He is founder and, for more than 15 years, Managing Partner of Primarius Capital, a family office that manages public and private investments focused on small capitalization companies. For 10 years prior to forming Primarius Capital, Mr. Lin worked at several Wall Street banking and brokerage firms including Robertson Stephens & Co., E*Offering, and Goldman Sachs & Co. Mr. Lin was Co-Founding Partner of E*Offering. Mr. Lin received an MBA from Kellogg Graduate School of Management, an M.S. in Engineering Management, and a BS from the University of Southern California.

Russell Skibsted – Mr. Skibsted has served as our Chief Financial Officer since July 16, 2024. He has nearly 30 years of experience in the pharmaceutical industry including expertise in financial management, global business development, capital raises, investor relations and operations. He has worked with public and private life sciences companies at all stages of development. Most recently, he served as Senior Vice President and CFO of Alimera Sciences, a publicly traded global ophthalmic pharmaceuticals company that was acquired by ANI Pharmaceuticals from January 2023 to December 2023. Prior to that, he was Executive Vice President, CFO and Chief Business Officer at Rockwell Medical, a public company providing hemodialysis products from September 2020 to November 2022. From July 2017 to May 2020, Mr. Skibsted served as CFO of BioTime, a publicly traded biotechnology company now named Lineage Cell Therapeutics, where he also was CFO at various times for several of BioTime’s public and private subsidiaries, including Agex Therapeutics, OncoCyte Corporation and Asterias Biotherapeutics. Prior to BioTime, Mr. Skibsted served as CFO or Chief Business Officer for several public and private life science companies, including Aeolus Pharmaceuticals, Spectrum Pharmaceuticals and Hana Biosciences. Mr. Skibsted holds a BA in economics from Claremont McKenna College and an MBA from the Stanford Graduate School of Business.

| 15 |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation awarded to or earned by our Chief Executive Officer and our two other highest paid executive officers for the years ended December 31, 2024 and 2023. George Ng joined as our CEO and a director on August 8, 2023. Up until that time, Dr. David Young served as our CEO. Dr. Young, who continues as a director, is now President, Research and Development to focus on drug development.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(2) | Option Awards ($) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||||||

| George Ng(1) | 2024 | 400,000 | (5) | 100,000 | (4) | - | - | 21,033 | 521,033 | ||||||||||||||||||

| Chief Executive Officer | 2023 | 159,091 | - | 312,000 | - | - | 471,091 | ||||||||||||||||||||

| David Young | 2024 | 290,940 | (6) | - | 14,484 | - | - | 305,424 | |||||||||||||||||||

| President, Research and Development and former Chief Executive Officer | 2023 | 160,200 | - | 26,433 | - | - | 186,633 | ||||||||||||||||||||

| Sian Bigora | 2024 | 290,940 | (7) | - | 14,484 | - | 22,827 | 328,251 | |||||||||||||||||||

| Chief Development and Regulatory Officer | 2023 | 160,200 | - | 136,837 | - | 24,665 | 321,702 | ||||||||||||||||||||

| (1) | Mr. Ng joined the Company on August 8, 2023. | |

| (2) | Reflects the aggregate grant date fair value of RSUs granted calculated in accordance with FASB ASC Topic 718. Assumptions applicable to these valuations and other information can be found in Note 3 of the Notes to Consolidated Financial Statements — Stock-Based Compensation contained in the Processa Pharmaceuticals, Inc. Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and Annual Report on Form 10-K for the year ended December 31, 2023. | |

| (3) | Amounts reflect the dollar value of group health insurance premiums for the named executive officer. | |

| (4) | $100,000 contractual bonus received during the year ended December 31, 2024. | |

| (5) | Includes$16,259 of salary that was voluntarily deferred by the executive. | |

| (6) | Includes $181,733 of salary that was voluntarily deferred by the executive. | |

| (7) | Includes $11,664 of salary that was voluntarily deferred by the executive. |

Narrative to the Summary Compensation Table

Overview of Our Executive Compensation Philosophy and Design

We believe that a skilled, experienced and dedicated executive and senior management team is essential to the future performance of our Company and to building stockholder value. We have sought to establish competitive compensation programs that enable us to attract and retain executive officers with these qualities. The other objectives of our compensation programs for our executive officers are the following:

| ● | to motivate our executive officers to achieve strong financial performance; | |

| ● | to attract and retain executive officers who we believe have the experience, temperament, talents and convictions to contribute significantly to our future success; and | |

| ● | to align the economic interests of our executive officers with the interests of our stockholders. |

| 16 |

Our executive compensation philosophy in 2023 and 2024 centered on providing the majority of each executive officers compensation in common stock. This allowed us to conserve our cash and utilize it in our clinical and other operating activities.

Setting Executive Compensation

Our compensation committee has primary responsibility for, among other things, determining our compensation philosophy, evaluating the performance of our named executive officers, setting the compensation and other benefits of our named executive officers and administering our equity compensation plan.

It is our CEO’s responsibility to provide recommendations to the compensation committee for most compensation matters related to executive compensation. The recommendations are based on a general analysis of market standards and trends and an evaluation of the contribution of each executive officer to our performance. Our compensation committee considers, but retains the right to accept, reject or modify such recommendations and has the right to obtain independent compensation advice. Neither the CEO nor any other members of management is present during executive sessions of the compensation committee. The CEO is not present when decisions with respect to his compensation are made. Our Board of Directors appoints the members of our compensation committee and delegates to the compensation committee the direct responsibility for overseeing the design and administration of our executive compensation program.

We have not historically utilized a compensation consultant to set the compensation of our named executive officers.

Elements of Executive Compensation

We believe the most effective compensation package for our named executive officers is one designed to reward achievement of individual and corporate objectives; provide for short-, medium- and long-term financial and strategic goals; and align the interest of management with those of the stockholders by providing incentives for improving stockholder value. To accomplish that objective, our named executive officers have, and it is anticipated will continue to receive a significant portion of their annual compensation in the form of RSUs.

Base Compensation – We pay our named executive officers base compensation to compensate them for services rendered and to provide them with a steady source of income for living expenses throughout the year. In 2024, our named executive officers received base salaries ranging between $298,000 and $400,000, depending on their position and responsibilities. With the exception of Mr. Ng, our named executive officers received $290,940 in cash and the remainder was paid in salary shortfall RSUs that cliff vested on January 1, 2025. During 2024, the named executive officers voluntarily deferred a portion of their base salary for the benefit of the Company: Mr. Ng deferred $16,259, Dr. Young deferred $181,733 and Dr. Bigora deferred $11,644.

For 2023, with the exception of Mr. Ng, our named executive officers received base compensation ranging between $160,200 to $244,000, depending on their position and responsibilities. These two named executive officers received $160,200 in cash and with the remainder paid in salary shortfall RSUs that cliff vested on January 1, 2024.