As filed with the U.S. Securities and Exchange Commission on December 29, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Processa Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 45-1539785 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

7380 Coca Cola Drive, Suite 106

Hanover, Maryland 21076

(443) 776-3133

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

George Ng

Chief Executive Officer

Processa Pharmaceuticals, Inc.

7380 Coca Cola Drive, Suite 106

Hanover, Maryland 21076

(443) 776-3133

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael B. Kirwan John J. Wolfel, Jr. Neda Sharifi Foley & Lardner LLP One Independent Drive, Suite 1300 Jacksonville, Florida 32202 (904) 359-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED DECEMBER 29, 2023

Up to ● Shares of Common Stock

Up to ● Pre-Funded Warrants to Purchase up to ● Shares of Common Stock

Up to ● Common Warrants to Purchase up to ● Shares of Common Stock

Up to ● Placement Agent Warrants to Purchase up to ● Shares of Common Stock

Up to ● Shares of Common Stock underlying such Pre-Funded Warrants, Common Warrants and Placement Agent Warrants

We are offering up to ● shares of our common stock and accompanying common warrants to purchase up to ● shares of our common stock (the “Common Warrants”), at an assumed combined public offering price of $● per share of common stock and accompanying Common Warrant (equal to the last sale price of our common stock as reported by The Nasdaq Capital Market on ●, 202●). The Common Warrants have an exercise price of $● per share (●% of the combined public offering price per share of the common stock and accompanying Common Warrant) and will be exercisable beginning on the effective date of stockholder approval of the issuance of the shares upon exercise of the warrants (“Warrant Stockholder Approval”), provided however, if the Pricing Conditions (as defined below) are met, the Common Warrant will be exercisable upon issuance (the “Initial Exercise Date”). The Common Warrants will expire on the five-year anniversary date of the Initial Exercise Date. As used herein “Pricing Conditions” means that the combined offering price per share and accompanying Common Warrant is such that the Warrant Stockholder Approval is not required under Nasdaq rules because either (i) the offering is an at-the-market offering under Nasdaq rules and such price equals or exceeds the sum of (a) the applicable “Minimum Price” per share under Nasdaq rule 5635(d) plus (b) $0.125 per whole share of common stock underlying the Common Warrant or (ii) the offering is a discounted offering where the pricing and discount (including attributing a value of $0.125 per whole share underlying the warrants) meet the pricing requirements under the Nasdaq rules.

We are also offering to each purchaser whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (the “Pre-Funded Warrants”), in lieu of shares of common stock that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the investor, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise price of $0.0001 per share of common stock. The public offering price per Pre-Funded Warrant and accompanying Common Warrant, is equal to the public offering price per share of common stock and accompanying Common Warrant less $0.0001. Each Pre-Funded Warrant will be exercisable upon issuance and will expire when exercised in full. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants.

For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because a Common Warrant is being sold together in this offering with each share of common stock and, in the alternative, each Pre-Funded Warrant to purchase one share of common stock, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and Pre-Funded Warrants sold. The shares of common stock or Pre-Funded Warrants, as applicable, and the accompanying Common Warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance.

We are also registering shares of common stock that are issuable from time to time upon exercise of the Pre-Funded Warrants, Common Warrants and Placement Agent Warrants (as defined below).

This offering will terminate on ●, 202●, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering. The combined public offering price per share (or pre-funded warrant) and accompanying Common Warrants will be fixed for the duration of this offering.

We have engaged ●, or the placement agent, to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. Since we will deliver the securities to be issued in this offering upon our receipt of investor funds, there is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. In addition, because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors” for more information. We will bear all costs associated with the offering. See “Plan of Distribution” on page 35 of this prospectus for more information regarding these arrangements.

Our common stock is listed on The Nasdaq Capital Market under the symbol “PCSA.” The closing price of our common stock on ●, 202●, as reported by The Nasdaq Capital Market, was $● per share. There is no established public trading market for the Pre-Funded Warrants or the Common Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-Funded Warrants or the Common Warrants on any securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited.

The public offering price per share of common stock and accompanying Common Warrant and any Pre-Funded Warrant and accompanying Common Warrant will be determined by us at the time of pricing, may be at a discount to the current market price, and the recent market price used throughout this prospectus may not be indicative of the final public offering price.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus before investing. You should also consider the risk factors described or referred to in any documents incorporated by reference in this prospectus, and in any applicable prospectus supplement, before investing in these securities.

We are a “smaller reporting company” as defined under federal securities law and we have elected to comply with certain reduced public company reporting requirements available to smaller reporting companies. See the section titled “Prospectus Summary — Implications of Being a Smaller Reporting Company.”

| Per share of Common Stock and accompanying Common Warrant | Per Pre-Funded Warrant and accompanying Common Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Placement agent fees (1) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses (2) | $ | $ | $ | |||||||||

| (1) | We have agreed to pay the placement agent a cash fee equal to 7.0% of the gross proceeds raised in this offering (other than proceeds received from the Company’s current directors and officers). We have also agreed to reimburse the placement agent for certain of its offering related expenses, including reimbursement for non-accountable expenses in legal fees and expenses in the amount of up to $112,500, and for its clearing expenses in the amount of $15,950. In addition, we have agreed to issue the placement agent or its designees warrants (“Placement Agent Warrants”) to purchase a number of shares of common stock equal to 4.0% of the shares of common stock sold in this offering (including the shares of common stock issuable upon the exercise of the Pre-Funded Warrants, but not including shares of common stock sold to current directors and officers of the Company), at an exercise price of $● per share, which represents 125% of the public offering price per share and accompanying warrant. For a description of compensation to be received by the placement agent, see “Plan of Distribution” for more information |

| (2) | Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. For more information, see “Plan of Distribution.” |

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock is expected to be made on or about ●, 202●.

Prospectus dated ●, 202●

TABLE OF CONTENTS

| i |

You should rely only on the information we have provided or incorporated by reference into this prospectus, any applicable prospectus supplement and any related free writing prospectus. We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information By Reference,” before deciding to invest in our securities.

We have not, and the placement agent and its affiliates have not, authorized anyone to provide you with any information or to make any representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. We do not, and the placement agent and its affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission (“SEC”) before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the late date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

For investors outside the United States: neither we nor the placement agent have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States of America. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus and any such free writing prospectus outside of the U.S.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations, market position and market opportunity, is based on our management’s estimates and research, as well as industry and general publications and research, surveys and studies conducted by third parties. We believe that the information from these third-party publications, research, surveys and studies included in this prospectus is reliable. Management’s estimates are derived from publicly available information, their knowledge of our industry and their assumptions based on such information and knowledge, which we believe to be reasonable. These data involve a number of assumptions and limitations which are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

As used in this prospectus, unless the context indicates or otherwise requires, “the Company,” “our Company,” “we,” “us,” and “our” refer to Processa Pharmaceuticals, Inc., a Delaware corporation, and its consolidated subsidiary.

| 1 |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making an investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including the information set forth under the “Risk Factors” section of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of the risks involved in investing in our securities.

Overview

We are a clinical-stage biopharmaceutical company focused on utilizing our “regulatory science” approach, including the principles associated with FDA’s Project Optimus Oncology initiative and the related FDA Draft Guidance, in the development of Next Generation Chemotherapy (“NGC”) oncology drug products. Our mission is to provide better treatment options than those that presently exist by extending a patient’s survival and/or improving a patient’s quality of life. This is achieved by improving upon FDA-approved, widely used oncology drugs or the cancer-killing metabolites of these drugs by altering how they are metabolized and/or distributed in the body, including how they are distributed to the actual cancer cells.

Regulatory science was conceived in the early 1990s when the founders of Processa and other faculty at the University of Maryland worked with the FDA to develop multiple FDA Guidances. Regulatory science is the science of developing new tools, standards, and approaches to assess the safety, efficacy, quality, and performance of all FDA-regulated products. Over the last 30 years, two of our founders, Dr. David Young and Dr. Sian Bigora, have expanded the original regulatory science concept by including the pre-clinical and clinical studies to justify the benefit-risk assessment required for FDA approval when designing the development programs of new drug products.

Our regulatory science approach defines the scientific information that the FDA requires to determine if the benefit outweighs the risk of a drug in a specific population of patients and at a specific dosage regimen for a specific drug product. The studies are designed to obtain the necessary scientific information to support the regulatory decision.

The FDA has more recently taken steps to define some of the regulatory science required for the FDA approval of oncology products. Through the FDA’s Project Optimus Oncology Initiative and the related Draft Guidance on determining the “optimal” dosage regimen for an oncology drug, the FDA has chosen to make the development of oncology drugs more science-based than in the past. Since the principles of the FDA’s Project Optimus and the related Draft Guidance have been used by our regulatory science approach in a number of non-oncology drugs, our experience with the principles of Project Optimus differentiates us from other biotechnology companies by focusing us not only on the clinical science, but also on the equally important regulatory process. We believe utilizing our regulatory science approach provides us with three distinct advantages:

| ● | greater efficiencies (e.g., the right trial design and trial readouts); | |

| ● | greater possibility of drug approval by the FDA or other regulatory authorities; and | |

| ● | greater ability to evaluate the benefit-risk of a drug compared to existing therapy, which allows prescribers to provide better treatment options for each patient. |

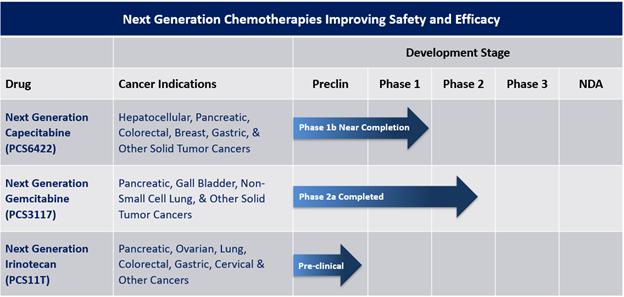

In January 2023, we announced our strategic prioritization to advance our pipeline of NGC proprietary small molecule oncology drugs. The NGC products are new chemical entities, but they work by changing the metabolism, distribution and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells. We believe our NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts – capecitabine, gemcitabine, and irinotecan. All future studies of these drugs are subject to availability of capital to conduct the trials.

The three NGC treatments in our pipeline are as follows:

| ● | NGC-Capecitabine (NGC-Cap) is a combination of PCS6422 and capecitabine, capecitabine being the oral prodrug of the cancer drug 5-fluorouracil (5-FU). PCS6422, without having any clinically meaningful biological effect itself, alters the metabolism of 5-FU, resulting in more 5-FU distribution to the cancer cells. In clinical trials, NGC-Cap has shown a safety profile different than capecitabine when administered alone. Side effects such as Hand-Foot Syndrome (HFS) and cardiotoxicity typically occur in up to 50-70% of patients treated with capecitabine and are caused by specific capecitabine metabolites. These types of toxicities frequently result in decreased doses, interrupted doses, or discontinuation of treatment with capecitabine. Since a much smaller amount of these metabolites are formed with NGC-Cap, these side effects appear in less patients and are less severe when they do occur. In addition, NGC-Cap has been found to be up to 50 times more potent than capecitabine based on the systemic exposure of the capecitabine metabolite 5-FU, which is metabolized to the cancer-killing metabolites. Like capecitabine, NGC-Cap could be used to treat patients with various cancers, such as metastatic colorectal, gastrointestinal, breast, and pancreatic. We estimate at least 200,000 patients in the United States were newly diagnosed in 2022 with metastatic colorectal, gastrointestinal, breast, and pancreatic cancers. On December 11, 2023, we had a successful meeting with the FDA regarding the next Phase 2 study supporting the advancement of NGC-Cap for cancer patients. The meeting with the FDA was supported by the interim results from the ongoing Phase 1B study that should complete enrollment in the first quarter of 2024. |

| 2 |

| ● | PCS3117, also referred to as NGC-Gemcitabine (NGC-Gem), is an oral analog of gemcitabine that is converted to its active metabolite by a different enzyme system than gemcitabine resulting in a positive response in gemcitabine patients as well as some gemcitabine treatment-resistant patients. Like gemcitabine, NGC-Gem could be used to treat patients with various cancers such as pancreatic, biliary tract, lung, ovarian, and breast. We estimate more than 275,000 patients in the United States were newly diagnosed in 2022 with pancreatic, biliary tract, lung, ovarian, and breast cancer. We plan to meet with the FDA to discuss potential study designs including implementation of the Project Optimus initiative as part of the design in 2024. | |

| ● | PCS11T, also referred to as NGC-Irinotecan (NGC-Iri), is a prodrug of the active metabolite of irinotecan (SN-38). The chemical structure of NGC-Iri influences the uptake of the drug into cancer cells, resulting in more NGC-Iri entering cancer cells than normal cells in mice. These levels were significantly greater than those seen with irinotecan, resulting in lower doses of NGC-Iri having greater efficacy than irinotecan and improved safety in animal models. Like irinotecan, NGC-Iri could be used to treat patients with various cancers such as lung, colorectal, gastrointestinal, and pancreatic cancer. We estimate at least 200,000 patients in the United States were newly diagnosed in 2022 with lung, colorectal, gastrointestinal, and pancreatic cancer. We plan to conduct IND-enabling and toxicology studies in 2024. |

We have completed our Phase 2A trial for PCS12852 in gastroparesis patients with positive results. Additionally, in February 2023, due primarily to the inability to identify and enroll patients in our rare disease Phase 2 trial for PCS499 in ulcerative Necrobiosis Lipoidica (uNL), we decided to cease further enrollment in the PCS499 trial and terminated the trial. We did not experience any safety concerns during the conduct of either the PCS12852 or PCS499 trial. We are currently evaluating options to monetize these non-core drug assets, which may include out-licensing or partnering these assets with one or more third parties.

Our shift in prioritization to NGC oncology drugs does not change our mission. We continue to be focused on drug products that improve the survival and/or quality of life for patients by improving the safety and/or efficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our approach is to take three current FDA-approved cancer drugs and modify and improve how the human body metabolizes and/or distributes these NGC treatments compared to their presently approved counterpart drugs while maintaining the cancer-killing mechanism of action; thus, our reason for calling our drugs Next Generation Chemotherapy (or NGC) treatments. Part of the development includes determining the optimal dosage regimen based on the dose-response relationship as described in the FDA’s Project Optimus Initiative and Draft Optimal Dosage Regimen Oncology Guidance. To date, we have data that suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose-adjust or discontinue treatment because of side effects or lack of response.

| 3 |

Our Strategy

Our strategy is to develop our pipeline of NGC proprietary small molecule oncology drugs using our regulatory science approach to determine the optimal dosage regimen of our oncology drugs.

By changing either the metabolism, distribution, and/or elimination of already FDA-approved cancer drugs (e.g., capecitabine, gemcitabine, and irinotecan) or their active metabolites, we believe that our three new oncology drugs represent the next generation of chemotherapy with an improved safety profile, improved efficacy profile and/or potentially benefiting more patients while maintaining the mechanism of how the drug kills cancer cells. By combining these modified approved cancer treatments with our regulatory science approach and our experience using the principles of FDA’s Project Optimus initiative, we anticipate that we will be able to increase the probability of FDA approval, improve the safety-efficacy profile over the existing counterparts of our NGC drugs, and more efficiently develop each drug.

Our pipeline of NGCs (i) already has data demonstrating the desired pharmacological activity in humans or appropriate animal models and is able to provide improved safety and/or efficacy by some modification in the formation and/or distribution of the active moieties associated with the drug and (ii) targets cancers for which a single positive pivotal trial demonstrating efficacy might provide enough evidence that the clinical benefits of the drug and its approval outweighs the risks associated with the drug.

Our Drug Pipeline

Our pipeline currently consists of NGC-Cap, NGC-Gem and NGC-Iri (also identified as PCS6422, PCS3117 and PCS11T, respectively) and two non-oncology drugs (PCS12852 and PCS499). The non-oncology drugs are not included in the pipeline chart above, as we are exploring our options for those drugs. A summary of each drug is provided below.

Next Generation Chemotherapy Pipeline

| ● | Next Generation Capecitabine (NGC-Cap) is a combination of PCS6422 and a lower dose of the FDA-approved cancer drug capecitabine. PCS6422 is an orally administered irreversible inhibitor of the enzyme dihydropyrimidine dehydrogenase (DPD). DPD metabolizes 5-Fluorouracil (5-FU), the major metabolite of capecitabine and widely used itself as an intravenous chemotherapeutic agent in many types of cancer, to multiple metabolites classified as catabolites. These catabolites do not have any cancer-killing properties but frequently cause dose-limiting side effects that may require dose adjustments or discontinuation of therapy. |

| 4 |

Capecitabine, as presently prescribed and FDA-approved, forms the cancer drug 5-FU which is then further metabolized to anabolites (which kill both cancer cells and normal duplicating cells) and catabolites (which cause side effects and have no cancer killing properties). When capecitabine is given in combination with PCS6422 in NGC-Cap, PCS6422 significantly changes the metabolism of 5-FU, which results in a change in the distribution of 5-FU within the body. Due to this change in metabolism and the overall metabolite profile of anabolites and catabolites, the side effect and efficacy profile of NGC-Cap has been found to be different from capecitabine given without PCS6422. Since the potency of NGC-Cap is also greater than FDA-approved capecitabine based on the 5-FU systemic exposure per mg of capecitabine administered, the amount of capecitabine anabolites formed from 1 mg of capecitabine administered in NGC-Cap will, therefore, be much greater than formed from the administration of 1 mg of existing capecitabine.

On August 2, 2021, we enrolled the first patient in our Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. Our interim analysis of Cohorts 1 and 2A of the ongoing clinical trial found no dose-limiting toxicities (DLTs), no drug-related adverse events greater than Grade 1, and no adverse events associated with the catabolites of 5-FU such as HFS. In this Phase 1B trial, it was demonstrated that the irreversible inhibition of DPD by PCS6422 could alter the metabolism, distribution and elimination of 5-FU, making NGC-Cap significantly (up to 50 times) more potent than capecitabine alone and potentially leading to higher levels of anabolites which can kill replicating cancer and normal cells. By administering NGC-Cap to cancer patients, the balance between anabolites and catabolites changes depending on the dosage regimens of PCS6422 and capecitabine used, making the efficacy-safety profile of NGC-Cap different than that of FDA-approved capecitabine and requiring further evaluation of the PCS6422 and capecitabine regimens to determine the optimal NGC-Cap regimens for patients.

In order for NGC-Cap to provide a safer and more efficacious profile for cancer patients compared to existing chemotherapy, understanding how the different regimens of PCS6422 and capecitabine may affect the systemic and tumor exposure to the anabolites, as well as the systemic exposure to the catabolites, is required. This can be achieved by following the timeline of DPD irreversible inhibition and the formation of new DPD using the plasma concentrations of 5-FU and its catabolites.

In an effort to better estimate the timeline of DPD inhibition and formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause DLTs. One of the regimens in the Phase 1B trial did cause DLTs in two patients, one of whom died. The Phase 1B trial is continuing to enroll patients and is expected to complete enrollment in early 2024. The next trial will be a Phase 2 trial to determine which regimens provide an improved efficacy-safety profile over present therapy using the principles of the FDA’s Project Optimus initiative to help guide the design of the trial. This FDA initiative requires us to consider NGC regimens that are not at the maximum tolerated dose or exposure level.

Discussions with the FDA in April 2023 have clarified that the major goal for the next Phase 2 trial will be to evaluate and understand the dose- and exposure-response relationship for anti-tumor activity and safety. The specific dosage regimens for the trial will be defined following the determination of the MTD from our ongoing Phase 1B trial. Cohort 3 in the Phase 1B trial, which dosed patients with PCS6422 in combination with capecitabine at 150 mg BID (twice a day), completed with no dose-limiting toxicities. Enrollment in Cohort 4 was expanded to include six patients to further evaluate the safety at this dose. Enrollment in this cohort is now complete and to date, no DLTs have been observed in this cohort, but safety evaluation for this cohort is still ongoing. Once the cohort and the safety evaluation is complete, the need for any additional cohorts will be further evaluated. Based on the data from the Phase 1B trial and ongoing discussions with the FDA from a successful FDA meeting on December 11, 2023, we have begun Phase 2 trial preparation tasks and will collaborate with the FDA to further define the final design prior to the trial. The trial is planned for 2024, but we will need to obtain additional funding before we can conduct this trial.

| 5 |

Our license agreement with Elion Oncology, Inc. (“Elion”) for NGC-Cap requires us to use commercially reasonable efforts, at our sole cost and expense, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that include dosing a first patient with a product in a Phase 2 or 3 clinical trial on or before October 2, 2024. We are currently conducting pre-trial activities and planning to dose the first patient in our Phase 2 trial in the second or third quarter of 2024.

| ● | PCS3117 is a cytidine analog similar to gemcitabine (Gemzar®), but different enough in chemical structure that some patients are more likely to respond to PCS3117 than gemcitabine. The difference in response occurs because NGC-Gem is metabolized to its active metabolite through a different enzyme system than gemcitabine. We continue to evaluate the potential use of NGC-Gem in patients with pancreatic and other potential cancers and to evaluate ways to identify patients who are more likely to respond to NGC-Gem than gemcitabine. We plan to meet with the FDA in 2024 to discuss potential trial designs including implementation of the Project Optimus initiative as part of the design. Similar to NGC-Cap, we will need to obtain additional funding before we can begin the Phase 2 trial for NGC-Gem. |

Our license agreement with Ocuphire Pharma, Inc. (“Ocuphire”) for NGC-Gem requires us to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) dosing a patient in a clinical trial prior to June 16, 2024; and (ii) dosing a patient in a pivotal clinical trial or in a clinical trial for a second indication of the drug prior to June 16, 2026. We are currently negotiating with Ocuphire to extend these deadlines.

| ● | PCS11T is an analog of SN38 (SN38 is the active metabolite of irinotecan) and should have an improved safety/efficacy profile in every type of cancer that irinotecan is presently used. The manufacturing process and sites for drug substance and drug product are presently being evaluated and IND-enabling toxicology studies will then be initiated. In addition, we are defining the potential paths to approval, which include defining the targeted patient population and the type of cancer. We plan to conduct IND enabling and toxicology studies in 2024, subject to available funding. |

Non-Oncology Pipeline for Out-licensing or Partnership

| ● | PCS12852 is a highly specific and potent 5HT4 agonist that has already been evaluated in clinical studies in South Korea for gastric emptying and gastrointestinal motility in healthy volunteers and volunteers with a history of constipation. In October 2021, the FDA cleared our IND application to proceed with a Phase 2A trial for the treatment of gastroparesis. We enrolled our first patient on April 5, 2022 and completed enrollment of the trial on September 2, 2022. Results from this Phase 2A trial, which included 25 patients with moderate to severe gastroparesis, demonstrated improvements in gastric emptying in patients receiving 0.5 mg of PCS12852 as compared to placebo. The results indicated that for the patients in the PCS12852 group, the mean time for 50% of the gastric contents to empty (t50) compared to their baseline value (±SD) decreased by -31.90 min (±50.53) (compared to the change seen in the placebo group of only -9.36 min (±42.43). Significant gastric emptying differences were not observed between the placebo and the 0.1 mg dose. Adverse events associated with the administration of PCS12852 were generally mild to moderate as expected, limited in duration, and quickly resolved without any sequelae. There were no cardiovascular safety events or serious adverse events reported during the trial. Additionally, the 0.5 mg of PCS12852 showed a greater improvement than placebo in the gastroparesis symptomology scales used in the trial, including both total scores in the scales, as well as sub-scores such as nausea, vomiting and abdominal pain. With the trial now complete, we have the data necessary to finalize the development plan for the treatment of diabetic gastroparesis patients. We are exploring options for PCS12852, which may include licensing, partnering and/or collaborating opportunities. |

| ● | PCS499 is an oral tablet of the deuterated analog of one of the major metabolites of pentoxifylline (PTX or Trental®). PCS499 is a drug that can be used to treat unmet medical need conditions caused by multiple pathophysiological changes. We completed a Phase 2A trial for PCS499 in patients with ulcerative and non-ulcerative necrobiosis lipoidica (uNL and NL, respectively) in late 2020, and in May 2021, we enrolled the first patient in our Phase 2B trial for the treatment of uNL. Although we initiated several recruitment programs to enroll patients in this trial, we were only able to recruit four patients. We experienced extremely slow enrollment in the trial given the extreme rarity of the condition (rarer than reported in the literature), the impact of COVID-19, and the reluctance of patients to be in a clinical trial. We completed the Phase 2B uNL trial for those currently enrolled but halted further efforts to enroll new patients in the trial and have terminated the trial. There were no safety concerns during the conduct of the trial. Although we believe that PCS499 can be effective in treating uNL, preliminary data indicated that the placebo response was likely to be much greater than the literature and clinical experts believe; thus, a much larger sample size would be required in a pivotal trial for an indication where it was extremely difficult to enroll even four patients. We are exploring options for PCS499, which may include licensing, partnering and/or collaborating opportunities. |

| 6 |

Going Concern

This offering is being made on a best-efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net proceeds from this offering. Assuming that we receive a minimum of $● of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our capital needs until ● under our current business plan. In late 2024 or early 2025, we will need to raise additional capital to fund our operations and continue our planned development of our NGC drugs.

Compliance With the Nasdaq Capital Market Listing Requirements

Our common stock is currently listed for trading on Nasdaq Capital Market (the “Nasdaq”). On March 16, 2023 we received notice from Nasdaq indicating that we are not in compliance with the requirement to maintain a minimum bid price of $1.00 per share for continued listing on Nasdaq. We were provided a compliance period of 180 calendar days from the date of the notice, or until September 16, 2023, to regain compliance with the minimum closing bid requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A). On September 19, 2023, Nasdaq notified us that it granted an extension until March 18, 2024 to regain compliance with the minimum closing bid requirement. If we fail to evidence compliance by March 18, 2024, we may be subject to delisting.

We will continue to monitor the closing bid price of our common stock and may, if appropriate, consider available options, including implementation of a reverse stock split of our common stock, to regain compliance with the minimum closing bid requirement. If we seek to implement a reverse stock split in order to remain listed on Nasdaq, the announcement or implementation of such a reverse stock split could negatively affect the price of our common stock and/or warrants.

We must satisfy Nasdaq’s continued listing requirements or risk delisting, which could have a material adverse effect on our business. If our common stock is delisted from Nasdaq, it could materially reduce the liquidity of our common stock and result in a corresponding material reduction in the price of our common stock as a result of the loss of market efficiencies associated with Nasdaq and the loss of federal preemption of state securities laws. In addition, delisting could harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities. If our common stock is delisted, it could be more difficult to buy or sell our common stock or to obtain accurate quotations, and the price of our common stock could suffer a material decline. Delisting could also impair our ability to raise capital on acceptable terms, if at all.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may take advantage of certain of the scaled disclosures available to smaller reporting companies such as including: (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act of 2002, as amended; (ii) scaled executive compensation disclosures; and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

Corporate Information

We were incorporated under the laws of the state of Delaware on March 29, 2011. Our principal executive offices are located at 7380 Coca Cola Drive, Suite 106, Hanover, Maryland 21076, and our telephone number is (443) 776-3133. Our website address is www.processapharmaceuticals.com. The information contained in, or accessible through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained in, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our Annual Report on Form 10-K for the year ended December 31, 2022 and our subsequently filed reports on Form 10-Q, as described in the section entitled “Incorporation of Certain Documents by Reference” in this prospectus.

| 7 |

| Issuer | Processa Pharmaceuticals, Inc. | |

| Shares of common stock being offered by us | Up to ● shares of common stock at an assumed combined public offering price of $● per share which is the last reported sales price of our common stock on The Nasdaq Capital Market on ●, 202● and assuming no sale of any Pre-Funded Warrants. | |

| Pre-Funded Warrants offered by us | We are also offering to each purchaser whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, Pre-Funded Warrants, in lieu of shares of common stock that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the investor, 9.99%) of our outstanding common stock. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable upon issuance for one share of our common stock and will expire when exercised in full. The purchase price of each Pre-Funded Warrant will equal the public offering price per share of common stock and accompanying Common Warrant less $0.0001, and the exercise price of each Pre-Funded Warrant will be $0.0001 per share. This offering also relates to the shares of common stock issuable upon exercise of any Pre-Funded Warrants sold in this offering. The exercise price and number of shares of common stock issuable upon exercise will be subject to certain further adjustments as described herein. See “Description of Securities” on page 25 of this prospectus.

For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because a Common Warrant to purchase one share of our common stock is being sold together in this offering with each share of common stock and, in the alternative, each Pre-Funded Warrant to purchase one share of common stock, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and Pre-Funded Warrant sold. | |

| Common Warrants offered by us | Each share of common stock or pre-funded warrant is being offered together with one Common Warrant to purchase one share of common stock. The Common Warrants will have an exercise price of $● per share (●% of the combined public offering price per share of common stock and accompanying warrants) and will be exercisable beginning on the effective date of the Warrant Stockholder Approval, provided however, if the Pricing Conditions are met, the Common Warrants will be exercisable upon the Initial Exercise Date. The Common Warrants will expire on the five-year anniversary of the Initial Exercise Date. See “Description of Securities We Are Offering” for additional information. | |

| Placement Agent Warrants | We have agreed to issue to the placement agent or its designees, warrants, or the Placement Agent Warrants, to purchase up to 4.0% of the aggregate number of shares of common stock sold in this offering (including the shares of common stock issuable upon the exercise of the Pre-Funded Warrants, but not including shares of common stock sold to the Company’s current directors and officers) at an exercise price equal to 125% of the public offering price per share and accompanying warrants to be sold in this offering. The Placement Agent Warrants will be exercisable upon issuance and will expire three (3) years from the commencement of sales under this offering. See “Plan of Distribution” for additional information |

| 8 |

| Common Stock Outstanding prior to this Offering (1) | 24,631,474 shares | |

| Common Stock to be Outstanding After this Offering (1) | ● shares assuming we sell only shares of common stock and no Pre-Funded Warrants. | |

| Use of Proceeds | We estimate that the net proceeds of this offering assuming no exercise of the warrants, after deducting placement agent fees and estimated offering expenses, will be approximately $●, assuming we sell only shares of common stock and no pre-funded warrants and assuming no exercise of the warrants. We intend to use the net proceeds from the offering to begin a Phase 2 clinical trial of NGC-Cap and for working capital and other general corporate purposes. We may also use a portion of the net proceeds, together with our existing cash and cash equivalents, to in-license, acquire, or invest in complementary businesses, technologies, products or assets; however, we have no current commitments or obligations to do so. Assuming that we receive a minimum of $● of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our capital needs until ● under our current business plan. In late 2024 or early 2025, we will need to raise additional capital to fund our operations and continue our planned development of our NGC drugs. See the section titled “Use of Proceeds” for more information. | |

| Risk Factors | Investing in our securities involves a high degree of risk. For a discussion of factors to consider before deciding to invest in our securities, you should carefully review and consider the “Risk Factors” section of this prospectus, as well as the risk factors described or referred to in any documents incorporated by reference in this prospectus, and in any applicable prospectus supplement. | |

| Market Symbol and trading | Our common stock is listed on The Nasdaq Capital Market under the symbol “PCSA.” There is no established trading market for any of the warrants being issued and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Common Warrants or Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Common Warrants and Pre-Funded Warrants will be limited. |

| (1) | The number of shares of our common stock to be outstanding immediately after this offering as shown above is based on 24,631,474 shares of common stock outstanding as of September 30, 2023. The number of shares outstanding used throughout this prospectus, unless otherwise indicated, excludes: |

| ● | 141,611 shares of our common stock issuable upon exercise of outstanding options, which have a weighted average exercise price of $18.22 per share; | |

| ● | 4,554,867 shares of common stock issuable for restricted stock units (RSUs) (of which 2,291,923 are vested) issuable upon meeting distribution restrictions; | |

| ● | 3,366,480 shares of common stock issuable upon exercise of outstanding vested common warrants at a weighted-average exercise price of $1.61 per share; | |

| ● | 467,735 shares of common stock reserved for issuance and available for future grant under our 2019 Omnibus Incentive Plan; and |

Unless otherwise indicated or the context requires otherwise, all information in this prospectus assumes (i) we issue no Pre-Funded Warrants and (ii) no exercise of the Common Warrants offered hereby.

| 9 |

An investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, including the shares of common stock offered by this prospectus, you should carefully consider the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, any subsequent Quarterly Report on Form 10-Q and our other filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business, results of operations or financial condition and prospects could be harmed. In that event, the market price of our common stock and the value of the warrants could decline, and you could lose all or part of your investment.

Risks Related to Our Financial Position and Need for Capital

We need to raise additional capital to fund our operations.

We have incurred recurring losses since inception and had an accumulated deficit of approximately $73.0 million as of September 30, 2023. At November 30, 2023, we had cash and cash equivalents totaling $5.4 million and a prepaid expense with the clinical research organization of our Phase 1B trial of $660,000. Assuming that we receive a minimum of $● of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will allow us to begin our Phase 2 trial of NGC-Cap and satisfy our capital needs until ● under our current business plan. In late 2024 or early 2025, we will need to raise additional capital to fund our operations and continue our planned development of our NGC drugs.

Following this offering, we will need to raise additional capital to complete the development efforts for NGC-Cap, NGC-Gem and/or NGC-Iri. If we are unable to raise capital when needed, we could be forced to delay, reduce or terminate certain of our development programs or other operations.

Following this offering, we will need to raise additional capital to fund our operations and continue to support our planned development of our next generation chemotherapy drugs. Our estimates of the amount of cash necessary to fund our activities may prove to be wrong and we could spend our available financial resources much faster than we currently expect. Our future funding requirements will depend on many factors, including, but not limited to:

| ● | the timing, rate of progress and cost of any clinical trials and other manufacturing/product development activities for our current and any future product candidates that we develop, in-license or acquire; | |

| ● | the results of the clinical trials for our product candidates; | |

| ● | the timing of, and the costs involved in, FDA approval and any foreign regulatory approval of our product candidates, if at all; | |

| ● | the number and characteristics of any additional future product candidates we develop or acquire; | |

| ● | our ability to establish and maintain strategic collaborations, licensing, co-promotion or other arrangements and the terms and timing of such arrangements; | |

| ● | the degree and rate of market acceptance of any approved products; | |

| ● | costs under our third-party manufacturing and supply arrangements for our current and any future product candidates and any products we commercialize; | |

| ● | costs and timing of completion of any additional outsourced commercial manufacturing or supply arrangements that we may establish; | |

| ● | costs of preparing, filing, prosecuting, maintaining, defending and enforcing any patent claims and other intellectual property rights associated with our product candidates; | |

| ● | costs associated with prosecuting or defending any litigation that we are or may become involved in and any damages payable by us that result from such litigation; | |

| ● | costs of operating as a public company; | |

| ● | the emergence, approval, availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and competing products or treatments; | |

| ● | costs associated with any acquisition or in-license of products and product candidates, technologies or businesses; and | |

| ● | personnel, facilities and equipment requirements. |

| 10 |

We cannot be certain that additional funding will be available on acceptable terms, or at all. In addition, future debt financing into which we may enter may impose upon us covenants that restrict our operations, including limitations on our ability to incur liens or additional debt, pay dividends, redeem our stock, make certain investments and engage in certain merger, consolidation or asset sale transactions.

If we are unable to raise additional capital when required or on acceptable terms, we may be required to significantly delay, scale back or discontinue the development of our product candidates, restrict our operations or obtain funds by entering into agreements on unattractive terms, which would likely have a material adverse effect on our business, stock price and our relationships with third parties with whom we have business relationships, at least until additional funding is obtained. If we do not have sufficient funds to continue operations, we could be required to seek bankruptcy protection or other alternatives that would likely result in our security holders losing some or all of their investment in us. In addition, our ability to achieve profitability or to respond to competitive pressures would be significantly limited.

In addition, if we are unable to secure sufficient capital to fund our operations, we may have to enter into strategic collaborations that could require us to share license rights with third parties in ways that we currently do not intend or on terms that may not be favorable to us or our security holders.

We have incurred a history of operating losses and expect to continue to incur substantial costs for the foreseeable future. We are not currently profitable, and we may never achieve or sustain profitability. Our financial situation creates doubt whether we will continue as a going concern.

We have incurred recurring losses since inception and had an accumulated deficit of approximately $73.0 million as of September 30, 2023. We expect continued operating losses and negative cash flow from operations for the foreseeable future. We have never generated revenue from operations, nor do we have any revenue under contract or any immediate sales prospects. We may never be able to obtain regulatory approval for the marketing of our drug candidates in any indication in the United States or internationally. Even if we obtain regulatory approval for any drug candidates, development expenses will continue to increase. These conditions raise substantial doubt about our ability to continue as a going concern, meaning that we may be unable to continue operations for the foreseeable future or realize assets and discharge liabilities in the ordinary course of operations. If we are unable to obtain funding, we will be forced to delay, reduce or eliminate some or all of our research and development programs, or we may be unable to continue operations. Although we continue to pursue these plans, there can be no assurance that we will be successful in obtaining sufficient funding on terms acceptable to us to fund continuing operations, if at all.

We will continue to expend substantial cash resources for the foreseeable future for the clinical development of our product candidates and development of any other indications and product candidates we may choose to pursue. These expenditures will include costs associated with manufacturing and clinical development, such as conducting clinical trials, manufacturing operations and product candidate supply. Because the conduct and results of any clinical trial are highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development of our current and any future product candidates.

This offering is being made on a best efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net proceeds from this offering. We believe that the net proceeds from this offering, together with our cash on hand, will satisfy our capital needs into ● under our current business plan. Following this offering, we will need to raise additional capital to fund our operations and continue to support our planned development and commercialization activities.

| 11 |

Risks Related to This Offering and Ownership of Our Common Stock

Because management has broad discretion as to the use of the net proceeds from this offering, you may not agree with how we use them, and such proceeds may not be applied successfully.

Our management will have considerable discretion over the use of proceeds from this offering. We currently intend to use the net proceeds from this offering for continued research and development for NCG-Cap, and for working capital, capital expenditures, and general corporate purposes, including investing further in research and development efforts. However, our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not necessarily improve our operating results or enhance the value of our securities, or that you otherwise do not agree with. You will be relying on the judgment of our management concerning these uses and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The failure of our management to apply these funds effectively could, among other things, result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our securities to decline.

Pending their use, we may invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

If you purchase our securities sold in this offering, you will experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

Based on an assumed public offering price of $● per share and accompanying Common Warrant, the last reported sale price of our common stock on The Nasdaq Capital Market on ●, 202●, and our as adjusted net tangible book value per share as of September 30, 2023, if you purchase securities in this offering, you will experience an increase of $● per share in the net tangible book value of the common stock you purchase representing the difference between our as adjusted net tangible book value per share after giving effect to this offering and the assumed public offering price per share of common stock. The exercise of outstanding stock options and warrants, including those sold in this offering, will, however, result in dilution of your investment. In addition, to the extent we need to raise additional capital in the future and we issue additional shares of common stock or securities exercisable, convertible or exchangeable for our common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering. See the section titled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

There is no public market for the Pre-Funded Warrants or Common Warrants offered by us.

There is no established public trading market for the Pre-Funded Warrants or Common Warrants being offered in this offering, and we do not expect such a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants or Common Warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited.

Holders of Pre-Funded Warrants and Common Warrants purchased in this offering will have no rights as common stockholders until such holders exercise their Pre-Funded Warrants or Common Warrants and acquire our common stock.

Until holders of Pre-Funded Warrants or Common Warrants acquire shares of our common stock upon exercise of such warrants, holders of Pre-Funded Warrants and Common Warrants will have no rights with respect to the shares of our common stock underlying such Pre-Funded Warrants and Common Warrants. Upon exercise of the Pre-Funded Warrants and Common Warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

| 12 |

The Common Warrants are speculative in nature.

The Common Warrants do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price for a limited period of time. Moreover, following this offering, the market value of the Common Warrants, if any, will be uncertain and there can be no assurance that the market value of the Common Warrants will equal or exceed their imputed offering price. The Common Warrants will not be listed or quoted for trading on any market or exchange. There can be no assurance that the market price of our common stock will ever equal or exceed the exercise price of the Common Warrants, and consequently, the Common Warrants may expire valueless.

The Common Warrants being offered may not have value.

The Common Warrants being offered by us in this offering have an exercise price of $● per share, subject to certain adjustments, and expire on the five-year anniversary of the Initial Exercise Date, upon which date such Common Warrants will expire and have no further value. In the event that the market price of our common stock does not exceed the exercise price of the Common Warrants during the period when they are exercisable, the Common Warrants may not have any value.

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for one year from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for 60 days from closing; and (iv) indemnification for breach of contract.

This is a best efforts offering, with no minimum amount of securities required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans.

The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell a sufficient number of securities to support our continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short term and may need to raise additional funds, which may not be available or available on terms acceptable to us.

Because there is no minimum required for the offering to close, investors in this offering will not receive a refund in the event that we do not sell a sufficient number of securities to pursue the business goals outlined in this prospectus.

We have not specified a minimum offering amount nor have or will we establish an escrow account in connection with this offering. Because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds will not be returned under any circumstances whether during or after the offering.

| 13 |

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock and warrants will depend in part on the research and reports that securities or industry analysts publish about us or our business. We currently have limited research coverage by securities and industry analysts. If we fail to maintain adequate coverage by securities or industry analysts, the trading price for our stock would be negatively impacted. If one or more of the analysts who cover us downgrades our stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our stock could decrease, which could cause our stock price and trading volume to decline.

Future sales of our common stock, warrants, or securities convertible into our common stock may depress our stock price.

The price of our common stock or warrants could decline as a result of sales of a large number of shares of our common stock or warrants or the perception that these sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

In addition, in the future, we may issue additional shares of common stock, warrants or other equity or debt securities convertible into common stock in connection with a financing, acquisition, litigation settlement, employee arrangements or otherwise. We may also issue additional shares of common stock to satisfy the exercise of outstanding warrants. Any such issuances could result in substantial dilution to our existing stockholders and could cause the price of our common stock to decline.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain any future earnings to finance the operation and expansion of our business. Consequently, stockholders must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which stockholders have purchased their shares.

If we fail to regain compliance with the continued listing requirements of Nasdaq, our common stock and/or warrants may be delisted and the price of our common stock and/or warrants and our ability to access the capital markets could be negatively impacted.

On March 16, 2023 we received notice from Nasdaq indicating that we are not in compliance with the requirement to maintain a minimum bid price of $1.00 per share for continued listing on Nasdaq. We were provided a compliance period of 180 calendar days from the date of the notice, or until September 16, 2023, to regain compliance with the minimum closing bid requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A). On September 19, 2023, Nasdaq notified us that that it granted an extension until March 18, 2024 to regain compliance with the minimum closing bid requirement. If we fail to evidence compliance by March 18, 2024, we may be subject to delisting. If Nasdaq determines to delist our securities, we will have the right to appeal to a Nasdaq hearings panel. There can be no assurance that we will be able to regain compliance with the applicable Nasdaq listing requirements.

We will continue to monitor the closing bid price of our common stock and may, if appropriate, consider available options, including implementation of a reverse stock split of our common stock, to regain compliance with the minimum closing bid requirement. If we seek to implement a reverse stock split in order to remain listed on Nasdaq, the announcement or implementation of such a reverse stock split could negatively affect the price of our common stock and/or warrants.