| PROSPECTUS SUPPLEMENT | Filed Pursuant to Rule 424(b)(5) |

| (To Prospectus July 9, 2021) | Registration No. 333-257558 |

PROCESSA PHARMACEUTICALS, INC.

7,812,544 Shares of Common Stock

We are offering 7,812,544 shares of our common stock in this offering to certain accredited investors pursuant to this prospectus supplement and the accompanying prospectus. Each share of common stock is being sold at a price of $0.80.

Our common stock is listed on the Nasdaq Capital Market under the symbol “PCSA.” On February 9, 2023, the closing price of our common stock was $0.80 per share. The aggregate market value of our outstanding common stock held by non-affiliates as of the date of this prospectus was approximately $8.4 million, based on 16.7 million shares of common stock outstanding, 10.5 million of which were held by non-affiliates, and a per share price of $0.80 based on the closing sale price of our common stock on February 9, 2023. We have sold $747,204 of securities pursuant to General Instructions I.B.6 of Form S-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

We have retained Spartan Capital Securities, LLC to act as the exclusive placement agent in connection with this offering. The placement agent is not purchasing or selling any of the common stock but has agreed to use its best efforts to arrange for the sale of the shares. See “Plan of Distribution” in this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves a high degree of risk. You should read this prospectus supplement and the accompanying prospectus carefully before you make your investment decision. See “Risk Factors” beginning on page S-10 of this prospectus supplement, the accompanying prospectus, and the other documents we file or have filed with the Securities and Exchange Commission (the “SEC”) that are incorporated by reference in this prospectus supplement and in the accompanying prospectus, for a discussion of the factors you should consider before investing in our common stock.

Neither the SEC nor any other regulatory body has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Offering Price | $ | 0.80 | $ | 6,250,035 | ||||

| Placement Agent’s fees (1) | $ | 0.06 | $ | 495,763 | ||||

| Proceeds to the Company (before expenses) (1) | $ | 0.74 | $ | 5,754,272 | ||||

| (1) | The Company has agreed to pay to Spartan Capital Securities, LLC a fee (the “agent’s fee”) equal to 8.0% of the gross proceeds realized from the offering in consideration for its services rendered, excluding proceeds received from officers, directors and 10% shareholders. |

Delivery of the shares of common stock is expected to be made on or about February 14, 2023.

Sole Placement Agent

Spartan Capital Securities, LLC

The date of this prospectus supplement is February 9, 2023

TABLE OF CONTENTS

Prospectus Supplement

Base Prospectus

| S-i |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus summary highlights information contained elsewhere in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus supplement and the accompanying base prospectus carefully, including the section entitled “Risk Factors” beginning on page S-10 and our consolidated financial statements and the related notes and the other information incorporated by reference into this prospectus supplement and the accompanying base prospectus, before making an investment decision.

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the securities we are offering. The second part is the accompanying prospectus, including the documents incorporated by reference therein, which provides more general information, some of which may not apply to this offering. This prospectus supplement and the information incorporated by reference in this prospectus supplement also may add to, update and change information contained in, or incorporated by reference into, the accompanying prospectus. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between (i) the information contained in this prospectus supplement and (ii) the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission (the “SEC”) before the date of this prospectus supplement, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus, the statement in the document having the later date modifies or supersedes the earlier statement.

The accompanying prospectus is part of a registration statement that we filed with the SEC using a shelf registration process. Under the shelf registration process, from time to time, we may offer and sell any of the securities described in the accompanying prospectus separately or together with other securities described therein.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus and any related free writing prospectus that we authorized to be distributed to you. Neither we nor the placement agent have authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. Neither we nor any of the placement agents are making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted, and you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should assume that the information contained in this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized to be delivered to you and the documents incorporated by reference herein and therein is accurate only as of their respective dates, regardless of the time of delivery of such documents or of any sale of securities. Our business, financial condition, results of operations and prospects may have changed since those dates. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

For purposes of this prospectus supplement and the accompanying prospectus, references to “Company,” “Processa,” “we,” “us,” “our,” and “ours” refer to Processa Pharmaceuticals, Inc. and its subsidiary where the context so requires, unless otherwise indicated or the context otherwise requires

| S-1 |

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus supplement, the accompanying base prospectus and reports incorporated by reference herein and therein may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our ability to obtain funding for our future clinical trials and operations; | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | the potential market size, opportunity and growth potential for our product candidates, if approved; | |

| ● | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize our product candidates, if approved; | |

| ● | the initiation, timing, progress and results of our pre-clinical studies and clinical trials, and our research and development programs; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory filings and approvals and other product development objectives; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates by physicians, patients, third-party payors and others in the medical community, if approved; | |

| ● | the implementation of our business model, strategic plans for our business, product candidates and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; |

| S-2 |

| ● | developments relating to our competitors and our industry; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; | |

| ● | our future financial and operating results; | |

| ● | our stock price is volatile and this could impact our ability to continue being listed on the Nasdaq Capital Market; and | |

| ● | our ability to comply with evolving legal standards and regulations, particularly concerning requirements for being a public company. |

Forward-looking statements reflect our management’s expectations or predictions of future conditions, events or results based on various assumptions and management’s estimates of trends and economic factors in the markets in which we are active, as well as our business plans. They are not guarantees of future performance. By their nature, forward-looking statements are subject to risks and uncertainties. Our actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. There are a number of factors that could cause actual conditions, events or results to differ materially from those described in the forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements.

You should read this prospectus supplement, the accompanying base prospectus and the reports incorporated by reference herein and therein with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. You should also carefully review the risk factors and cautionary statements described in the other documents we file or furnish from time to time with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The forward-looking statements included in this prospectus supplement, the accompanying prospectus and any other offering material, or in the documents incorporated by reference into this prospectus supplement, the accompanying prospectus and any other offering material, are made only as of the date of the prospectus supplement, the accompanying prospectus, any other offering material or the incorporated document. We undertake no obligation to update any forward-looking statement as a result of new information, future events or otherwise.

The following summary highlights basic information about Processa, this offering, and selected information contained elsewhere in or incorporated by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. You should review this entire prospectus supplement and the accompanying prospectus carefully, including our consolidated financial statements and other information incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. In addition, please read the “Risk Factors” section beginning on page S-10 of this prospectus supplement.

Overview

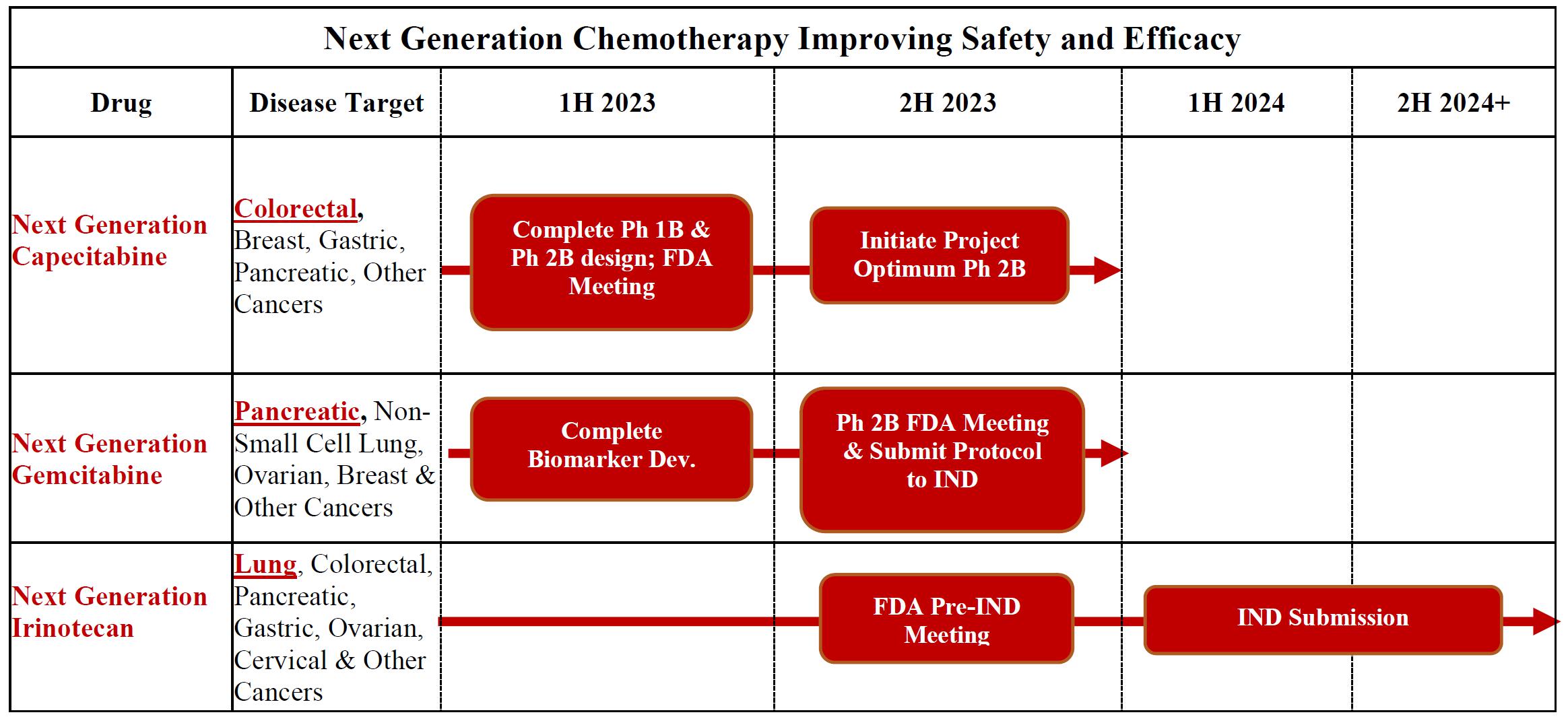

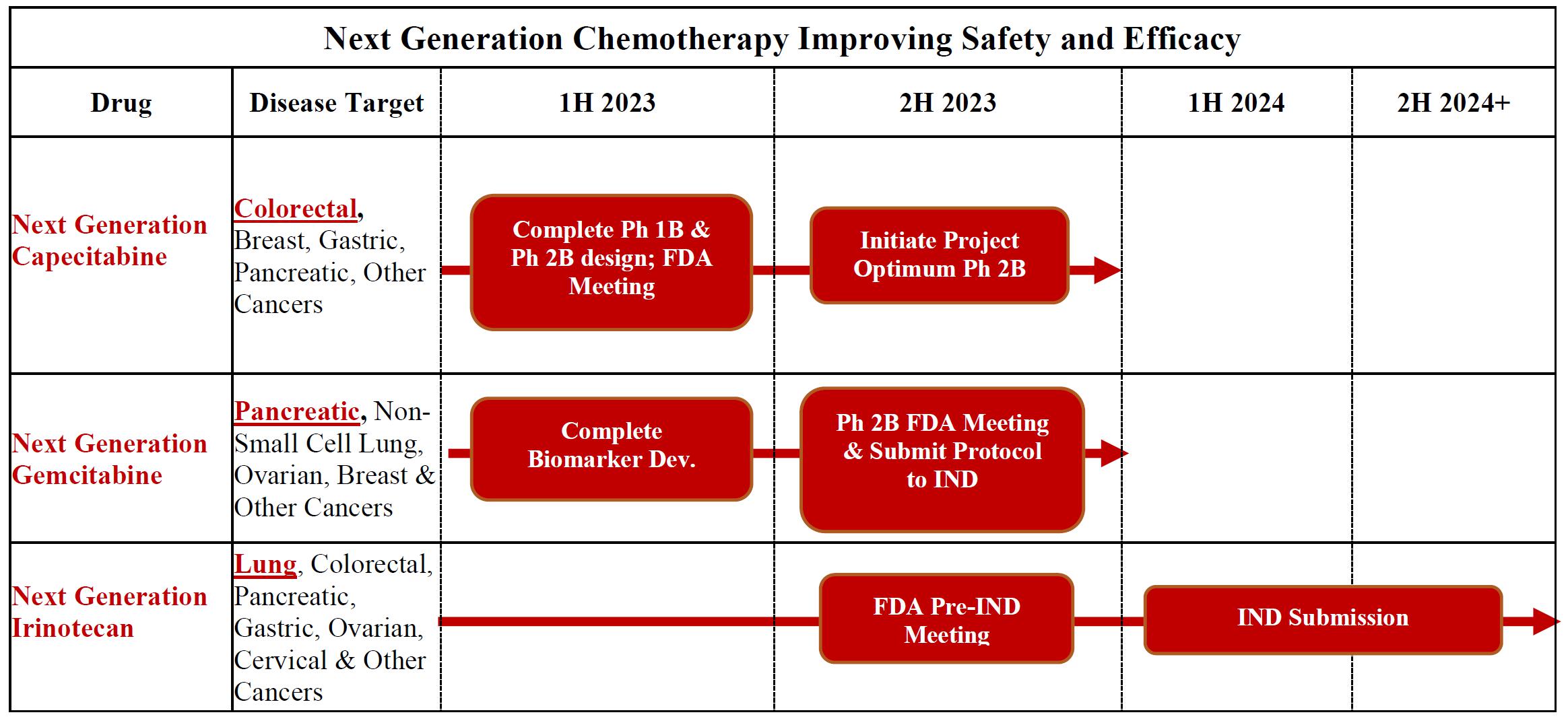

At the Biotech Showcase Conference in January 2023, we announced our strategic prioritization to advance our pipeline of Next Generation proprietary small molecule oncology drugs. Management believes our three Next Generation Chemotherapy (NGC) treatments provide improved safety-efficacy profiles when compared to their currently marketed counterparts - capecitabine, gemcitabine, and irinotecan.

The three NGC treatments in our pipeline are NGC-Capecitabine, NGC-Gemcitabine, and NGC-Irinotecan:

| ● | NGC-Capecitabine is a combination of PCS6422 and capecitabine. PCS6422 alters the metabolism of capecitabine without having any clinically meaningful biological effect itself. In clinical trials, NGC-Capecitabine is greater than fifty times more potent with an improved safety profile over capecitabine. Like capecitabine, NGC-Capecitabine could be used to treat patients with cancers, such as metastatic colorectal, gastrointestinal, breast, and pancreatic. We estimate at least 200,000 patients in the United States were diagnosed in 2022 with metastatic colorectal, gastrointestinal, breast, and pancreatic cancers. We plan to meet with the FDA in the first half of 2023 to discuss the Phase 2B design including implementation of the FDA Project Optimus Oncology initiatives as part of the design and then initiate the Phase 2B trial in the second half of 2023 subject to funding. |

| S-3 |

| ● | NGC-Gemcitabine (PCS3117) is an oral analog of gemcitabine that is converted to its active metabolite by a different enzyme system than gemcitabine resulting in a positive response in gemcitabine patients as well as some gemcitabine treatment-resistant patients. Like gemcitabine, NGC-Gemcitabine could be used to treat patients with cancers such as pancreatic, lung, ovarian, and breast. We estimate at least 275,000 patients in the United States were diagnosed in 2022 with pancreatic, lung, ovarian, and breast cancer. We plan to meet with the FDA in 2023 to discuss potential study designs including implementation of the FDA’s Project Optimus Oncology initiative as part of the designs and then submit the Phase 2B protocol to the IND in the second half of 2023 with the initiation of the trial occurring soon after the IND submission. | |

| ● | NGC-Irinotecan (PCS11T) is a prodrug of the active metabolite of irinotecan (SN-38). The chemical structure of PCS11T influences the uptake of NGC-Irinotecan into cancer cells resulting in more NGC-Irinotecan entering cancer cells than normal cells in mice. These levels were significantly greater than those seen with irinotecan, resulting in lower doses of NGC-Irinotecan having greater efficacy than Irinotecan and improved safety in animal models. Like irinotecan, NGC-Irinotecan could be used to treat patients with cancers such as lung, colorectal, gastrointestinal, and pancreatic cancer. We estimate at least 200,000 patients in the United States were diagnosed in 2022 with lung, colorectal, gastrointestinal, and pancreatic cancer. We plan to conduct IND enabling and toxicology studies in 2023 and 2024 subject to funding. |

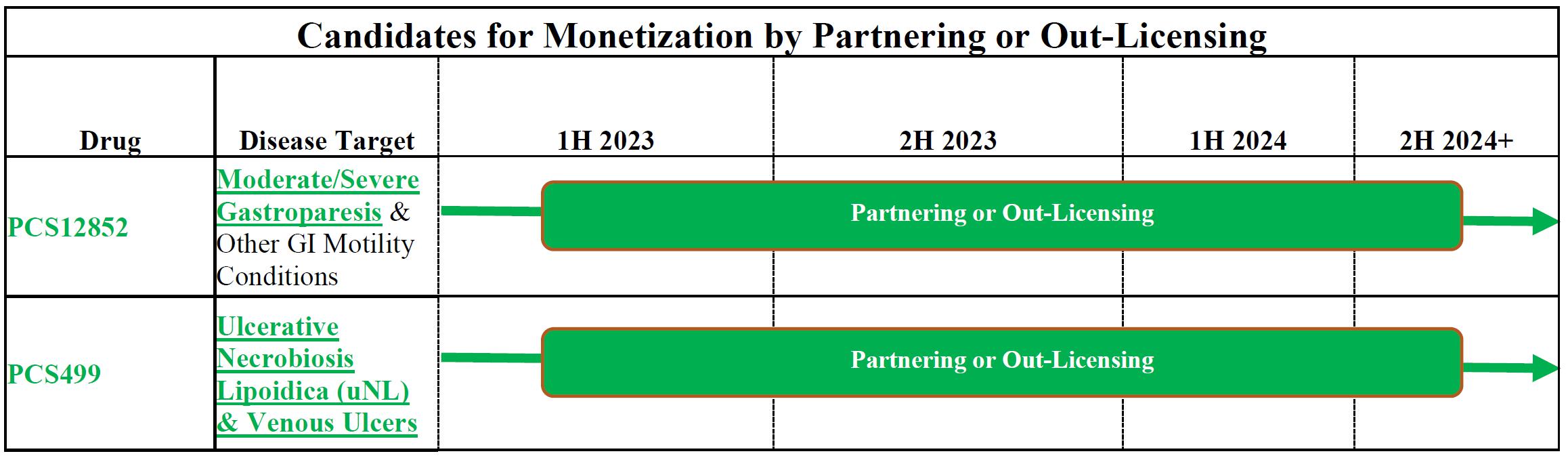

Consistent with the shift in priority, including the allocation of resources to these NGC drugs, we intend to suspend further enrollment in the PCS499 trial for ulcerative Necrobiosis Lipoidica. We have begun and will continue to meet with potential licensing partners as well as other options to monetize PCS12852 and PCS499. As previously reported, the clinical study findings for PCS12852 were positive in gastroparesis patients. There were no safety concerns during the conduct of either study, and we continue to believe that PCS499 could be effective in treating ulcerative Necrobiosis Lipoidica and other conditions, including less rare indications for PCS499 such as chronic venous ulcers and intermittent claudication.

Our shift in priority does not change our mission. We continue to be focused on drug products that improve the survival and/or quality of life for patients with high unmet medical need conditions for which few or no treatment options currently exist. We are a development company (not discovery) and apply principles developed by members of the team that seek to abate development risks with the aim of improving the overall odds for a drug approval.

Historically, much of oncology drug development has searched for a new or different way to treat cancer. Our approach is to modify and improve three different, currently approved, and widely used chemotherapy treatments so that the human body handles these NGC treatments differently than their presently approved counterpart drugs while the cancer killing mechanism of action remains the same. FDA’s Project Optimus Oncology initiative and Oncology Guidance recommends that the dose-response (both safety and efficacy) relationships be evaluated for all oncology drugs. We have begun this process for our NGC treatments. To date, we have found that our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose adjust or discontinue treatment because of side effects or lack of response.

Our Strategy

Historically, our strategy was to obtain and develop drugs that will not only treat patients with unmet medical need conditions but, with our Regulatory Science Approach, also have the potential to be more efficiently developed with a greater probability of development success than what typically occurs in the biotech-pharma industry, as well as a better return on investment given lower development costs, more efficient development and high commercial value. We applied rigorous standards to identify drugs for our portfolio, the three most important being:

| ● | The drug must represent a treatment option to patients with a high unmet medical need condition by improving survival and/or quality of life for these patients, | |

| ● | The drug or its metabolite or a drug with similar pharmacological properties must have demonstrated some clinical evidence of efficacy in the target population, and | |

| ● | The probability of approval and the efficiency of development for the drug will be improved using the Regulatory Science Approach conceived by the FDA and the Founders of Processa over 30 years ago and further refined by the Processa Founders over the last 30 years. |

| S-4 |

Our rigorous requirement resulted in the in-licensing of five drugs: three Next Generation Chemotherapy (NGC) drugs and two non-oncology drugs. These clinical candidates had significant pre-clinical and clinical data that de-risked the programs.

To execute on our strategy, we assembled an experienced and development team with a successful track record of drug approvals and successful exits. Our team is experienced in developing drug products through all principal regulatory tiers from IND enabling studies to NDA submission. Throughout their careers, the combined scientific, development and regulatory experiences of our team members have resulted in more than 30 drug approvals in indications reviewed by almost every division of the FDA, over 100 meetings with the FDA and involvement with more than 50 drug development programs, including drug products targeted to patients who have an unmet medical need and cancer patients. In addition, the FDA Project Optimus Oncology initiative and recent FDA Oncology Guidance applies the Regulatory Science Approach and principles used and refined by our Founders over the last 30 years.

In January 2023, we announced our plan to prioritize our team’s time and our capital resources on the continued development of our NGC drugs while exploring opportunities, including non-dilutive licensing, collaborations and other strategic transactions, for our non-oncology drugs. The potential for us to differentiate our NGC treatments from existing therapies is potentially groundbreaking for patients and for commercialization of these drugs.

Our pipeline now prioritizes next generation products that (i) already have data demonstrating the desired pharmacological activity in humans or appropriate animal models and is able to provide improved safety and/or efficacy by some modification in the formation of the active moieties associated with the drug; (ii) target indications for which a single positive pivotal study demonstrating efficacy might provide enough evidence that the clinical benefits of the drug and its approval outweighs the risks associated with the drug or the present standard of care (e.g., limitations of existing therapies that require dose reductions or discontinuation due to safety concerns, orphan indications, many serious life-threatening conditions, some serious quality of life conditions); and/or (iii) target indications where the prevalence of the condition and the likelihood of patients enrolling in a study meet the desired timeframe to demonstrate that the drug can, at some level, treat or potentially treat patients with the condition.

Our Team

Our drug development efforts are guided by our knowledge and experience in applying a rigorous Regulatory Science Approach to decrease manageable risks, costs and time toward achieving marketing authorization from regulatory authorities including the FDA. We have assembled a seasoned management team and development team with extensive experience in developing therapies, including advancing product candidates from preclinical research through clinical development and ultimately regulatory approval and commercialization. Our team is led by our President, CEO, and Founder David Young, Pharm.D., Ph.D. who has extensive experience in research, regulatory approval and business development and who served at Questcor for eight years, initially as an independent director and subsequently as its Chief Scientific Officer. Dr. Young’s guidance led to the approval of Acthar in Infantile Spasms and the ultimate sale of Questcor in 2014.

| S-5 |

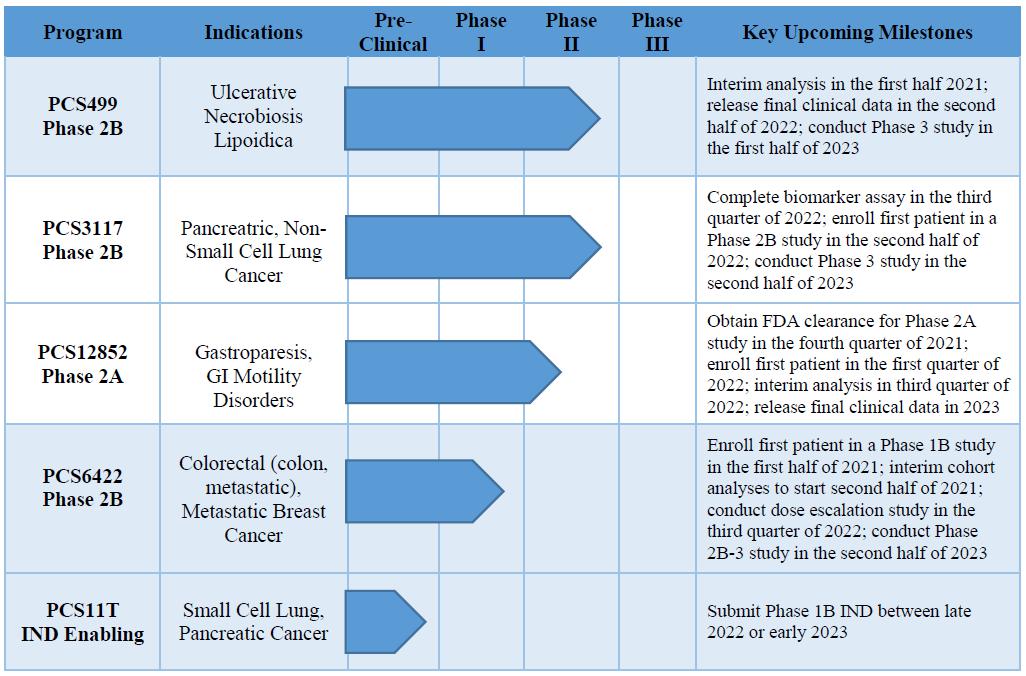

Our Drug Pipeline

Our pipeline currently consists of three oncology drugs (NGC-Capecitabine, NGC-Gemcitabine and NGC-Irinotecan previously identified as PCS6422, PCS3117 and PCS11T, respectively) and two non-oncology drugs (PCS12852 and PCS499). A summary of each drug is provided below.

| S-6 |

Next Generation Chemotherapy Pipeline

| ● | Next Generation Capecitabine (NGC-Capecitabine), also identified as PCS6422, is a combination of PCS6422 and the FDA-approved cancer drug capecitabine. PCS6422 is an orally administered irreversible inhibitor of the enzyme dihydropyrimidine dehydrogenase (DPD). DPD metabolizes 5-Fluorouracil (5-FU), the major metabolite of capecitabine and widely used itself as an intravenous chemotherapeutic agent in many types of cancer, to multiple metabolites classified as catabolites. These catabolites do not have any cancer-killing properties but do cause dose-limiting side effects that may require dose adjustments or discontinuation of therapy.

When combining capecitabine with PCS6422 in NGC-Capecitabine, capecitabine becomes a significantly more potent drug than the current FDA-approved capecitabine requiring significantly lower doses. On August 2, 2021, we enrolled the first patient in our Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. Our interim analysis of Cohorts 1 and 2A found no dose-limiting toxicities (DLTs), no drug-related adverse events greater than Grade 1, and no hand-foot syndrome, a major side effect found with the catabolites of 5-FU. In this Phase 1B trial it was demonstrated that the irreversible inhibition of DPD by PCS6422 could alter the elimination of 5-FU making NGC-Capecitabine significantly more potent (greater than 50x more potent) and potentially lead to higher levels of the group of metabolites called anabolites which can kill replicating cancer and normal cells. By administering NGC-Capecitabine to cancer patients, the balance between anabolites and catabolites changes depending on the dosage regimens of PCS6422 and capecitabine used, making the efficacy-safety profile of NGC-Capecitabine different than that of FDA-approved capecitabine and requiring further evaluation of the PCS6422 and capecitabine regimens to determine the optimal NGC-Capecitabine regimens for patients.

In order for NGC-Capecitabine to provide a safer and more efficacious profile for cancer patients compared to existing chemotherapy, understanding how the different regimens of PCS6422 and capecitabine may affect the systemic and tumor exposure to the anabolites, as well as the systemic exposure to the catabolites, is required. This can be achieved by following the timeline of DPD irreversible inhibition and the formation of new DPD using the plasma concentrations of 5-FU and its catabolites.

In an effort to better estimate the timeline of DP inhibition and formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause DLTs. One regimen in the Phase 1B trial did cause DLTs in 2 patients, one of whom died. The Phase 1B study is continuing to enroll patients and is expected to complete enrollment in 2023. The next study will be a Phase 2B trial to determine which regimens provide an improved efficacy-safety profile over present therapy using the principles of the FDA’s Oncology Project Optimus initiative to help guide the design of the trial. This FDA initiative requires us to consider NGC regimens that are not at the maximum tolerated dose or exposure level. In 2023, we plan to meet with FDA to discuss the design of our Phase 2B trial and initiate the trial. |

| S-7 |

| ● | NGC-Gemcitabine, also identified as PCS3117, is a cytidine analog, similar to gemcitabine (Gemzar®), but different enough in chemical structure that some patients are more likely to respond to PCS3117 than gemcitabine. The difference in response occurs because PCS3117 is metabolized to its active metabolite through a different enzyme system than gemcitabine. We continue to evaluate the potential use of PCS3117 in patients with pancreatic cancer and to evaluate ways to identify patients who are more likely to respond to PCS3117 than gemcitabine. We plan to meet with the FDA in 2023 to discuss potential study designs including implementation of the FDA’s Project Optimus Oncology initiative as part of the designs and then submit the Phase 2B protocol to the IND in the second half of 2023 with the initiation of the trial occurring soon after the IND submission. |

| ● | NGC-Irinotecan, also identified as PCS11T, is an analog of SN38 (SN38 being the active metabolite of irinotecan) and should have an improved safety/efficacy profile in every type of cancer that Irinotecan is presently used. The manufacturing process and sites for drug substance and drug product are presently being evaluated and IND enabling toxicology studies will then be initiated. In addition, we are defining the potential paths to approval, which include defining the targeted patient population and the type of cancer. We plan to meet with the FDA in 2023 to discuss the design of the Phase 1B incorporating the principles of the FDA Project Optimus initiative. We hope to submit an IND in 2024, followed by a Phase 1B trial. |

Non-Oncology Pipeline for Out-licensing or Partnership

| ● | PCS12852 is a highly specific and potent 5HT4 agonist which has already been evaluated in clinical studies in South Korea for gastric emptying and gastrointestinal motility in healthy volunteers and volunteers with a history of constipation. In October 2021, the FDA cleared our IND application to proceed with a Phase 2A trial for the treatment of gastroparesis. We enrolled our first patient on April 5, 2022 and completed enrollment of the trial on September 2, 2022. Results from this Phase 2A study which included 25 patients with moderate to severe gastroparesis, demonstrated improvements in gastric emptying in patients receiving 0.5 mg of PCS12852 as compared to placebo. The mean (±SD) t50 change from baseline was decreased for 0.5 mg of PCS12852 compared with placebo by -31.90 ± 50.53 min vs -9.36 ±42.43 min, respectively. Differences were not observed between the placebo and the 0.1 mg dose. Adverse events associated with the administration of PCS12852 were generally mild to moderate as expected, limited in duration, and quickly resolved without any sequelae. There were no clinically significant cardiovascular safety events or serious adverse events (SAEs) reported during the study. Additionally, the 0.5 mg of PCS12852 showed a greater improvement than placebo in the gastroparesis symptomology scales used in the study Total Score and subscores. With the study now complete, we have the data necessary to initiate a Phase 2B trial in 2023, depending on our priorities, funding, and licensing and/or partnering opportunities. |

| ● | PCS499 is an oral tablet of the deuterated analog of one of the major metabolites of pentoxifylline (PTX or Trental®). PCS499 is a drug that can be used to treat unmet medical need conditions caused by multiple pathophysiological changes. We completed a Phase 2A trial for PCS499 in patients with ulcerative and non-ulcerative necrobiosis lipoidica (NL) in late 2020, and in May 2021, we enrolled the first patient in our Phase 2B trial for the treatment of ulcerative NL. Although we initiated a number of recruitment programs to increase the enrollment of patients in this study, we were only able to recruit four patients. We will complete the study for those currently enrolled, but will halt further efforts to enroll new patients for our PCS499 Phase 2 ulcerative necrobiosis lipoidica study. We have experienced extremely slow enrollment in the PCS499 Phase 2 study given the extreme rarity of the condition (rarer than reported in the literature), the impact of COVID-19, and the reluctance of patients to be in a clinical study. There have been no safety concerns during the conduct of the study and we still believe that PCS499 would be effective in treating these patients. We are also evaluating other less rare indications for PCS499 such as chronic venous ulcers and intermittent claudication. |

Termination of ATM Prospectus Supplement

On February 6, 2023, we terminated the prospectus supplement (the “ATM Prospectus Supplement”) related to our common stock, par value $0.0001 per share (the “ATM Shares”). On February 5, 2023, we delivered written notice to Oppenheimer & Co. Inc. (the “Sales Agent”) of such termination, issuable pursuant to the Equity Distribution Agreement, dated August 20, 2021, by and between us and the Sales Agent (the “Equity Distribution Agreement”). We will suspend the sale of the ATM Shares pursuant to the Equity Distribution Agreement, unless and until a new prospectus supplement is filed. Other than the termination of the ATM Prospectus Supplement and suspension of the sale of the ATM Shares under the Equity Distribution Agreement, the Equity Distribution Agreement remains in full force and effect.

| S-8 |

Corporate Information

We were incorporated under the laws of the state of Delaware on March 29, 2011. Our principal executive offices are located at 7380 Coca Cola Drive, Suite 106, Hanover, Maryland 21076, and our telephone number is (443) 776-3133. Our website address is www.processapharmaceuticals.com. The information contained in, or accessible through, our website is not incorporated by reference into this prospectus supplement, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus supplement or in deciding whether to purchase our common stock.

We own unregistered trademarks, including our company name. All other trademarks or trade names referred to in this prospectus supplement are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus supplement are referred to without the symbols ® and ™, but such references should not be construed as any indication that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our Annual Report on Form 10-K for the year ended December 31, 2021 and subsequently filed Quarterly Reports on Form 10-Q as described in the section entitled “Incorporation of Certain Documents by Reference” in this prospectus supplement.

THE OFFERING

The following is a brief summary of some of the terms of the offering and is qualified in its entirety by reference to the more detailed information appearing elsewhere in this prospectus supplement and the accompanying base prospectus. For a more complete description of the terms of the securities offered hereby, see “Description of Securities” in the accompanying base prospectus.

| Common stock offered by us: | 7,812,544 shares. | |

| Offering price | $0.80 | |

| Common Stock outstanding after this offering: | 24,467,592 shares (1) | |

| Nasdaq Capital Market symbol: | “PCSA” | |

| Risk factors: | Investment in our securities involves a high degree of risk and could result in a loss of your entire investment. See “Risk Factors” beginning on page S-10 and the similarly entitled sections in the documents incorporated by reference into this prospectus supplement. | |

| Use of proceeds: | We intend to use the net proceeds from this offering to prepare for future clinical trials, research and development and working capital, and other general corporate purposes. See “Use of Proceeds” on page S-12 of this prospectus supplement. |

| (1) | The number of shares of our common stock to be outstanding after this offering is based on 16,655,048 shares of common stock outstanding as of February 6, 2023, and excludes: |

| ● | 171,661 shares of our common stock issuable upon exercise of outstanding options as of February 6, 2023, which have a weighted average exercise price of $17.08 per share; | |

| ● | 3,646,690 shares of common stock issuable for restricted stock units (RSUs) (of which 2,587,837 are vested) issuable upon meeting distribution restrictions; |

| ● | 151,888 shares of common stock issuable upon the future vesting of RSAs; | |

| ● | 285,618 shares of common stock issuable upon exercise of vested warrants at a weighted-average exercise price of $10.25 per share; | |

| ● | 2,387,622 shares of common stock reserved for issuance and available for future grant under our 2019 Omnibus Incentive Plan; and | |

| ● | warrants for the purchase of up to 3,160,130 shares at an exercise price of $1.02 the Company expects to issue to Spartan Capital Securities, LLC, the placement agent, under an amended consulting agreement. |

| S-9 |

Investing in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risks, uncertainties and assumptions contained in this prospectus supplement and discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K for the year ended December 31, 2021, in our subsequent Quarterly Reports on Form 10-Q which are incorporated into this prospectus supplement and the accompanying prospectus by reference in their entirety, as updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof, and which are incorporated by reference into this prospectus supplement and the accompanying prospectus, together with other information in this prospectus supplement and the accompanying prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be unduly relied upon to anticipate results or trends in future periods. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment. Please also read carefully the section above titled “Forward-Looking Statements.”

Risks Relating to this Offering

Because we will have broad discretion and flexibility in how the net proceeds from this offering are used, we may use the net proceeds in ways in which you disagree.

We intend to use the net proceeds from this offering to prepare for future clinical trials and for working capital and general corporate purposes. See “Use of Proceeds” on page S-12. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

We expect we will need additional financing following this offering to execute our business plan and fund future clinical trials and our operations, which additional financing may not be available on reasonable terms or at all.

As of September 30, 2022, we had total assets of approximately $18.6 million and working capital of approximately $9.7 million. As of September 30, 2022, our working capital included approximately $9.1 million of cash and cash equivalents. We believe that the net proceeds of this offering, plus our cash on-hand and amounts available to us under our Equity Line of Credit as of the date of this prospectus supplement, are sufficient to fund our proposed operating plan for at least the 12 months following the date of this prospectus supplement. However, as of the date of this prospectus supplement, we believe that we will need additional capital to fund our operations and conduct future clinical trials for existing drugs in our pipeline, assuming all necessary approvals and arrangements can be obtained, and to engage in the development of our pre-clinical drug candidate, including drug formulation, early stage animal testing and formal toxicology studies. We intend to seek additional funds through various financing sources, including the sale of our equity and debt securities, licensing fees for our drugs and/or technology and co-development and joint ventures with industry partners, with a preference towards licensing fees for our drugs and/or technology and co-development and joint ventures with industry partners. In addition, if available, we will consider alternatives to our current business plan that may enable to us to achieve revenue producing operations. However, there can be no guarantees that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to further pursue our business plan and we may be unable to continue operations, in which case you may lose your entire investment.

| S-10 |

The market price of our shares may be subject to fluctuation and volatility.

You could lose all or part of your investment. The market price of our common stock is subject to wide fluctuations in response to various factors, some of which are beyond our control. Since shares of our common stock were sold in our Nasdaq up-list in October 2020 at a price of $4.00 per share, the reported high and low sales prices of our common stock have ranged from $0.76 to $14.24 through February 6, 2023. The market price of our shares on the Nasdaq Capital Market may fluctuate as a result of a number of factors, some of which are beyond our control, including, but not limited to:

| ● | actual or anticipated variations in our and our competitors’ results of operations and financial condition; | |

| ● | market acceptance of our product candidates; | |

| ● | changes in earnings estimates or recommendations by securities analysts, if our shares are covered by analysts; | |

| ● | development of technological innovations or new competitive products by others; | |

| ● | announcements of technological innovations or new products by us; | |

| ● | publication of the results of clinical trials for our product candidates; | |

| ● | failure by us to achieve a publicly announced milestone; | |

| ● | delays between our expenditures to develop and market new or enhanced products and the generation of sales from those products; | |

| ● | developments concerning intellectual property rights, including our involvement in litigation brought by or against us; | |

| ● | regulatory developments and the decisions of regulatory authorities as to the approval or rejection of new or modified products; | |

| ● | changes in the amounts that we spend to develop, acquire or license new products, technologies or businesses; | |

| ● | changes in our expenditures to promote our product candidates; | |

| ● | our sale or proposed sale, or the sale by our significant stockholders, of our shares or other securities in the future; | |

| ● | changes in key personnel; | |

| ● | success or failure of our research and development projects or those of our competitors; | |

| ● | the trading volume of our shares; and | |

| ● | general economic and market conditions and other factors, including factors unrelated to our operating performance. |

| S-11 |

These factors and any corresponding price fluctuations may materially and adversely affect the market price of our shares and result in substantial losses being incurred by our investors. In the past, following periods of market volatility, public company stockholders have often instituted securities class action litigation. If we were involved in securities litigation, it could impose a substantial cost upon us and divert the resources and attention of our management from our business.

Because the price per share of our common stock being offered herein is substantially higher than the net tangible book value per share of our outstanding common stock following this offering, new investors will experience immediate and substantial dilution.

Because the price per share of our common stock offered herein is substantially higher than the net tangible book value per share of our common stock following this offering, you will suffer substantial dilution in the net tangible book value of the common stock offered herein. See “Dilution” for a more detailed discussion of the dilution you will incur if you purchase shares of our common stock in this offering.

We may not be able to maintain compliance with the continued listing requirements of The Nasdaq Capital Market.

Our common stock is listed on the Nasdaq Capital Market. In order to maintain that listing, we must satisfy minimum financial and other requirements including, without limitation, a requirement that our closing price be at least $1.00 per share. Since January 1, 2023, our closing price was less than $1.00 per share on seven trading days, five of which were consecutive. If our closing price is less than $1.00 per share for 10 consecutive business days, or if we fail to continue to meet any other applicable continued listing requirements for The Nasdaq Capital Market in the future, and Nasdaq determines to delist our common stock, the delisting could adversely affect the market liquidity of our common stock, our ability to obtain financing to repay debt and fund our operations.

We estimate that our net proceeds from this offering will be approximately $5.7 million, after deducting the underwriting discount and estimated offering expenses payable by us. We expect to use the net proceeds from this offering to prepare for future clinical trials, research and development and working capital, and general corporate purposes.

Our management will have broad discretion in the allocation of the net proceeds of this offering for any purpose, and investors will be relying on the judgment of our management with regard to the use of these net proceeds.

If you invest in our common stock, you will experience immediate dilution to the extent of the difference between the price per share you pay in this offering and the net tangible book value per share of our common stock after this offering.

Our net tangible book value as of September 30, 2022 was $9.5 million, or $0.61 per share. Net tangible book value is determined by subtracting our total liabilities from our total tangible assets, and net tangible book value per share is determined by dividing our net tangible book value by the number of outstanding shares of our common stock. After giving effect to the sale of shares of common stock in this offering at the offering price of $0.80 per share of common stock, and after deducting the underwriting discount and estimated offering expenses payable by us, our adjusted net tangible book value as of September 30, 2022 would have been approximately $23.9 million, or approximately $0.67 per share. This represents an immediate increase in net tangible book value of approximately $0.06 per share to our existing stockholders and an immediate dilution in net tangible book value of approximately $0.13 per share to investors participating in this offering. The following table illustrates this calculation on a per share basis:

| Public offering price per share of common stock | $ | 0.80 | ||||||

| Net tangible book value per share as of September 30, 2022 | $ | 0.61 | ||||||

| Increase per share attributable to investors participating in this offering | $ | 0.06 | ||||||

| Adjusted net tangible book value per share after giving effect to this offering | $ | 0.67 | ||||||

| Dilution per share to investors participating in this offering | $ | 0.13 |

| S-12 |

The number of shares of our common stock to be outstanding after this offering is based on 16,655,048 shares of common stock outstanding as of February 6, 2023, and excludes:

| ● | 171,661 shares of our common stock issuable upon exercise of outstanding options as of February 6, 2023, which have a weighted average exercise price of $17.08 per share; | |

| ● | 3,646,690 shares of common stock issuable for restricted stock units (RSUs) (of which 2,587,837 are vested) issuable upon meeting distribution restrictions; | |

| ● | 151,888 shares of common stock issuable upon the future vesting of RSAs; | |

| ● | 285,618 shares of common stock issuable upon exercise of vested warrants at a weighted-average exercise price of $10.25 per share; | |

| ● | 2,387,622 shares of common stock reserved for issuance and available for future grant under our 2019 Omnibus Incentive Plan; and | |

| ● | warrants for the purchase of up to 3,160,130 shares at an exercise price of $1.02 the Company expects to issue to Spartan Capital Securities, LLC, the placement agent, under an amendment to the current consulting agreement. |

The exercise of warrants or the vesting of outstanding restricted stock awards and restricted stock units would increase dilution to investors participating in this offering. In addition, we may choose to raise additional capital depending on market conditions, our capital requirements and strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. Furthermore, to the extent that we issue additional equity securities in connection with future capital raising activities, our then-existing stockholders may experience dilution.

We have engaged Spartan Capital Securities, LLC as our exclusive placement agent in connection with this offering subject to the terms and conditions of the Placement Agreement. They are located at 45 Broadway, 19th Floor, New York, NY 10006. The placement agent is not purchasing or selling any of the securities offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any specific number or dollar amount of securities, but it has agreed to use its reasonable best efforts to arrange for the sale of all of the securities offered hereby. We have entered into a purchase agreement directly with investors in connection with this offering and we may not sell the entire amount of shares offered pursuant to this prospectus supplement and the accompanying prospectus. We will make offers only to a limited number of institutional investors. The placement agent may retain other broker-dealers to act as sub-agents in connection with this offering and may pay a portion of its compensation hereunder to such sub-agent.

We have agreed to indemnify the placement agent against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the placement agent may be required to make in respect thereof.

| S-13 |

Fees and Expenses

This offering is being conducted on a “reasonable best efforts” basis, and the placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. The following table provides information regarding the amount of the placement agent fees to be paid to the placement agent by us, before expenses assuming the purchase of all of the securities offered hereby:

| Per Share | Total | |||||||

| Offering Price | $ | 0.80 | $ | 6,250,035 | ||||

| Placement Agent Fees (1) | $ | 0.06 | $ | 495,763 | ||||

| Proceeds to us (before expenses) | $ | 0.74 | $ | 5,754,272 | ||||

| (1) | We have agreed to pay the placement agent’s fee equal to 8.0% of the aggregate gross proceeds for the sale of the shares sold in this offering, excluding proceeds received from officers, directors and 10% shareholders. |

We have also agreed to reimburse the placement agent at closing for legal expenses in connection with the offering in an amount not to exceed $60,000. We estimate the total expenses payable by us for this offering, excluding the placement agent fees and expenses, will be approximately $50,000.

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the placement agent acting as principal. Under these rules and regulations, the placement agent:

| ● | may not engage in any stabilization activity in connection with our securities; and |

| ● | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Electronic Distribution

A prospectus supplement in electronic format may be made available on websites or through other online services maintained by the placement agent of the offering, or by its affiliates. Other than the prospectus supplement in electronic format, the information on the placement agent’s websites and any information contained in any other website maintained by the placement agent is not part of this prospectus supplement or the registration statement of which this prospectus supplement forms a part, has not been approved and/or endorsed by us or the placement agent in its capacity as placement agent and should not be relied upon by investors.

Listing

Our common shares are listed on the Nasdaq Capital Market under the trading symbol “PCSA.”

| S-14 |

Affiliations

The placement agent and its affiliates have provided, and may in the future provide, various investment banking, financial advisory and other financial services to us and our affiliates for which they have received, and in the future may receive, advisory or transaction fees, as applicable.

Lock-Up

The purchase agreement provides that, subject to certain exceptions, until the earlier of (i) 90 days after the closing of the offering or (ii) the trading day following the date that our common stock’s closing price exceeds $2.00 for a period of 10 consecutive trading days, we will not issue or enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents.

Other Activities and Relationships

The placement agent and certain of its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The placement agent and certain of its affiliates have, from time to time, performed, and may in the future perform, various commercial and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary fees and expenses.

We are amending our consulting agreement, entered into on August 24, 2022 with Spartan Capital Securities, LLC (“Spartan”) extending the term of the consulting agreement until February 10, 2024. We will compensate Spartan for financial consulting services provided under the amendment by granting Spartan warrants to purchase 3,160,130 shares of our common stock on April 12, 2023 with an exercise price of $1.02. The warrants will expire three years from the date of issuance and contain both call and cashless exercise provisions

In the ordinary course of their various business activities, the placement agent and certain of its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates. If the placement agent or its affiliates have a lending relationship with us, they routinely hedge their credit exposure to us consistent with their customary risk management policies. The placement agent and its affiliates may hedge such exposure by entering into transactions that consist of either the purchase of credit default swaps or the creation of short positions in our securities or the securities of our affiliates, including potentially the shares offered hereby. Any such short positions could adversely affect future trading prices of the shares offered hereby. The placement agent and certain of its affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

| S-15 |

Certain legal matters relating to this offering and the validity of the shares offered by this prospectus supplement will be passed upon for us by Foley & Lardner, LLP, Jacksonville, Florida. Sichenzia Ross Ference LLP, New York, New York is acting as counsel for Spartan Capital Securities, LLC in connection with this Offering.

The consolidated financial statements as of and for the fiscal years ended December 31, 2021 and 2020, incorporated by reference into this prospectus supplement from the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, have been so incorporated in reliance on the report of BD & Company, an independent registered public accounting firm, as stated in their report which is incorporated by reference herein, and has been so incorporated in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus supplement. Information in this prospectus supplement supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus supplement, while information that we file later with the SEC will automatically update and supersede the information in this prospectus supplement. We incorporate by reference into this prospectus supplement and the registration statement of which this prospectus supplement is a part the information or documents listed below that we have filed with the SEC (Commission File No. 001-39531):

| ● | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed on March 30, 2022 and amended on May 2, 2022; | |

| ● | Our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2022, filed on May 12, 2022; for the quarter ended June 30, 2022, filed on August 11, 2022; and for the quarter ended September 30, 2022, filed on November 8, 2022; | |

| ● | Our Proxy Statement on Schedule 14A for the 2022 Annual Meeting of Shareholders, filed on May 31, 2022 | |

| ● | Our Current Reports on Form 8-K filed on January 6, 2022; March 24, 2022; July 14, 2022; July 25, 2022; November 4, 2022; and February 6, 2023 and | |

| ● | The description of our common stock contained in or incorporated into our Registration Statement on Form 8-A, filed September 17, 2020, and any amendments or report updating that description. |

| S-16 |

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act made after the effective date of this registration statement of which this prospectus supplement is a part and until we terminate this offering. Information in such future filings updates and supplements the information provided in this prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will furnish without charge to each person, including any beneficial owner, to whom a prospectus supplement is delivered, upon written or oral request, a copy of any or all of the reports or documents incorporated by reference into this prospectus supplement but not delivered with the prospectus supplement, including exhibits that are specifically incorporated by reference into such documents. You can access the reports and documents incorporated by reference into this prospectus supplement at https:www.processapharmaceuticals.com. You may also direct any requests for reports or documents to:

Processa Pharmaceuticals, Inc.

7380 Coca Cola Drive, Suite 106

Hanover, Maryland 21076

(443)

776-3133

Attention: Wendy Guy

You should rely only on information contained in, or incorporated by reference into, this prospectus supplement and accompanying base prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus supplement, the accompanying base prospectus and the reports incorporated by reference herein and therein. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act that registers the common shares to be sold in this offering. In addition, we file annual, quarterly and current reports and proxy statements and other information with the SEC. Our SEC filings are and will become available to the public over the Internet at the SEC’s website at www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities at 100 F Street N.E., Washington, D.C. 20549. You can also obtain copies of the documents upon the payment of a duplicating fee to the SEC. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities. Copies of certain information filed by us with the SEC are also available on our website at https://www.processapharmaceuticals.com. We have not incorporated by reference into this prospectus supplement the information on our website and it is not a part of this document.

This prospectus supplement and the base prospectus does not contain all of the information set forth in the registration statement and the exhibits and schedules thereto. Some items are omitted in accordance with the rules and regulations of the SEC. You should review the information and exhibits included in the registration statement for further information about us and the securities we are offering. Statements in this prospectus supplement concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

| S-17 |

PROSPECTUS

Common Stock

Preferred Stock

Warrants

Units

We may offer and sell from time to time up to $75,000,000 of any combination of the securities described in this prospectus, in one or more classes or series and in amounts, at prices and on terms that we will determine at the times of the offerings.

This prospectus describes the general manner in which our securities may be offered using this prospectus. We will provide specific terms of the securities, including the offering prices, in one or more supplements to this prospectus. The supplements may also add, update or change information contained in this prospectus. You should read this prospectus and the prospectus supplement relating to the specific issue of securities carefully before you invest. This prospectus may be used to offer and sell any of the securities for the account of persons other than us as provided in an applicable prospectus supplement.

We may offer the securities independently or together in any combination for sale directly to purchasers or through underwriters, dealers or agents to be designated at a future date. The supplements to this prospectus will provide the specific terms of the plan of distribution.

Our common stock is traded on the Nasdaq Capital Market under the symbol “PCSA.” On June 25, 2021, the closing price of our common stock on the Nasdaq Capital Market was $8.62 per share.

Investment in our securities involves a high degree of risk. Before making an investment decision, please read the information in the section titled “Risk Factors” on page 5 of this prospectus. Please read carefully and consider these risk factors, as well as those included in reports we file under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as our most recent Annual Report on Form 10-K, and those included in any applicable prospectus supplement and/or other offering material we file with the Securities and Exchange Commission (the “SEC”).

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 9, 2021.

TABLE OF CONTENTS

| i |

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $75,000,000. This prospectus sets forth certain terms of the securities that we may offer.

This prospectus provides a general description of the securities we may offer. Each time we offer securities, we will, to the extent required by law, provide a prospectus supplement to this prospectus. The prospectus supplement will contain the specific description of the securities we are then offering and the terms of the offering. The prospectus supplement will supersede this prospectus to the extent it contains information that is different from, or that conflicts with, the information contained in this prospectus. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits. You should read this prospectus, any prospectus supplement and any other offering material together with the documents incorporated herein by reference and the additional information described herein under the heading “Where You Can Find More Information” before making an investment decision.

You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement. We have not authorized anyone else to provide you with different or additional information. We are offering to sell these securities and seeking offers to buy these securities only in jurisdictions where offers and sales are permitted. This prospectus and any accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date.

This prospectus may not be used by us to consummate sales of our securities unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will control.

As used in this prospectus, unless the context indicates or otherwise requires, “the Company,” “our Company,” “we,” “us,” and “our” refer to Processa Pharmaceuticals, Inc., a Delaware corporation, and its consolidated subsidiary.

| 1 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our ability to obtain funding for our future operations; | |

| ● | the impact of the COVID-19 pandemic on our business, operations or ability to obtain funding; | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | the potential market size, opportunity and growth potential for our product candidates, if approved; | |

| ● | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize our product candidates, if approved; | |

| ● | the initiation, timing, progress and results of our pre-clinical studies and clinical trials, and our research and development programs; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory filings and approvals and other product development objectives; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates by physicians, patients, third-party payors and others in the medical community, if approved; | |

| ● | the implementation of our business model, strategic plans for our business, product candidates and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| ● | developments relating to our competitors and our industry; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; and | |

| ● | our financial performance. |

Forward-looking statements reflect our management’s expectations or predictions of future conditions, events or results based on various assumptions and management’s estimates of trends and economic factors in the markets in which we are active, as well as our business plans. They are not guarantees of future performance. By their nature, forward-looking statements are subject to risks and uncertainties. Our actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. There are a number of factors that could cause actual conditions, events or results to differ materially from those described in the forward-looking statements contained in this prospectus and the documents incorporated by reference into this prospectus.

See an additional discussion under “Risk Factors” in any applicable prospectus supplement and any related free writing prospectus, and in our most recent Annual Report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q. These forward-looking statements are representative only as of the date they are made, and we undertake no obligation to update any forward-looking statement as a result of new information, future events or otherwise.

| 2 |

Overview

We are a clinical-stage biopharmaceutical company focused on the development of drug products that are intended to provide treatment for patients who have a high unmet medical need condition that effects survival or the patient’s quality of life and have few or no treatment options.

Our mission is to develop drug products that improve the survival and/or quality of life for patients with high unmet medical need conditions. We are a development company, not a discovery company, that seeks to identify and develop drugs for patients who need better treatment options than presently exist for their medical condition. In order to increase the probability of development success, our pipeline only includes drugs which have previously demonstrated some efficacy in the targeted population or a drug with very similar pharmacological properties has been shown to be effective in the population.

Our screening criteria for identifying and selecting new candidates include:

| ● | addressing an unmet or underserved clinical need, | |

| ● | having demonstrated evidence of efficacy in humans and | |

| ● | leveraging our regulatory science approach to improve the probability for approval. |