Exhibit 10.11

Execution Copy

LICENSE AGREEMENT

BY AND BETWEEN

PROCESSA PHARMACEUTICALS, INC.

AND

YUHAN CORPORATION

DATED AS OF AUGUST 19, 2020

TABLE OF CONTENTS

| ARTICLE I | DEFINITIONS | 1 |

| ARTICLE II | GRANTS OF RIGHTS | 13 |

| ARTICLE III | DEVELOPMENT & GOVERNANCE | 14 |

| ARTICLE IV | SUPPLY | 17 |

| ARTICLE V | COMMERCIALIZATION | 18 |

| ARTICLE VI | DILIGENCE | 18 |

| ARTICLE VII | FINANCIAL PROVISIONS | 19 |

| ARTICLE VIII | INTELLECTUAL PROPERTY OWNERSHIP, PROTECTION AND RELATED MATTERS | 26 |

| ARTICLE IX | CONFIDENTIAL INFORMATION | 33 |

| ARTICLE X | REPRESENTATIONS, WARRANTIES AND COVENANTS | 35 |

| ARTICLE XI | INDEMNIFICATION | 38 |

| ARTICLE XII | TERM AND TERMINATION | 41 |

| ARTICLE XIII | MISCELLANEOUS | 45 |

Schedules

| Schedule 1.10 | Compound |

| Schedule 1.49 | Form of Share Issuance Agreement |

| Schedule 1.57 | Yuhan Patent Rights |

| - i - |

LICENSE AGREEMENT

THIS LICENSE AGREEMENT is entered into this 19th day of August 2020 (the “Effective Date”), by and between Processa Pharmaceuticals, Inc. a company organized under the laws of Delaware, having a business address at 7380 Coca Cola Drive, Suite 106, Hanover, MD 21076 (“Processa”), and Yuhan Corporation a company in Seoul, Korea, whose principal place of business is at 74, Noryangjin-ro, Dongjak-gu, Seoul, Korea (“Yuhan”).

WHEREAS, Yuhan has developed or obtained rights to Yuhan Know-How, Yuhan Patent Rights and the Compound (each as defined below); and

WHEREAS, Processa desires to obtain a license of the Yuhan Patent Rights and the Yuhan Know-How to Develop and Commercialize Compounds and Products (each as defined below), under the terms and conditions set forth herein, and Yuhan desires to grant such a license;

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants herein contained, the Parties agree as follows:

ARTICLE

I

DEFINITIONS

The following terms, whether used in the singular or plural, shall have the following meanings:

1.1 “Affiliate.” Affiliate means any Person directly or indirectly controlled by, controlling or under common control with, a Party, but only for so long as such control shall continue. For purposes of this definition, “control” (including, with correlative meanings, “controlled by,” “controlling,” and “under common control with”) means, with respect to a Person, possession, direct or indirect, of (a) the power to direct or cause direction of the management and policies of such Person (whether through ownership of securities or partnership or other ownership interests, by contract or otherwise), or (b) at least 50% of the voting securities (whether directly or pursuant to any vested and exercisable option, warrant or other similar arrangement) or other comparable equity interests. For clarity, neither of the Parties shall be deemed to be an “Affiliate” of the other.

1.2 “Bankruptcy Code.” Bankruptcy Code means Title 11 of the U.S. Code, as amended from time to time.

1.3 “Business Day.” Business Day means a day that is not a Saturday, Sunday, or a day on which banking institutions in Baltimore, Maryland or in South Korea are authorized by Law to remain closed.

1.4 “Calendar Quarter.” Calendar Quarter means each of the periods ending on March 31, June 30, September 30, and December 31 of any Calendar Year.

1.5 “Calendar Year.” Calendar Year means each calendar year during the Term.

| 1 |

1.6 “Combination Product.” Combination Product means (a) any pharmaceutical product that is a single formulation consisting of a Compound and one or more other active compounds or active ingredients, which other active compounds or active ingredients are not Compounds (“Other API”) or (b) any combination of a Compound sold together with any separately formulated Other API for a single invoiced price.

1.7 “Commercialization” or “Commercialize.” Commercialization or Commercialize means activities directed to obtaining pricing and reimbursement approvals, marketing, promoting, Manufacturing commercial supplies of, distributing, importing, offering for sale, or selling a product.

1.8 “Commercially Reasonable Efforts.” Commercially Reasonable Efforts means, with respect to an objective, the reasonable, diligent, good faith efforts of a Party (including the efforts of its Affiliates and Sublicensees) to accomplish such objective that a biopharmaceutical company of comparable size and resources would normally use to accomplish a similar objective under similar circumstances, and, specifically with respect to obligations hereunder relating to a Compound or Product, the carrying out of such obligations with those efforts and resources that a biopharmaceutical company of comparable size and resources would use were it Developing, Manufacturing or Commercializing its own pharmaceutical products that are at a similar stage of development or product life cycle and of similar market potential as the Compound or Product, taking into account actual and potential issues of safety, efficacy or stability, product profile (including product modality, category and mechanism of action), stage of development or life cycle status, product labeling or anticipated labeling, the present and future market potential, past performance of the Compound or Product, actual and projected Development, Regulatory Approval, pricing and reimbursement approval, Manufacturing and Commercialization costs, existing or projected pricing, sales, reimbursement and financial return, medical and clinical considerations, present and future regulatory environment, any issues regarding the ability to Manufacture the Compound or Product, the likelihood and timing of obtaining Regulatory Approvals and pricing and reimbursement approvals, proprietary position, strength and duration of patent protection and anticipated exclusivity, competitive Third Party products at the time and the likely competitive environment at the time of projected entry into the market and thereafter, and any other relevant scientific, technical, operational and commercial factors, all as measured by the facts and circumstances at the time such efforts are due. Commercially Reasonable Efforts will be determined on a country-by-country and indication-by-indication basis for the Compound or Product, and the level of effort is expected to change over time, reflecting changes in the status and value of the Compound or Product and the market conditions and country(ies) involved.

1.9 “Clinical Trial.” Clinical Trial shall mean any study in which human subjects are dosed with a drug, whether approved or investigational, including any Phase 1 Clinical Trial, Phase 2 Clinical Trial, Phase 3 Clinical Trial, or any Pivotal Clinical Trial.

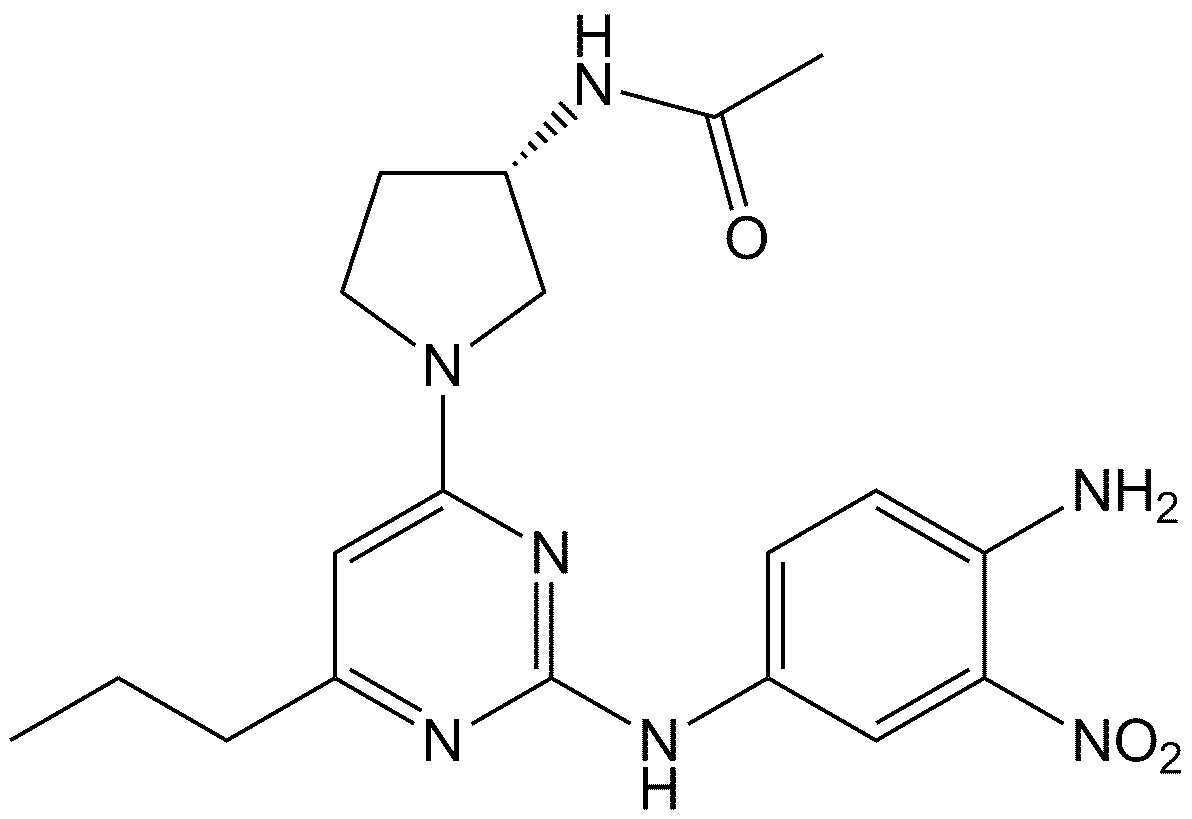

1.10 “Compound.” Compound means YH12852, which has the chemical structure set forth on Schedule 1.10, together with all analogs, derivatives, metabolites, stereoisomers, polymorphs, formulations, mixtures or compositions thereof, and any existing or future improved or modified versions of the foregoing developed by or on behalf of Processa, its Affiliates or Sublicensees.

| 2 |

1.11 “Control” or “Controlled.” Control or Controlled means, with respect to any tangible property or intellectual property right or other intangible property, the possession (whether by ownership or license (other than by grant of a license to one Party by the other Party pursuant to this Agreement or by grant of a license or sublicense to a Sublicensee by Processa pursuant to a license or sublicense agreement)) by a Person of the ability to grant to another Person access to such tangible property or access to or a license or sublicense to such intellectual property right or other intangible property, as provided herein without violating the terms of any agreement with any other Person.

1.12 “Cover,” “Covering” or “Covered.” Cover, Covering or Covered means, with respect to a compound, product, technology, process or method that, in the absence of ownership of or a license granted under a Patent Right, the manufacture, use, offer for sale, sale or importation of such compound or product or the practice of such technology, process or method would infringe such Patent Right (or, in the case of a Patent Right that has not yet issued, would infringe such Patent Right if it were to issue).

1.13 “CTA.” CTA means (a) a clinical trial authorization application filed with a Regulatory Authority in any regulatory jurisdiction outside the United States, the filing of which is necessary to commence or conduct clinical testing of a drug or biologic product in humans in such jurisdiction; or (b) documentation issued by a Regulatory Authority that permits the conduct of clinical testing of a product in humans in a regulatory jurisdiction.

1.14 “Development” or “Develop.” Development or Develop means pre-clinical, non-clinical and clinical drug research, discovery and development activities, including IND-enabling toxicology and other IND-enabling pre-clinical development efforts, stability testing, process development, compound property optimization, formulation development, delivery system development, quality assurance and quality control development, statistical analysis, clinical pharmacology, Manufacturing supplies of compounds and products for pre-clinical, non-clinical and clinical use, clinical studies (including pre- and post-approval studies and investigator sponsored clinical studies), regulatory affairs, and Regulatory Approval and clinical study regulatory activities (excluding regulatory activities directed to obtaining pricing and reimbursement approvals).

1.15 “EMA.” EMA means the European Medicines Agency and any successor agency.

1.16 “FDA.” FDA means the U.S. Food and Drug Administration and any successor agency.

1.17 “Field.” Field means for use in the treatment, prevention, palliation, and/or diagnosis of any and all human and/or animal diseases, disorder, or conditions.

1.18 “First Commercial Sale.” First Commercial Sale means, with respect to a Product in a country, the first sale of such Product in such country by Processa, any of its Affiliates or any Sublicensee to the first unrelated Third Party (excluding any Sublicensee) in such country for use or consumption of such Product in such country after receipt of the first Regulatory Approval for such Product in such country. Sales for purposes of testing the Product and sample purposes shall not be deemed a First Commercial Sale. For clarity, First Commercial Sale will be determined on a Product-by-Product and country-by-country basis, as applicable.

| 3 |

1.19 “FPFV.” FPFV means the first patient’s first screening visit in a Clinical Trial at or prior to which such subject signs an informed consent to participate in such Clinical Trial.

1.20 “Governmental Authority.” Governmental Authority means any national, federal, state or local government, or political subdivision thereof, or any multinational organization or authority or any authority, agency, or commission entitled to exercise any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power, any court or tribunal (or any department, bureau or division thereof), or any governmental arbitrator or arbitral body.

1.21 “IND.” IND means an investigational new drug application filed with the FDA with respect to a Compound or Product, or an equivalent application filed with the Regulatory Authority of a country or regulatory jurisdiction in the Territory other than the United States, and all amendments and supplements thereto.

1.22 “Joint Intellectual Property.” Joint Intellectual Property means the Joint Inventions and Joint Patent Rights.

1.23 “Know-How.” Know-How means all unpatented technical information, trade secrets, formulae, standards, knowledge, directions, instructions, test protocols, procedures and results, studies, analyses, raw material sources, data, Manufacturing data, and any other confidential or proprietary interest in information.

1.24 “Law” or “Laws.” Law or Laws means all laws, statutes, rules, regulations, orders, judgments, or ordinances of any Governmental Authority.

1.25 “Losses.” Losses means any and all (a) claims, losses, liabilities, damages, fines, royalties, governmental penalties or punitive damages, deficiencies, interest, awards, judgments, and settlement amounts (including special, indirect, incidental, and consequential damages, lost profits, and Third Party punitive and multiple damages) payable to a Third Party, and (b) in connection with all of the items referred to in clause (a) above, any and all costs and expenses (including reasonable counsel fees and all other expenses reasonably incurred in investigating, preparing or defending any litigation or proceeding, commenced or threatened) payable to a Third Party.

1.26 “Major Markets.” Major Markets means, collectively, the United States, France, Germany, Italy, Spain, and the United Kingdom.

1.27 “Manufacture” or “Manufacturing.” Manufacture or Manufacturing means activities directed to making, having made, producing, manufacturing, processing, filling, finishing, packaging, labeling, quality assurance testing and release, shipping and storage of a product.

| 4 |

1.28 “Marketing Approval.” Marketing Approval means any and all approvals (including supplements, amendments, and post-marketing approvals), licenses, registrations or authorizations of any Regulatory Authority that are necessary to market and/or sell a drug or biologic product in a country or jurisdiction for one or more uses.

1.29 “NDA.” NDA means a New Drug Application, as defined in the United States Federal Food, Drug, and Cosmetic Act (21 U.S.C. 301, et. seq., as it may be amended from time to time, including the rules, regulations, guidance, guidelines, and requirements promulgated or issued thereunder), filed with the FDA with respect to a Compound or Product, or an equivalent application filed with the Regulatory Authority of a country in the Territory other than the United States, and all amendments and supplements thereto.

1.30 “Net Sales.” Net Sales means the gross amounts billed or invoiced by Processa, or any of its Affiliates, to any Third Party that is not a Sublicensee with respect to sales of Products in the Territory, calculated in the same manner as reported in such Person’s audited financial statements, less the following to the extent actually incurred or allocated in accordance with Processa’s or its Affiliates’ customary accounting practices consistently and generally applied:

(a) Volume, cash or trade discounts, credits or allowances not to exceed thirty five percent (35%) of the billed or invoiced amount, including discounts in the form of inventory management fees paid to wholesalers and distributors all to the extent such discounts are included in the invoices and actually granted, but excluding commissions for commercialization;

(b) Credits, refunds or allowances granted upon returns, rejections or recalls and for retroactive price reductions or billing errors;

(c) Freight, postage, shipping, and insurance costs incurred in transporting the applicable Products to the extent that such items are applicable to such sale and are separately itemized and invoiced and actually paid as evidenced by invoices, receipts or other appropriate documents;

(d) Amounts paid (including rebates and chargeback payments or credits or other equivalents thereof) to formularies, government or government agency programs, trade customers, managed health care organizations and pharmacy benefit managers (or equivalents thereof) to obtain listing or purchase of the applicable Products not to exceed thirty-five (35%) of the billed or invoiced amount;

(e) Bad debts, uncollectible amounts, and collection costs relating to the sale of Products that are actually written off; and

(f) To the extent not reimbursed by a third party, taxes, tariffs, duties or other governmental charges (other than income taxes) levied on, absorbed, or otherwise imposed on the sales, transportation, delivery, use, exportation, or importation of the applicable Products.

Sales of Products between Processa and its Affiliates or Sublicensees for resale shall be excluded from the computation of Net Sales. Subject to Section 7.6, all sales by a Sublicensee shall also be excluded from the computation of Processa Net Sales. Disposal or use of Products at or below cost for regulatory, Development or charitable purposes, such as clinical trials, compassionate use, named patient use, or indigent patient programs, shall not be deemed a sale hereunder.

| 5 |

With respect to any sale of any Product in a given country for any substantive consideration other than monetary consideration on arm’s length terms (which has the effect of reducing the invoiced amount below what it would have been in the absence of such non-monetary consideration), for purposes of calculating the Net Sales under this Agreement, such Product shall be deemed to be sold exclusively for cash at the average Net Sales price charged to Third Parties for cash sales in such country during the applicable reporting period (or if there were only de minimis cash sales in such country, at the fair market value as determined in good faith based on pricing in comparable markets).

If a Product is sold as part of a Combination Product, Net Sales will be the product of (x) Net Sales of the Combination Product calculated as above (i.e., calculated as for a non-Combination Product) and (y) the fraction (A/(A+B)), where:

(i) A is the average selling price of the Product comprising a Compound as the sole therapeutically active ingredient during the most recently completed Calendar Quarter during which such non-Combination Product was sold in such country; and

(ii) B is the average selling price in such country of products containing the Other API contained in the Combination Product as the sole therapeutically active ingredient when sold separately during the most recently completed Calendar Quarter during which such products were sold in such country.

If both A and B cannot be determined by reference to non-Combination Product sales as described above, then Net Sales for purposes of determining Royalty payments will be calculated as above, but the average selling price in the above equation shall be determined by mutual agreement reached in good faith by the Parties prior to the end of the accounting period in question based on an equitable method of determining same that takes into account, in the applicable country, variations in dosage units and the relative fair market value of each therapeutically active ingredient in the Combination Product. If the Parties are unable to reach such an agreement prior to the end of the applicable accounting period, then the Parties will refer such matter to a jointly selected Third Party with expertise in the pricing of pharmaceutical products that is not an employee, consultant, legal advisor, officer, director or stockholder of, and does not have any conflict of interest with respect to, either Party for resolution, which will be final and binding on the Parties.

1.31 “Party.” Party means either Yuhan or Processa; “Parties” means both Yuhan and Processa.

1.32 “Patent Rights.” Patent Rights means all patent applications, patents, certificates of invention, applications for certificates of invention and priority patent filings, including any continuations, continuations-in-part, renewals, requests for continued examination and divisions of any such patents and patent applications, any patents or certificates of invention issuing from any of the foregoing, any extensions, reissues, reexaminations, substitutions, confirmations, registrations, revalidations, revisions, additions or supplementary patent certificates thereto, and all foreign counterparts thereof.

| 6 |

1.33 “Person.” Person means any natural person or any corporation, company, partnership, joint venture, firm, Governmental Authority, or other entity, including a Party.

1.34 “Phase 1 Clinical Trial.” Phase 1 Clinical Trial means a single randomized, placebo, or active controlled human clinical trial which provides for the first introduction into humans of a product, conducted in normal volunteers or patients to get information on product safety, tolerability, immunogenicity, pharmacological activity, or pharmacokinetics, as more fully defined in 21 C.F.R. § 312.21(a) (or analogous regulations of an applicable Regulatory Authority outside the U.S.).

1.35 “Phase 2 Clinical Trial.” Phase 2 Clinical Trial means, a single randomized, placebo, or active controlled human clinical trial of any product, the principal purposes of which are the evaluation of the efficacy of such product for a particular indication in the target patient population and a determination of the common side-effects and risks associated with the product in the dosage range to be prescribed and to obtain sufficient information about the efficacy for such pharmaceutical product in the disease or condition being studied to permit the design and dose of such product in a Phase 2 Clinical Trial, as described in 21 C.F.R. § 312.21(b) (or analogous regulations of an applicable Regulatory Authority outside the U.S.). Phase 2 Clinical Trial shall include any Phase 2a or Phase 2b Clinical Trial.

1.36 “Phase 3 Clinical Trial.” Phase 3 Clinical Trial means a single randomized, placebo or active controlled human clinical trial of any product on sufficient numbers of patients that is designed to demonstrate statistically that such product is safe and efficacious for its intended use, to evaluate the risk-benefit relationship of the product, and to define warnings, precautions and adverse reactions that are associated with such product in the dosage range to be prescribed, as described in 21 C.F.R. § 312.21(c) (or analogous regulations of an applicable Regulatory Authority outside the U.S.), and that is intended to support Regulatory Approval of such product.

1.37 “Pivotal Clinical Trial.” Pivotal Clinical Trial shall mean (a) a Phase 3 Clinical Trial that is intended by Company or its Affiliates or Sublicensees to be submitted (together with any other registration trials that are prospectively planned when such Phase 3 Clinical Trial is Initiated) for Regulatory Approval in the United States or the EU, or (b) any other Clinical Trial that is intended by Company or its Affiliates or Sublicensees to establish that a Product is safe and efficacious for its intended use, and to determine warnings, precautions, and adverse reactions that are associated with such pharmaceutical product in the dosage range to be prescribed, which Clinical Trial is a registration trial intended by Company or its Affiliates or Sublicensees to be sufficient for filing an application for a Regulatory Approval for such product in the United States or another country or some or all of an extra-national territory, solely as evidenced by the acceptance for filing for a Regulatory Approval for such Product after completion of such Clinical Trial.

1.38 “Planned Public Offering.” Planned Public Offering means Processa’s planned capital raise for the up-list to Nasdaq or the NYSE pursuant to the sale of shares pursuant to the Form S-1 Registration Statement (File No. 333-235511), as amended.

| 7 |

1.39 “Processa Intellectual Property.” Processa Intellectual Property means, collectively, Processa Know-How and Processa Patent Rights.

1.40 “Processa Know-How.” Processa Know-How means all Know-How Controlled as of the Effective Date or thereafter during the Term by Processa or any of its Affiliates (other than any Know-How included in Joint Intellectual Property) that is used by Processa or any of its Affiliates in the Development, Manufacture or Commercialization of any Compound or Product; provided, however, that, if Processa is acquired by a Third Party, “Processa Know-How” shall exclude any Know-How that (a) is Controlled by such Third Party or the Affiliates of such Third Party (other than Processa and the Persons that were Processa’s Affiliates immediately prior to the closing of such acquisition transaction (such Affiliates, “Processa Pre-Existing Affiliates”)) (“Processa Excluded Affiliates”) and (b) was not Controlled by Processa or any of the Processa Pre-Existing Affiliates immediately prior to the closing of such acquisition transaction; provided further that, if, after the closing of such acquisition, any such Processa Excluded Affiliate has or acquires Control of any Know-How that is necessary or useful to Develop, Manufacture or Commercialize any Compound or Product and that is used to Develop, Manufacture or Commercialize any such Compound or Product, such additional Know-How that is Controlled by such Processa Excluded Affiliate shall be included in Processa Know-How.

1.41 “Processa Patent Rights.” Processa Patent Rights means all Patent Rights in the Territory Controlled as of the Effective Date or thereafter during the Term by Processa or any of its Affiliates (other than Joint Patent Rights) that Cover any Compound or Product and are used by Processa or any of its Affiliates in the Development, Manufacture or Commercialization of any Compound or Product; provided, however, that, if Processa is acquired by a Third Party, “Processa Patent Rights” shall exclude any Patent Rights that (a) are Controlled by such Third Party or the Affiliates of such Third Party (other than Processa and Processa Pre-Existing Affiliates) and (b) were not Controlled by Processa or any of the Processa Pre-Existing Affiliates immediately prior to the closing of such acquisition transaction; provided further that, if, after the closing of such acquisition, any such Processa Excluded Affiliate has or acquires Control of any Patent Right that Covers the Development, Manufacture or Commercialization of any Compound or Product and that is used to Develop, Manufacture or Commercialize any such Compound or Product, such additional Patent Right that is Controlled by such Processa Excluded Affiliate shall be included in Processa Patent Rights.

1.42 “Product.” Product means any pharmaceutical preparation containing one or more Compounds either as its only active ingredient(s) or as part of a Combination Product. For the avoidance of doubt, nothing in this Agreement grants to Processa or Yuhan any right or license under any Patent Rights or Know-How Controlled by Yuhan or Processa, respectively, with respect to any Other API.

1.43 “Regulatory Approval.” Regulatory Approval means an approval by the applicable Regulatory Authority of an NDA and any other approval, license, registration, permit, notification or authorizations (or waiver) of the applicable Regulatory Authority, which is necessary for the Manufacture, use, storage, import, transport, promotion, marketing, distribution, offer for sale, sale, or other Commercialization of pharmaceutical products in a given country or regulatory jurisdiction, other than any pricing or reimbursement approval.

| 8 |

1.44 “Regulatory Authority.” Regulatory Authority means any Governmental Authority with responsibility for granting licenses or approvals necessary for the Development, Manufacture, use, storage, import, transport, promotion, marketing, distribution, offer for sale, sale or other Commercialization of pharmaceutical products in a country or regulatory jurisdiction, including but limited to the FDA or EMA.

1.45 “Regulatory Documentation.” Regulatory Documentation means: (i) all applications for Regulatory Approval; (ii) all Regulatory Approvals, including INDs, CTAs and Marketing Approvals; (iii) all supporting documents created for, referenced in, submitted to or received from an applicable Regulatory Authority relating to any of the applications or Regulatory Approvals described in clauses (i) or (ii), including drug master files (or any equivalent thereof outside the U.S.), annual reports, regulatory drug lists, advertising and promotion documents filed or shared with Regulatory Authorities, adverse event files, safety reports, inspection reports, documents with regard to clinical data, complaint files and Manufacturing records and any supplements thereto; and (iv) all correspondence made to, made with or received from any Regulatory Authority (including written and electronic mail correspondence and minutes from meetings, discussions, or conferences (whether in person or by audio conference or videoconference)).

1.46 “Regulatory Exclusivity.” Regulatory Exclusivity means exclusive marketing rights or data protection or other exclusivity rights conferred by any Regulatory Authority with respect to a Product in a country or regulatory jurisdiction within the Territory, other than a Patent Right, including orphan drug exclusivity, pediatric exclusivity, and rights conferred in the United States under the Hatch-Waxman Act.

1.47 “Right of Cross-Reference.” Right of Cross-Reference means an authorization that permits an applicable Regulatory Authority in a country to rely on the relevant information (by cross-reference, incorporation by reference or otherwise) contained in Regulatory Documentation (and any data contained therein) filed with such Regulatory Authority with respect to such Party’s compound or product, as necessary to conduct a Clinical Trial, to support Regulatory Approval of a product, to support a label expansion, or to support a further indication in such country or as otherwise expressly permitted or required under this Agreement to enable a Party to exercise its rights or perform its obligations hereunder, and, without the disclosure of underlying Confidential Information to such Party.

1.48 “Senior Executive.” Senior Executive means, with respect to Yuhan, the CEO of Yuhan, or his or her designee, and, with respect to Processa, the CEO of Processa, or his or her designee. “Senior Executives” means the applicable officers of Yuhan and Processa.

1.49 “Share Issuance Agreement.” Share Issuance Agreement means the Share Issuance Agreement entered into by Yuhan and Processa as of August 19, 2020, a copy of which is set forth as Schedule 1.49.

1.50 “Sublicensee.” Sublicensee means a Third Party that has been granted a sublicense under the rights granted to Processa pursuant to Section 2.1 of this Agreement, beyond the mere right to purchase Compound or Product Manufactured by or on behalf of Processa or its Affiliates.

| 9 |

1.51 “Territory.” Territory means all countries of the world except for Manufacturing and Commercialization rights in South Korea.

1.52 “Third Party.” Third Party means any Person other than Yuhan or Processa or any of their respective Affiliates.

1.53 “U.S.” U.S. means the United States of America, including its territories and possessions.

1.54 “Valid Claim.” Valid Claim means any claim of (a) an issued and unexpired patent within the Yuhan Patent Rights, Processa Patent Rights, or Joint Patent Rights that has not been revoked or held unenforceable or invalid by a final decision of a court or other Governmental Authority of competent jurisdiction, or that has not been disclaimed, denied or admitted to be invalid or unenforceable through reissue or disclaimer or otherwise; or (b) a patent application within the Yuhan Patent Rights, Processa Patent Rights, or Joint Patent Rights; provided that such a claim within a patent application has not been canceled, withdrawn, or abandoned or been pending for more than seven (7) years from the date of its first priority filing in the applicable country. For clarity, a claim of a patent that, pursuant to clause (b), had ceased to be a Valid Claim before it issued but that subsequently issues and is otherwise described by clause (a), shall again be considered to be a Valid Claim once it issues until it is no longer considered a Valid Claim in accordance with clause (a).

1.55 “Yuhan Intellectual Property.” Yuhan Intellectual Property means the Yuhan Know-How and the Yuhan Patent Rights.

1.56 “Yuhan Know-How.” Yuhan Know-How means all Know-How that is Controlled by Yuhan or any of its Affiliates as of the Effective Date or thereafter during the Term (other than any Know-How included in Joint Intellectual Property) that is necessary or useful to Develop, Manufacture or Commercialize any Compound or Product; provided, however, that, if Yuhan is acquired by a Third Party, “Yuhan Know-How” shall exclude any Know-How that (a) is Controlled by such Third Party or the Affiliates of such Third Party (other than Yuhan and the Persons that were Yuhan’s Affiliates immediately prior to the closing of such acquisition transaction (such Affiliates, “Yuhan Pre-Existing Affiliates”)) (“Yuhan Excluded Affiliates”) and (b) was not Controlled by Yuhan or any of the Yuhan Pre-Existing Affiliates immediately prior to the closing of such acquisition transaction; provided further that, if, after the closing of such acquisition, any such Yuhan Excluded Affiliate has or acquires Control of any Know-How that is necessary or useful to Develop, Manufacture or Commercialize any Compound or Product and that is used to Develop, Manufacture or Commercialize any such Compound or Product, such additional Know-How that is Controlled by such Yuhan Excluded Affiliate shall be included in Yuhan Know-How.

1.57 “Yuhan Patent Rights.” Yuhan Patent Rights means all Patent Rights in the Territory that are Controlled by Yuhan or any of its Affiliates as of the Effective Date or thereafter during the Term (other than Joint Patent Rights) that Cover any Compound or Product. The Yuhan Patent Rights existing as of the Effective Date are set forth on Schedule 1.57; provided, however, that, if Yuhan is acquired by a Third Party, “Yuhan Patent Rights” shall exclude any Patent Rights that (a) are Controlled by such Third Party or the Affiliates of such Third Party (other than Yuhan and Yuhan Pre-Existing Affiliates) and (b) were not Controlled by Yuhan or any of the Yuhan Pre-Existing Affiliates immediately prior to the closing of such acquisition transaction; provided further that, if, after the closing of such acquisition, any such Yuhan Excluded Affiliate has or acquires Control of any Patent Right that Covers the Development, Manufacture or Commercialization of any Compound or Product and that is used to Develop, Manufacture or Commercialize any such Compound or Product, such additional Patent Right that is Controlled by such Yuhan Excluded Affiliate shall be included in Yuhan Patent Rights.

| 10 |

1.58 Additional Definitions. Each of the following definitions is set forth in the Section of this Agreement indicated below:

| Definition: | Section: |

| Abandoned Patents | Section 8.2(a) |

| Agents | Section 9.1 |

| Commercialization Plan | Section 5.2 |

| Confidential Information | Section 9.2 |

| Confidentiality Agreement | Section 9.2 |

| Courts | Section 13.1 |

| Deadlocked Matter | Section 3.5(e) |

| Development Milestone Payments | Section 7.2 |

| Development Plan | Section 6.1(a) |

| Effective Date | Preamble |

| Indemnified Party | Section 11.3(a) |

| Indemnifying Party | Section 11.3(a) |

| Infringement Claim | Section 8.3(a) |

| Joint Inventions | Section 8.1(b) |

| Joint Patent Rights | Section 8.2(b) |

| Late Payment Notice | Section 7.12 |

| Milestone Shares | Section 7.2 |

| Other API | Section 1.6 |

| Paragraph IV Claim | Section 8.8(a) |

| PCYU Board | Section 3.5(a) |

| Product Liability Claims | Section 11.1(b) |

| Processa | Preamble |

| Processa Excluded Affiliates | Section 1.40 |

| Processa Parties | Section 11.2 |

| Processa Pre-Existing Affiliates | Section 1.40 |

| Processa Sole Inventions | Section 8.1(a) |

| ROFN Notice | Section 4.2 |

| ROFN Response | Section 4.2 |

| Royalties | Section 7.5(a) |

| Royalty Floor | Section 7.5(d) |

| Royalty Rate | Section 7.5(a) |

| Royalty Term | Section 7.5(b) |

| Sales Milestone Payment | Section 7.4 |

| Sublicense Considerations | Section 7.6(a) |

| Sublicense Materials | Section 2.1(c) |

| Sublicense Payments | Section 7.6 |

| Sublicensee Intellectual Property | Section 2.1(c) |

| Taxes | Section 7.9 |

| Term | Section 12.1 |

| Third Party Claims | Section 11.1 |

| Third Party Patent Licenses | Section 7.5(c) |

| Upfront Fee | Section 7.1 |

| Worldwide Annual Accrued Net Sales | Section 7.4 |

| Yuhan | Preamble |

| Yuhan Excluded Affiliates | Section 1.56 |

| Yuhan Parties | Section 11.1 |

| Yuhan Pre-Existing Affiliates | Section 1.56 |

| Yuhan Sole Inventions | Section 8.1(a) |

| 11 |

1.59 Captions; Certain Conventions; Construction. All headings and captions herein are for convenience only and shall not be interpreted as having any substantive meaning. The Schedules to this Agreement are incorporated herein by reference and shall be deemed a part of this Agreement. Unless otherwise expressly provided herein or the context of this Agreement otherwise requires:

(a) words of any gender include each other gender;

(b) words such as “herein,” “hereof,” and “hereunder” refer to this Agreement as a whole and not merely to the particular provision in which such words appear;

(c) words using the singular shall include the plural, and vice versa;

(d) the words “include,” “includes” and “including” shall be deemed to be followed by the phrase “but not limited to”, “without limitation”, “inter alia” or words of similar import;

(e) the word “or” shall be deemed to include the word “and” (i.e., shall mean “and/or”)

(f) references to “Article,” “Section,” “subsection,” “paragraph,” “clause,” or other subdivision, or to a Schedule, without reference to a document, are to the specified provision or Schedule of this Agreement; and

(g) references to “$” or “dollars” shall be references to U.S. Dollars.

This Agreement shall be construed as if the Parties drafted it jointly.

| 12 |

ARTICLE

II

GRANTS OF RIGHTS

2.1 Licenses.

(a) License. Subject to the terms of this Agreement, Yuhan shall, and hereby does, grant to Processa an exclusive (even as to Yuhan and its Affiliates), royalty-bearing right and license, including the right to sublicense in accordance with Section 2.1(b), under the Yuhan Intellectual Property and Yuhan’s interest in the Joint Intellectual Property, to Develop, Manufacture, use and Commercialize, including filing for, obtaining and maintaining Regulatory Approval for, Products in the Field in the Territory.

(b) License Back. Subject to the terms of this Agreement and in order to facilitate Yuhan’s right to Develop (solely to obtain Marketing Approval), Manufacture and Commercialize Products in South Korea, Processa shall, and hereby does, grant to Yuhan an exclusive (even as to Processa and its Affiliates), royalty-bearing and sublicensable right and license (i) to access and use any data generated by or on behalf of Processa in the Development of Products for the Territory, including all data included in any regulatory submission; and (ii) under any Processa Intellectual Property, and Processa’s interest in the Joint Intellectual Property directed to modifications or improvements to the Yuhan Intellectual Property, in each case ((i) and (ii)) for the sole purpose of obtaining Marketing Approval for, and Manufacturing and Commercializing the Products in South Korea only. Yuhan shall pay Processa a royalty equal to three percent (3%) of Net Sales (by Yuhan or its Affiliates, or its or their sublicensees) of such Products Covered by Processa Patents in South Korea (starting from the First Commercial Sale of such Product made by Yuhan in South Korea, to be calculated in accordance with Sections 7.5(a) through 7.5(d), but without any reference to Section 7.6, applied mutatis mutandis as if such Net Sales were made by Yuhan, and as if the Royalty Term were until the expiration or invalidation of the last Valid Claim in the Processa Patents Covering such Patent in South Korea). Upon the expiration or invalidation of the last Valid Claim in the Processa Patents Covering such Patent in South Korea, the licenses granted to Yuhan under this Section 2.1(b) shall become non-exclusive, fully-paid-up, perpetual, and irrevocable.

(c) Sublicenses. From the Effective Date, Processa shall have the right to grant sublicenses under the licenses to Yuhan Intellectual Property and Yuhan’s interest in the Joint Intellectual Property granted to Processa under Section 2.1(a) to its Affiliates and to Third Parties, such sublicense rights being subject to Yuhan’s prior written approval (which may not be unreasonably withheld or delayed) with respect to Third Parties; provided, however, that (i) any such sublicense shall be subject to all applicable terms and conditions of this Agreement; (ii) any Sublicensee to whom Processa discloses Confidential Information shall enter into an appropriate written agreement obligating such Sublicensee to be bound by obligations of confidentiality and restrictions on use of such Confidential Information that are no less restrictive than the obligations in ARTICLE IX; (iii) Processa shall at all times be responsible for the performance of such Sublicensee; and (iv) Processa shall, prior to granting any sublicense to a Sublicensee under this Agreement, provide Yuhan with a copy of such sublicense agreement. Each agreement with each Sublicensee must include grants of rights sufficient to enable Processa to grant substantially the rights set forth in Sections 12.7(b) through 12.7(f) with respect to (1) all Know-How and Patent Rights (including all applicable pre-clinical and clinical data, including pharmacology and biology data; Manufacturing documents and materials; and Manufacturing technologies) Controlled by such Sublicensee during the Term and used by such Sublicensee in the Development, Manufacture or Commercialization of any Compound or Product (collectively, “Sublicensee Intellectual Property”); (2) all filings with Regulatory Authorities in the Territory relating to Compounds and Products and Regulatory Approvals relating to Compounds and Products held by such Sublicensee, including related correspondence with Regulatory Authorities; (3) all Manufacturing agreements to which such Sublicensee is a party that are related to Compounds or Products; (4) all of such Sublicensee’s inventory of Compounds and Products existing as of the applicable date; and (5) all trademarks owned by such Sublicensee and used solely in connection with the Products, along with all associated goodwill ((1) – (5), collectively, “Sublicense Materials”).

| 13 |

2.2 Rights Retained by the Parties. Any rights of Yuhan or Processa, as the case may be, not expressly granted to the other Party under the provisions of this Agreement shall be retained by such Party.

2.3 Section 365(n) of the Bankruptcy Code. All rights and licenses granted under or pursuant to any section of this Agreement, including the licenses granted under Sections 2.1 or 12.7(e) to Patent Rights and Know-How (including any data included in the Know-How), are and will otherwise be deemed to be for purposes of Section 365(n) of the Bankruptcy Code, licenses of rights to “intellectual property” as defined in Section 101(35A) of the Bankruptcy Code. Each Party will retain and may fully exercise all of its respective rights and elections under the Bankruptcy Code. The Parties agree that each Party, as licensee of such rights under this Agreement, will retain and may fully exercise all of its rights and elections under the Bankruptcy Code or any other provisions of applicable Law outside the United States that provide similar protection for “intellectual property.”

2.4 Transfer of Yuhan Material and Know-How. Within ninety (90) days after the Effective Date, Yuhan shall transition Yuhan Know-How to Processa and provide Processa with reasonable amounts of consultation regarding the transferred Yuhan Know-How. In addition, Yuhan will transfer all material and copies of documentation in English to Processa related to the Product including but not limited to (a) documents including communications, reports, white papers and supporting material, lab or study notes, Manufacturing documents, and similar material, (b) know-how related to the Development of the Product, and (c) Regulatory Approvals or clearances or submissions.

ARTICLE

III

DEVELOPMENT & Governance

3.1 General. From the Effective Date, and subject to the terms of this Agreement, including the requirements of ARTICLE VI, with input from the PCYU Board (defined in Section 3.5), Processa (or its Affiliates or Sublicensees) shall control and be solely responsible for the Development of and regulatory activities with respect to Compounds and Products in the Field in the Territory, including all costs and expenses relating thereto (excluding the costs and expenses of Yuhan appointed members of the PCYU Board). If Processa requests Yuhan’s cooperation outside of the PCYU Board as described above, the Parties shall mutually agree in advance on a budget therefor, and Processa shall reimburse Yuhan for any expenses incurred by Yuhan under this Section 3.1 within thirty (30) days after receiving an invoice therefor.

| 14 |

3.2 Exchange of Information Regarding Development. At least once each Calendar Year, beginning on the Effective Date and ending on the date on which Processa obtains the first Regulatory Approval for a Product in the United States and the first Regulatory Approval for a Product in another Major Market, Processa shall provide Yuhan with a reasonably detailed report describing Processa’s Development activities and the summary results thereof with respect to all Compounds and Products.

3.3 Right of Cross Reference. Processa hereby grants to Yuhan an option for an irrevocable and perpetual, fully paid-up, transferable right of access and Right of Cross-Reference to all Regulatory Documentation and Regulatory Approvals for the Compound and Products anywhere in the Territory for purposes of Development, Manufacture and Commercialization in South Korea. Yuhan may exercise such option and shall obtain such rights upon giving written notice to Processa and paying a one-time fee of two hundred fifty thousand dollars ($250,000). Upon Yuhan’s exercise of the option, Processa shall grant such rights to Yuhan and shall cooperate fully to make the benefits of such Regulatory Documentation and Regulatory Approvals available to Yuhan or its designee, including by providing a signed statement to such effect.

3.4 Recalls. In the event that any Regulatory Authority issues or requests a recall or takes a similar action in connection with a Product in the Territory, or in the event either Party determines that an event, incident or circumstance has occurred that may result in the need for a recall or market withdrawal in the Territory, the Party notified of such recall or similar action, or the Party that desires such recall or similar action, shall within 24 hours, advise the other Party thereof by telephone, facsimile or email. Processa, in consultation with Yuhan, through the PCYU Board, shall decide whether to conduct a recall in any market in the Territory (except in the case of a government mandated recall, when Processa may act without such advance notice but, shall notify Yuhan as soon as possible) and the manner in which any such recall shall be conducted (and in the event of any disagreement regarding a recall in the Territory, the approach that is more conservative shall control). Each Party will make available to the other Party, upon request, all of such Party’s (and its Affiliates’) pertinent records that such other Party may reasonably request to assist such other Party in effecting any recall.

3.5 Processa Yuhan Advisory Board.

(a) General; Responsibilities. Within thirty (30) days after the Effective Date, the Parties will establish a Processa Yuhan Advisory Board (the “PCYU Board”) to oversee and coordinate the Parties’ activities under this Agreement to the extent provided in this Agreement. The PCYU Board shall:

(i) oversee the Development Plan to ensure that the goals and direction of the plan are identified and achieved and to advise on courses of action to achieve the goal and direction of the plan;

(ii) on at least an annual basis, review the then-current Development Plan, and review, comment on, on approve (or reject) any proposed amendments to the then-current Development Plan;

| 15 |

(iii) not oversee nor provide approval for the everyday operations of and decisions by Processa that are required to demonstrate the safety and efficacy of the Compound and Products in order to obtain Regulatory Approval within any country in the Territory;

(iv) not oversee nor provide approval for the regulatory science process used by Processa for the Compound and Products in order to obtain Regulatory Approval within any country in the Territory; and

(v) perform such other functions, in each case as expressly assigned to the PCYU and set forth in this Agreement or as mutually agreed upon by the Parties in writing.

(b) Composition. The PCYU Board initially shall be composed of at least four (4) members, two (2) of whom shall be representatives appointed by Processa and two (2) of whom shall be representatives appointed by Yuhan. Each PCYU Board member shall have the requisite experience and seniority to enable such representative to make decisions on behalf of the Party who appointed such member with respect to the issues falling within the jurisdiction of the PCYU Board. Neither Party shall appoint any representative to the PCYU Board that is not an employee or member of the Board of Directors of such Party or its Affiliates without the prior written consent of the other Party. Processa shall appoint one (1) of its representatives as the chairperson of the PCYU Board. The size of the PCYU Board may be changed from time to time by written agreement of the Parties; provided that the PCYU Board shall at all times include an equal number of representatives of each Party. Each Party may replace its PCYU Board representatives at any time upon written notice to the other Party. An employee of Processa and not an official member of the PCYU Board may also be appointed by Processa as Secretary to take notes and provide minutes for the Board. This Secretary shall not have any voting privileges within the PCYU Board.

(c) Meetings. Unless otherwise agreed by the Parties, the PCYU Board shall hold meetings (a) at least once per Calendar Quarter or more often as its members may determine until the filing of an IND for the Compound and (b) twice per Calendar Year thereafter until the first anniversary of the First Commercial Sale in the Territory for the Product. PCYU Board meetings may be held in person or by any means of telecommunications as the members deem necessary or appropriate, including telephone, video conference or similar means in which each participant can hear what is said, and be heard, by the other participants. If a meeting is held in person, PCYU Board members may, in lieu of attending in person, attend by any means of telecommunications in which each participant can hear what is said, and be heard, by the other participants. A quorum of the PCYU Board shall exist whenever there is present at a meeting at least one (1) representative appointed by each Party. Employees or consultants of either Party who are not members of the PCYU Board may attend meetings of the PCYU Board; provided that: (i) such attendees shall not vote in the decision-making process of the PCYU Board; (ii) such attendees shall be bound in writing by obligations of confidentiality and non-use equivalent to those set forth in ARTICLE IX; and (iii) a consultant of a Party may attend a meeting only with prior notice to and consent of the other Party, which shall not be unreasonably withheld or delayed; provided further that any PCYU Board meetings that includes representatives of either Party who are not PCYU Board members may, at the request of any PCYU Board member, include a closed session consisting of only PCYU Board members. Except as provided in the prior sentence, individuals who are not members of the PCYU Board may not attend a meeting of the PCYU Board without the prior consent of both Parties. Each Party shall be responsible for its own expenses of participating in the PCYU Board.

| 16 |

(d) Minutes. As soon as reasonably practicable and in any event no fewer than fifteen (15) Business Days prior to each meeting, Processa shall disclose to Yuhan any proposed agenda items together with all appropriate information with respect to such proposed agenda items. The chairperson of the PCYU Board shall prepare and circulate to all members of the PCYU Board for review draft minutes of each PCYU Board meeting within an appropriate time after such meeting, but in no event later than the next meeting of the PCYU Board. The Parties shall approve in writing the minutes of each meeting promptly.

(e) Decision-Making. The PCYU Board shall make decisions and take action by consensus of the members present at a meeting at which a quorum exists, with each Party having a single vote, regardless of the number of representatives of such Party in attendance at such meeting. If the PCYU Board does not reach consensus on any matter within its authority (a “Deadlocked Matter”), the Deadlocked Matter will be referred to the Senior Executive of Processa or his/her designee as the final decision-making authority with respect to such Deadlocked Matter provided that Processa shall not have any such final decision-making authority with respect to a Deadlocked Matter that would require Yuhan to incur any additional costs or expenses, or otherwise materially adversely impact Yuhan’s rights and obligations under this Agreement. In addition, if the PCYU Board recommends changes to the development that require a change in budget, staffing, or external payments, the Senior Executive of Processa shall be the final decision-making authority to approve or not approve the PCYU Board recommendation(s).

(f) Authority. The PCYU Board shall have only such powers as are specifically delegated to it under this Agreement, and for clarity the PCYU Board shall not have any authority or ability to: (1) modify, amend, or waive the terms or conditions of this Agreement, including the milestone payment provisions, license rights provisions and delegations of authority provisions; (2) determine whether or not a breach of this Agreement has occurred; (3) make any decision that, under the terms of this Agreement, requires Yuhan’s or Processa’s consent, approval or agreement or the consent, approval or agreement of both Parties; or (4) require Yuhan or Processa to conduct any activities in contravention of, or outside the scope of, this Agreement.

(g) Sublicensee; Dissolution. If Processa grants sublicenses to Sublicensees for the Development, Manufacture, or Commercialization of the Product in the Field in any Major Market, Processa will provide Yuhan with copies of all correspondence with such Sublicensee, and shall invite Yuhan to attend all meetings with such Sublicensee. Subject to the foregoing, if Processa grants sublicenses to Sublicensees for the Development, Manufacture and Commercialization of the Product in the Field in all countries in the Territory, upon Yuhan’s written request the PCYU Board shall dissolve.

ARTICLE

IV

SUPPLY

4.1 Initial Clinical Supply. Yuhan shall, upon Processa’s request, use its current inventory to supply Processa with its requirements of the Compound and Product for all non-clinical studies, the first Phase 1 Clinical Trial, and first Phase 2 Clinical Trial to be conducted by Processa subject to the terms and conditions set forth in a clinical supply agreement to be executed by the Parties. The price for such initial clinical study supply shall be composed of Yuhan’s manufacturing cost. The Parties may agree on additional activities to be performed by Yuhan for Processa in relation to the Compound and the Product under a clinical supply agreement to be negotiated in good faith by the Parties.

| 17 |

4.2 ROFN For Further Supply. Yuhan shall have an exclusive right of first negotiation for a supply agreement for any supply of the Compound and Product to Processa for Development and Commercialization in the Territory other than as described in Section 4.1 as long as the Yuhan manufacturing site, control labs and storage facilities meet the GMP requirements of the Regulatory Authorities for the clinical protocols or the Regulatory Authorities where the Product is commercially sold. Processa shall notify Yuhan in writing of Processa’s intention to negotiate for such supply agreement (the “ROFN Notice”). If Yuhan desires to negotiate for such supply agreement, Yuhan shall so notify Processa in writing (the “ROFN Response”) within thirty (30) days of receipt of the ROFN Notice. Upon Processa’s receipt of the ROFN Response, Yuhan and Processa shall negotiate in good faith for such supply agreement, for up to one hundred and twenty (120) calendar days from the date of the ROFN Response (without guaranteeing success in reaching an agreement).

ARTICLE

V

COMMERCIALIZATION

5.1 General. From the Effective Date, and subject to the terms of this Agreement, including the requirements of ARTICLE VI, Processa (or its Affiliates or Sublicensees) shall control and be solely responsible for the Commercialization of Products in the Field in the Territory, including all costs and expenses relating thereto.

5.2 Commercialization Plans. During the Royalty Term with respect to each Product, at least thirty (30) days prior to the commencement of each Calendar Year, Processa shall provide Yuhan, for Yuhan’s review and comments, a summary of the planned Commercialization activities to be conducted by or on behalf of Processa and its Affiliates and Sublicensees with respect to such Product in each country in the Territory during such Calendar Year (each such plan, a “Commercialization Plan”). Processa, its Affiliates and Sublicensees shall consider Yuhan’s comments in good faith and shall not unreasonably decline to implement or incorporate any comments of Yuhan regarding any aspect of the Commercialization Plan.

ARTICLE

VI

DILIGENCE

6.1 Commercially Reasonable Efforts. During the Term, Processa shall, directly or through its Affiliates or Sublicensees, use Commercially Reasonable Efforts, from and after the Effective Date, to Develop and obtain Regulatory Approval for one (1) Product in the Field in the U.S. and in one (1) other Major Market, and, upon obtaining Regulatory Approval, Processa shall, directly or through its Affiliates or Sublicensees, use Commercially Reasonable Efforts to Commercialize the Product. Without limiting or derogating from the foregoing, Processa, by itself or through its Affiliates or Sublicensees, shall meet each of the following milestones within the respective time periods set forth herein:

(a) Prepare a first draft of the Product Development plan (the “Development Plan”) which incorporates, in good faith, Yuhan’s review and comment within ninety (90) days after the Effective Date;

| 18 |

(b) Request FDA pre-IND meeting for the Product within six (6) months from the Effective Date of this Agreement;

(c) Dose the first patient in a Phase 2A Clinical Trial with the Product within twenty-four (24) months from the Effective Date of this Agreement;

(d) Dose the first patient with the Product in a Phase 2B Clinical Trial, Phase 3 Clinical Trial or other Pivotal Clinical Trial within forty-eight (48) months from the Effective Date of this Agreement;

(e) Achieve First Commercial Sale of a Product within twelve (12) months from the date a Regulatory Approval for such Product is obtained.

6.2 Termination for Failure to Meet Diligence Obligation. If, at any time during the Term, Processa fails to timely achieve any of the foregoing milestones, or if Yuhan reasonably believes that Processa (itself and through its Affiliates and Sublicensees) has not complied with its obligations under Section 6.1 to Develop one (1) Compound or Product in the Field in the U.S. for any consecutive nine (9) month period following the Effective Date, Yuhan shall provide written notice to Processa specifying the nature of such reasonable belief, and Yuhan may terminate this Agreement pursuant to Section 12.4.

ARTICLE

VII

FINANCIAL PROVISIONS

7.1 Upfront Fee. In partial consideration for the rights granted to Processa hereunder, within ten (10) Business Days following the Effective Date, Processa shall issue to Yuhan, for no additional consideration, the number of Processa common shares equivalent to USD $2,000,000 at a price of $8.00 per share, subject to adjustment in and otherwise in accordance with, the terms and conditions of the Share Issuance Agreement (the “Upfront Fee”), which Upfront Fee shall be non-refundable and non-creditable. Notwithstanding the foregoing, if Processa does not complete the Planned Public Offering before January 31, 2021, the number of shares of Processa common stock issued in connection with the Upfront Fee will be adjusted in accordance with the Share Issuance Agreement.

7.2 Development Milestone Payments. Processa shall make the following one-time, non-refundable, non-creditable development milestone payments (the “Development Milestone Payments”) in the form of cash and issuance of Processa common shares (the “Milestone Shares”) to Yuhan as set forth in Section 7.2(a) or 7.2(b) below. For avoidance of doubt, in no event shall both Section 7.2(a) and 7.2(b) apply.

(a) The milestones, payments and share issuances set forth in this Section 7.2(a) shall apply only in the event that (i) Yuhan and/or its Affiliates purchase $3.0 million or more of the shares of common stock sold by Processa in the Planned Public Offering, or (ii) if the Planned Public Offering does not occur by January 31, 2021, Yuhan and/or its Affiliates provide an amount equal to or greater than $3.0 million of equity funding, on terms to be mutually agreed, to assist in the Development and Regulatory Approval of the Product (for clarity, Processa shall not use such funding for any purpose other than in the Development and Regulatory Approval of the Product):

| Development Milestone | Payment | |

| 1st Patient Dosed in 1st Pivotal Trial | Milestone Shares Equivalent to $1,000,000* | |

| Last Patient Dosed 1st Pivotal Trial | Milestone Shares Equivalent to $1,500,000* | |

| 1st NDA Approval | $4,000,000 | |

| 2nd NDA Approval | $3,000,000 | |

| Ex-US 1st Approval | $2,000,000 | |

| Ex-US 2nd Approval | $2,000,000 |

| 19 |

(b) The milestones, payments and share issuances set forth in this Section 7.2(b) shall apply only if both of the following occur: (i) Yuhan and/or its Affiliates do not invest in the Processa Planned Public Offering or purchases less than $3.0 million of the shares of common stock sold by Processa in the Planned Public Offering, and (ii) if the Planned Public Offering does not occur by January 31, 2021, Yuhan and/or its Affiliates do not otherwise provide equity funding, on terms to be mutually agreed to assist in the Development and Regulatory Approval of the Product, or provide less than $3.0 million (in aggregate when combined with any amounts invested pursuant to clause (i) above) of funding to assist in the Development and Regulatory Approval of the Product (for clarity, Processa shall not use such funding for any purpose other than in the Development and Regulatory Approval of the Product):

| Development Milestone | Payment | |

| 1st Patient Dosed in 1st Pivotal Trial | Milestone Shares Equivalent to $200,000 | |

| Last Patient Dosed 1st Pivotal Trial | Milestone Shares Equivalent to $200,000 | |

| 1st NDA Approval | $2,000,000 | |

| 2nd NDA Approval | $2,000,000 | |

| Ex-US 1st Approval | $2,000,000 | |

| Ex-US 2nd Approval | $2,000,000 |

*The number of common shares of Processa issued in connection with the achievement of each milestone set forth in the Tables 7.2(a) and 7.2(b) above shall be determined in accordance with the Share Issuance Agreement.

7.3 Development and Commercialization Costs. For clarity, following the Effective Date, Processa shall be solely responsible for all costs it incurs in Developing and Commercializing Compounds and Products, including all Manufacturing costs (excluding any compensation or expenses incurred by the Yuhan appointed members of the PCYU Board).

| 20 |

7.4 Sales Milestone Payments. Processa shall pay Yuhan the one-time, non-refundable, non-creditable sales milestone payments set forth in the table below (the “Sales Milestone Payments”) within thirty (30) days after the end of the first Calendar Year during which the total Net Sales accrued during such Calendar Year in the Territory (the “Worldwide Annual Accrued Net Sales”) first reach the values indicated below. For clarity, each Sales Milestone Payment will apply once and only once when the milestone is first achieved. Thereafter, the Sales Milestone Payment will no longer apply. In addition, if more than one milestone is achieved in a Calendar Year, all associated Sales Milestone Payments will be paid. For illustration purposes, if at a given Calendar Year Worldwide Annual Accrued Net Sales first reach $100,000,000 (without having reached $50,000,000 prior to such Calendar Year); the Sales Milestone Payment for such Calendar Year will be $7,500,000 ($2,500,000 plus $5,000,000). If in the next Calendar Year Worldwide Annual Accrued Net Sales first reach $250,000,000; the Sales Milestone Payment for such Calendar Year will be $12,500,000 because the Milestone Payment for $50,000,000 and $100,000,000 has already been achieved and each Sales Milestone Payment will apply once and only once. The calculation of Worldwide Annual Accrued Net Sales and the corresponding Sales Milestone Payments shall exclude all sales made by a Sublicensee in the event that Processa receives Sublicense Consideration on account of a specific Product in a specific Territory from such Sublicensee for which Processa is required to pay Yuhan the applicable percentage of the Sublicense Consideration as set forth in Section 7.6.

| Worldwide Annual Accrued Net Sales | Payment | |

| ≥ $50M | $2,500,000 | |

| ≥ $100M | $5,000,000 | |

| ≥ $250M | $12,500,000 | |

| ≥ $500M | $25,000,000 | |

| ≥ $1 Billion | $50,000,000 | |

| ≥ $2 Billion | $100,000,000 | |

| ≥ $5 Billion | $200,000,000 |

7.5 Product Royalties.

(a) Royalty Rate. Processa shall pay Yuhan royalties equal to seven percent (7%) (the “Royalty Rate”) on the aggregate Net Sales of Products in the Territory (collectively, “Royalties”) during each Calendar Year to Yuhan on a Product-by-Product basis. Notwithstanding the foregoing, with respect to Net Sales by Sublicensees, the Royalties shall exclude all sales made by a Sublicensee in the event that Processa receives Sublicense Consideration on account of a specific Product in a specific Territory from such Sublicensee for which Processa is required to pay Yuhan the applicable percentage of the Sublicense Consideration as set forth in Section 7.6.

(b) Royalty Term and Adjustments. Processa’s Royalty obligations to Yuhan under this Section 7.5 shall commence on a country-by-country and Product-by-Product basis on the Effective Date and shall expire on a country-by-country basis and Product-by-Product basis on the later of (i) expiration or invalidation of the last Valid Claim Covering such Product in such country or (ii) the tenth (10th) anniversary of the date of the First Commercial Sale by Processa or any of its Affiliates or Sublicensees (except as provided above) to a non-Sublicensee Third Party of such Product in such country (the “Royalty Term”); provided that, during any period within the Royalty Term remaining after the expiration of all Valid Claims Covering such Product in such country and all Regulatory Exclusivity as to such Product in such country, the Royalties payable as to such Product in such country under this Section 7.5 shall be reduced to fifty percent (50%) of the Royalties otherwise payable as to such Product in such country pursuant to Section 7.5. Such Royalty reduction will be calculated by determining the portion of total Net Sales of the relevant Product in a Calendar Quarter that is attributable to the applicable country in which such reduction applies, and by determining the total Royalties without reduction, and then reducing to fifty percent (50%) the applicable portion (based on Net Sales) of total Royalties attributable to the country in which such reduction applies. Upon the expiration of the Royalty Term with respect to each Product in each country, the licenses granted to Processa under Section 2.1(a) shall become non-exclusive, fully-paid–up, perpetual and irrevocable with respect to such Product in such country.

| 21 |

(c) Third Party Payments. If, in the opinion of patent counsel mutually acceptable to both Processa and Yuhan, in order to Develop, Manufacture, use or Commercialize a Product in the Field in a country of the Territory without infringing any third party intellectual property rights relating to the Yuhan Intellectual Property, Processa or its Affiliate or Sublicensee is obligated to obtain a license or comparable grant of rights (e.g., a covenant not to sue) under any Patent Rights from a Third Party (“Third Party Patent Licenses”) and pay a royalty under such Third Party Patent License with respect to such Product in such country, then, subject to Section 7.5, forty percent (40%) of such royalties actually paid by Processa, its Affiliates or Sublicensees shall be creditable against Royalties payable to Yuhan hereunder with respect to such Product in such country; provided that, (i) if Processa is obligated to enter into any Third Party Patent License, Processa shall use Commercially Reasonable Efforts to minimize the royalties owed by Processa under such Third Party Patent License; and (ii) for any creditable amounts permitted under the Section 7.5(c) but that are not applied in a given Calendar Quarter as a result of the Royalty Floor set forth in Section 7.5(d), Processa may carry forward and apply such amounts against Royalties due in up to four (4) subsequent Calendar Quarters, or until the amount of such reduction has been fully applied against Royalties due to Yuhan, whichever is earlier (in each case subject to Section 7.5(d)).

(d) Royalty Floor. In no event shall the Royalty reductions described in Sections 7.5(b) and 7.5(c), alone or together, reduce the Royalties payable by Processa for a given Calendar Quarter during the Royalty Term for a Product in a particular country in the Territory to less than fifty percent (50%) of the amounts otherwise payable by Processa for such Calendar Quarter pursuant to Section 7.5(a) (the “Royalty Floor”).

7.6 Sublicense. If Processa sublicenses the Product, Yuhan shall receive the applicable percentage of any Sublicense Consideration, as described in this Section 7.6 (the “Sublicense Payments”). The percentages described in this Section 7.6 shall apply to all Sublicense Consideration. Notwithstanding the foregoing, in the event that Processa receives Sublicense Consideration on account of a specific Product in a specific Territory, then in such case Processa shall be required to pay Yuhan the applicable Sublicense Payment, but such Sublicense Consideration shall not be taken into account when calculating Development Milestone Payments (Section 7.2) or Sales Milestone Payments (Section 7.4) or Royalties (Section 7.5). To clarify, three example scenarios are presented:

Example 1: If Processa Develops the Product in multiple Territories and licenses out the commercial sales to Sublicensee in all Territories such that Processa does not sell any of the product. The financial terms of ARTICLE VII would then be the following: Sections 7.2-7.3 would apply, Sections 7.4-7.5 would no longer apply, and Section 7.6 would apply for any funds from Sublicense Consideration for the Sublicensee Territories using the table in this Section 7.6. The percentage in the table would apply to all financial considerations from the Sublicensee such as upfront fees, any milestones payments, and royalties.

| 22 |

Example 2: If Processa Develops and Commercializes the Product in US while Sublicensing the Product for Development and Commercialization in other territories. The financial terms of ARTICLE VII would then be the following: Sections 7.2 – 7.3 would apply, Sections 7.4-7.5 would only apply to Territories in which Processa Commercializes the Product, and Section 7.6 would apply for any funds from Sublicense Consideration for the Sublicensee Territories using the table in this Section 7.6. The percentage in the table would apply to all financial considerations from the Sublicensee such as upfront fees, any milestones payments, and royalties.

Example 3: If Processa sublicenses the Product prior to Phase 3 trial and Sublicensee completes Development, obtains Regulatory Approval, and Commercializes the Product. The financial terms of ARTICLE VII would then be the following: for Sections 7.2 – 7.3 Processa would pay for milestones that it has completed, the remaining milestones of Sections 7.2 – 7.3 not completed by Processa would no longer apply, Sections 7.4-7.5 would not apply, and Section 7.6 would apply for any funds from Sublicense Consideration for the Sublicensee Territories using the table in this Section 7.6. The percentage in the table would apply to all financial considerations from the Sublicensee such as upfront fees, any milestones payments, and royalties.

(a) Sublicense Considerations shall mean any payments or other consideration that Processa or its Affiliates receive as a direct result of the grant of a sublicense or an option to obtain such sublicense, including without limitation license fees, license option fees, milestone payments, license maintenance fees, equity, and royalty on Sublicensee sales, provided that in the event that Processa or its Affiliates receive non-monetary consideration in connection with a sublicense, Sublicense Considerations shall be calculated based on the fair market value of such consideration or transaction, assuming an arm’s length transaction made in the ordinary course of business. Notwithstanding the foregoing, Sublicense Considerations shall not include amounts expressly dedicated to, and actually expended by the Sublicensee to reimburse Processa and its Affiliates for, the Development of Products, up to the sum of the actual external costs incurred by Processa and its Affiliates for such activities.

(b) Processa shall pay Yuhan the Sublicense Payments within thirty (30) days after the receipt of the Sublicense Consideration. Depending on when the applicable sublicense agreement enters into force Processa shall pay to Yuhan the percentage defined in the following Table:

| Sublicense Effective Date | Sublicense Payment Percentage | |

| Before 1st Phase 2a Clinical Trial FPFV | 80% | |

| Before 1st Phase 2b Clinical Trial FPFV | 50% | |

| After 1st Phase 2b Clinical Trial FPFV but Before 1st Phase 3 Clinical Trial FPFV | 40% | |

| After 1st Phase 3 Clinical Trial FPFV | 30% |

| 23 |

7.7 Reports; Payments. Within thirty (30) days after the end of each Calendar Quarter commencing from the earlier of (a) the First Commercial Sale of a Product; or (b) the grant of a sublicense or receipt of Sublicense Consideration, Processa shall furnish Yuhan with a quarterly report (“Periodic Report”) detailing, at a minimum, the following information for the applicable Calendar Quarter, each listed by Product and by country of sale: (i) the total number of units of Product sold by Company, its Affiliates and Sublicensees for which Royalties are owned to Yuhan hereunder, including a breakdown of the number and type of Products sold, (ii) gross amounts received for all such sales, (iii) deductions by type taken from Net Sales as specified herein, (iv) Net Sales, (v) Royalties, Development Milestone Payments and Sales Milestone Payments owed to Yuhan, listed by category, (vi) Sublicense Consideration received during the preceding Calendar Quarter and sublicense fees due to Yuhan, (vii) the currency in which the sales were made, including the computations for any applicable currency conversions, (viii) invoice dates and all other data enabling the Royalties and sublicense fees payable to be calculated accurately and (ix) a detailed summary of progress against each development and regulatory milestone set forth in Section 7.2 and each sales milestone set forth in Section 7.4, and an estimate of the timing of the achievement of the next applicable milestone. Once the events set forth in sub-section (a) or (b), above, have occurred, Periodic Reports shall be provided to Yuhan whether or not Royalties, Development Milestone Payments, Sales Milestone Payments or sublicense fees are payable for a particular Calendar Quarter. In addition to the foregoing, upon Yuhan’s reasonable request, Processa will provide to Yuhan such other information as may be reasonably requested by Yuhan, and will otherwise cooperate with Yuhan as reasonably necessary, to enable Yuhan to verify Processa’s compliance with the payment and related obligations under this Agreement, including verification of the calculation of amounts due to Yuhan under this Agreement and of all financial information provided or required to be provided in the Periodic Reports. Concurrently with each such report, Processa shall pay to Yuhan all amounts payable by it under Sections 7.4, 7.5, and 7.6.